-

The cyclical bull rally beginning in October 2022 is anticipated to final into 2025, in response to Ned Davis Analysis.

-

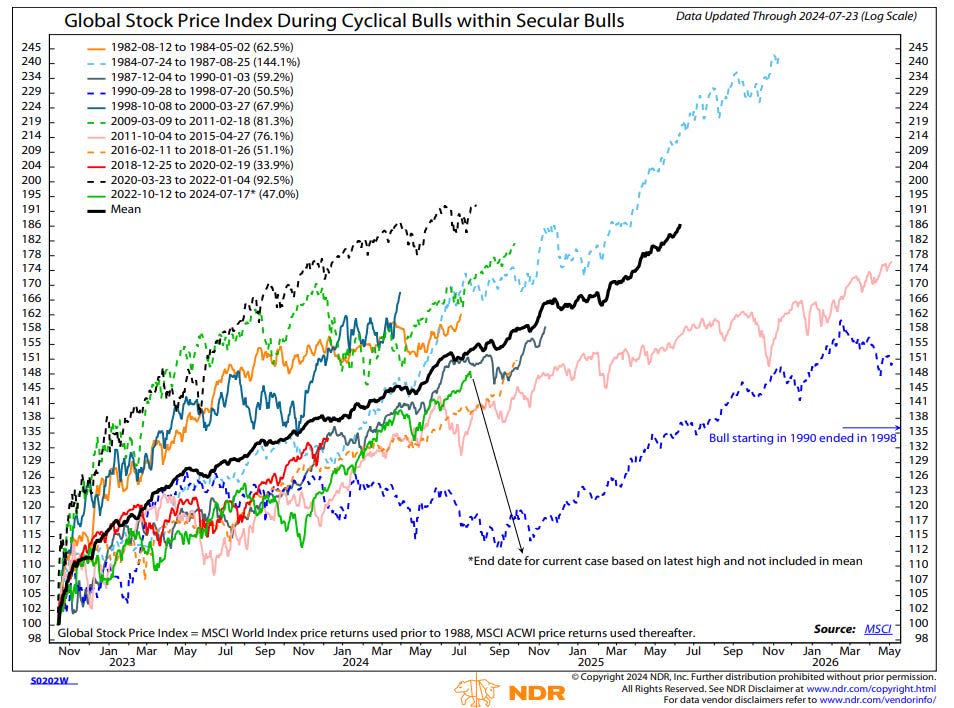

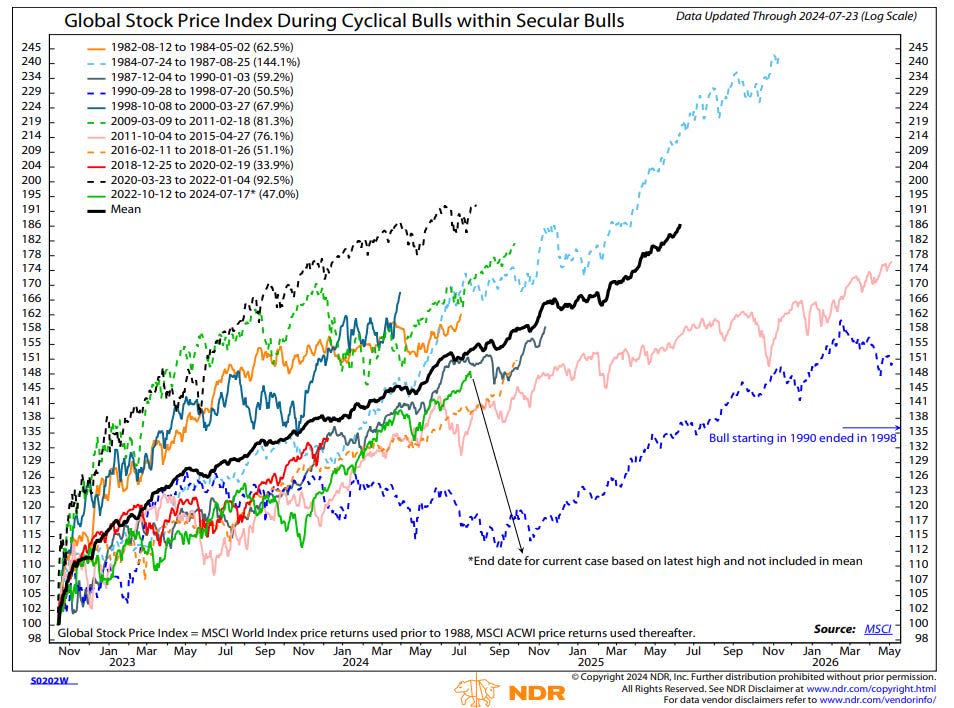

The agency highlights a chart that reveals the historic developments of cyclical bull market rallies, and after they sometimes finish.

-

“We count on to stay chubby equities, with the correction resulting in a shopping for alternative,” it mentioned.

The cyclical bull rally that began in October 2022 is about to final effectively into 2025, in response to historic developments highlighted by Ned Davis Analysis.

The analysis agency revealed a be aware final week that included a chart illustrating prior cyclical bull rallies inside a secular bull market, as is the present rally.

What Ned Davis Analysis discovered is that the common rally, primarily based on the beginning date of the October 2022 inventory market backside, ought to final into the summer season of 2025.

And it may final even longer into 2026 if it follows the footsteps of the 2011 to 2015 cyclical bull rally, or effectively into 2030 if it follows the trail of the technology-fueled cyclical rally of 1990 to 1998.

The bullish outlook from Ned Davis Analysis comes amid a slight correction within the inventory market, with the Nasdaq 100 falling practically 10% from its current peak in July.

However the correction is simply that, a short-term decline, and it would not mark the top of the bull rally, in response to the be aware.

“The worldwide comfortable touchdown proof and accommodative financial insurance policies proceed to bode effectively for long-term fairness efficiency,” Ned Davis Analysis mentioned. “We count on to stay chubby equities, with the correction resulting in a shopping for alternative.”

The analysis agency at present recommends its most chubby goal to equities at 70% in a balanced portfolio, with the remaining 25% and 5% being allotted to bonds and money, respectively.

Ned Davis Analysis mentioned dangers of a brand new bear market stay low, and that the present correction in shares is completely regular given the seasonal weak point through the summer season.

Strong valuations, subdued investor sentiment, an okay macro atmosphere, and falling bond yields imply “the burden of the proof has remained per an ongoing secular bull,” Ned Davis Analysis mentioned.

To observe the present well being of the bull rally in shares, the analysis agency suggests traders intently monitor earnings outcomes.

The speed at which US corporations are beating analyst revenue estimates has topped 75% for 5 straight quarters, in response to the be aware, and outcomes introduced to this point for the second quarter recommend the streak will enhance to 6 straight quarters.

But when momentum within the earnings beat charges begins to say no, that may be a warning signal.

“If the beat price begins declining with momentum turning detrimental, the growing disappointment may set off extra promoting. But when the beat price stays elevated because the earnings season matures, the possibilities for a market restoration will enhance,” Ned Davis Analysis mentioned.

Finally, the current correction “ought to give method to one other leg increased within the persevering with bull market,” Ned Davis Analysis concluded.

Learn the unique article on Enterprise Insider