The PHLX Semiconductor Sector index is off to a robust begin in 2024 with features of 11% to date. That is not stunning as a few of its key parts similar to Nvidia (NASDAQ: NVDA), AMD, Broadcom, and Taiwan Semiconductor Manufacturing have already jumped properly due to their strong earnings reviews — which have revealed that these firms are benefiting from the rising adoption of synthetic intelligence (AI) chips.

Nevertheless, there’s one PHLX Semiconductor Sector part that has did not step on the gasoline so far: Micron Expertise (NASDAQ: MU). Shares of the reminiscence producer are up simply 5% in 2024. Nevertheless, a current improvement has given Micron inventory a pleasant increase. Shares of the chipmaker jumped 4% on Feb. 26.

Let’s examine why that occurred and examine why this semiconductor inventory might go on a bull run following this improvement.

Supplying chips for Nvidia’s next-gen AI GPU

In a press launch dated Feb. 26, Micron identified that it has commenced the quantity manufacturing of its excessive bandwidth reminiscence 3E (HBM3E) chip. The corporate added that this specific chip “shall be a part of NVIDIA H200 Tensor Core GPUs, which is able to start delivery within the second calendar quarter of 2024.” Micron claims that HBM3E consumes 30% much less energy than what opponents provide.

It isn’t stunning to see Micron touchdown the HBM spot in Nvidia’s upcoming processors. In its December 2023 earnings convention name, Micron identified that its HBM3E chip was within the remaining levels of qualification with Nvidia. Now that the corporate has received this enterprise from Nvidia, it appears on its option to attaining its goal of producing “a number of hundred hundreds of thousands of {dollars} of HBM income in fiscal 2024.”

The great factor for Micron is that demand for Nvidia’s upcoming H200 processors is already strong. Nvidia administration remarked on its newest earnings name that demand for its next-generation merchandise shall be higher than provide. So the opportunity of Micron promoting out its whole output of HBM3E chips can’t be dominated out, particularly contemplating that fellow reminiscence producer SK Hynix has already offered out its HBM stock for 2024.

Extra importantly, Micron is reportedly boosting its HBM manufacturing capability in order that it may well serve the rising demand for this reminiscence sort not solely from Nvidia but additionally from different prospects. In November 2023, the chipmaker reportedly opened a brand new facility devoted to producing HBM3E on a mass scale. Additionally it is price noting that Micron is engaged on an even bigger HBM3E reminiscence dimension that may very well be rolled out subsequent month.

All this means that the corporate is on monitor to take advantage of the rising demand for HBM, a product that’s in large demand due to its deployment in AI processors. Market analysis agency Yole Group estimates that the HBM market might generate an annual income of virtually $20 billion in 2025, up from $5.5 billion final 12 months and an estimated $14.1 billion in 2024. By 2029, international HBM income is anticipated to leap to $38 billion.

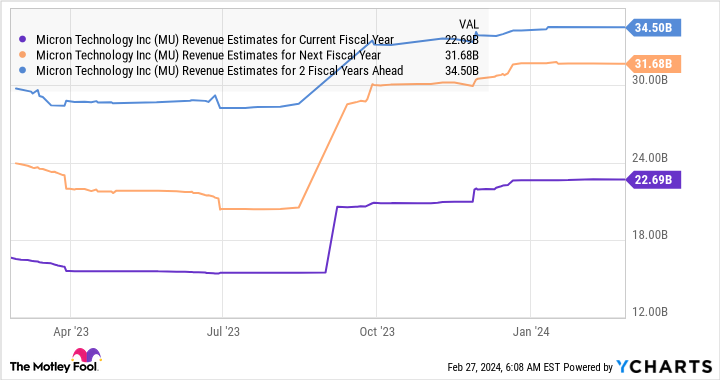

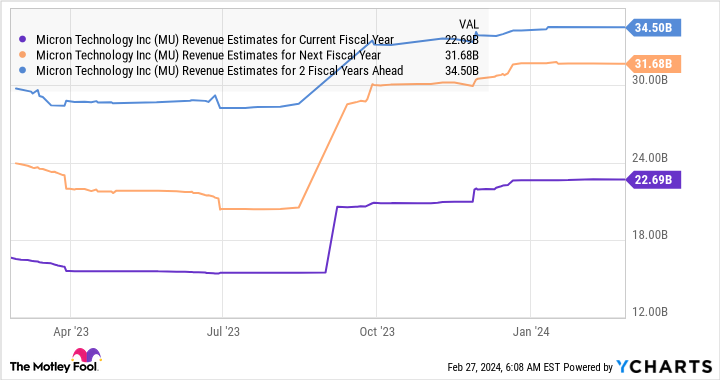

As such, Micron might win huge from this market in the long term, particularly contemplating that it has already landed a big buyer within the type of Nvidia, which dominates the worldwide AI chip market fingers down. Not surprisingly, Micron’s top-line progress is ready to speed up considerably in fiscal 2024, 2025, and 2026.

Massive inventory upside may very well be within the playing cards

Because the chart above signifies, Micron’s income is anticipated to leap to nearly $23 billion in fiscal 2024. That might be an enormous enhance over the fiscal 2023 studying of $15.5 billion. By fiscal 2026, Micron’s prime line is anticipated to shut in on the $35 billion mark, which signifies that the corporate is anticipated to greater than double its income within the area of simply three fiscal years.

Micron is at present buying and selling at 6 instances gross sales. Whereas that is greater than the S&P 500 index’s gross sales a number of of two.8, the potential progress that this AI inventory might ship signifies that it appears worthy of a premium valuation. That is very true contemplating that different chipmakers benefiting from AI adoption are buying and selling at greater gross sales multiples.

So, if Micron Expertise maintains its price-to-sales ratio of 6 after three years and certainly delivers $35 billion in annual income in fiscal 2026, its market capitalization might soar to $210 billion. That might be a 112% enhance from present ranges, which is why buyers ought to take into account shopping for this chipmaker earlier than its inventory market rally features momentum.

Do you have to make investments $1,000 in Micron Expertise proper now?

Before you purchase inventory in Micron Expertise, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Micron Expertise wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 26, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Broadcom. The Motley Idiot has a disclosure coverage.

This Synthetic Intelligence (AI) Inventory Is About to Go on a Bull Run was initially revealed by The Motley Idiot