The proliferation of synthetic intelligence (AI) has given shares of many corporations a giant elevate up to now 12 months or so, and Dell Applied sciences (NYSE: DELL) is certainly one of them. Shares of Dell have greater than tripled up to now 12 months as traders have been shopping for the inventory hand over fist within the perception that it may benefit huge time from the rising adoption of AI.

That is not stunning, as Dell can make the most of two profitable AI-related progress alternatives — servers and private computer systems (PCs). And up to date developments point out that the corporate is taking steps to capitalize on each these markets. Let’s take a better have a look at the the explanation why Dell’s red-hot inventory market rally might proceed due to AI.

The booming demand for AI servers is giving Dell Applied sciences a pleasant enhance

When Dell reported its fiscal 2024 fourth-quarter outcomes (for the three months ended Feb. 2), administration identified that it’s witnessing strong demand for its AI-optimized servers. Extra particularly, orders for Dell’s AI-focused servers had been up 40% quarter over quarter. In consequence, Dell’s order backlog of AI servers nearly doubled from the earlier quarter to $2.9 billion.

The corporate shipped $800 million value of AI servers in fiscal This autumn, and its strong backlog signifies that this determine might hold heading larger in future quarters. Extra importantly, Dell is scratching the floor of a large progress alternative in AI servers, as this market is predicted to generate $33 billion in income in 2024, based on market analysis agency IDC.

One other estimate from contract electronics producer Foxconn places the dimensions of the AI server market at a whopping $150 billion in 2027. As such, it would not be stunning to see demand for Dell’s AI servers growth in the long term, particularly contemplating that it’s optimizing its choices for Nvidia.

Dell lately introduced that it has prolonged its partnership with AI chip chief Nvidia to supply server options optimized for the latter’s next-generation Blackwell AI graphics processing models (GPUs). It’s value noting that Dell is providing liquid-cooled servers for mounting Nvidia’s Blackwell processors. That is a wise factor to do contemplating that the marketplace for liquid-cooled knowledge facilities is forecasted to clock annual progress of just about 25% over the following decade.

It’s value noting that the demand for Nvidia’s upcoming Blackwell AI chips is predicted to stay extraordinarily wholesome in 2025. John Vinh of KeyBanc estimates that Nvidia’s knowledge middle income might leap to a whopping $200 billion in 2025 due to the Blackwell processors, which might be an enormous improve from $47.5 billion final 12 months.

So Dell is doing the proper factor by bringing Blackwell-focused AI server options to the market, accurately capable of money in on the massive demand for Nvidia’s chips. Extra importantly, the long-term alternative within the AI server market bodes properly for Dell, as it’s among the many main gamers on this market.

The PC enterprise appears set for a turnaround

The mushy demand for PCs over the previous couple of years has weighed on Dell’s monetary efficiency. Its income within the earlier fiscal 12 months fell 14% 12 months over 12 months to $88.4 billion. The corporate’s income from the shopper options group (CSG), which incorporates gross sales of business and shopper PCs, was down 16% 12 months over 12 months to $48.9 billion in fiscal 2024.

That wasn’t stunning as PC shipments had been down 14% in 2023, based on IDC. Nonetheless, the arrival of AI-enabled PCs is more likely to set off a turnaround on this marketplace for Dell, as it’s the third-largest vendor of PCs, with a market share of simply over 15%. Based on market analysis agency Canalys, AI PC shipments are forecasted to extend at a formidable annual charge of 44% via 2028.

Dell has set its sights on this market, and lately introduced a brand new portfolio of PCs with on-device AI options, akin to permitting customers to generate photographs regionally with the assistance of textual content inputs, translate “any stay or pre-recorded audio from 44 languages to English,” and use AI to extend the decision of video games and movies in actual time for a extra immersive expertise.

Dell stays “bullish on the approaching PC refresh cycle and the longer-term influence of AI on the PC market,” and its product growth strikes ought to permit the corporate to dig into this chance and convey its CSG enterprise out of the droop it’s in.

Shopping for the inventory is a no brainer proper now

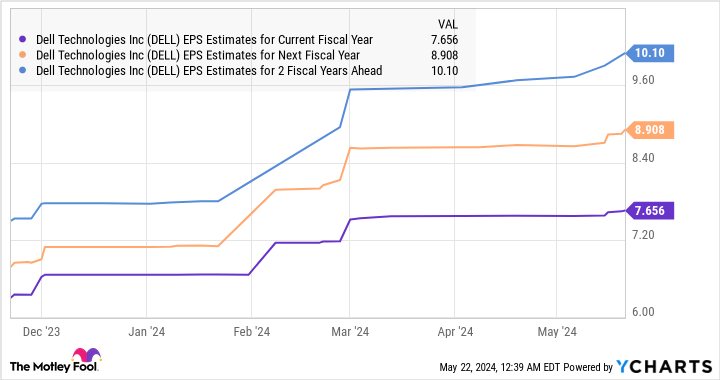

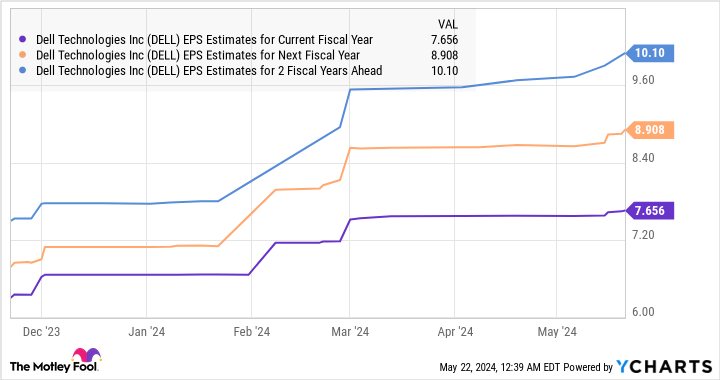

Dell’s earnings fell 6% in fiscal 2024 to $7.13 per share. Nonetheless, analysts expect its backside line to return to progress within the present fiscal 12 months, adopted by more healthy progress over the following couple of fiscal years.

Additionally, because the above chart tells us, analysts have been elevating their earnings progress expectations from Dell. With the inventory buying and selling at 20 occasions ahead earnings proper now, which is a reduction to the Nasdaq-100’s ahead earnings a number of of 27 (utilizing the index as a proxy for tech shares), traders are getting an excellent deal on this AI inventory proper now regardless of the excellent beneficial properties it has delivered up to now 12 months.

Shopping for Dell at this valuation seems like a wise factor to do in mild of the potential progress that AI might drive for the corporate, because the market might proceed rewarding the inventory with extra beneficial properties given the accelerated bottom-line progress it’s anticipated to ship.

Do you have to make investments $1,000 in Dell Applied sciences proper now?

Before you purchase inventory in Dell Applied sciences, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Dell Applied sciences wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $652,342!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Could 13, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

This Synthetic Intelligence (AI) Inventory Has Tripled in a 12 months, and You Could Remorse Not Shopping for It Hand Over Fist Earlier than It Soars Larger was initially revealed by The Motley Idiot