The “Magnificient Seven” shares have dominated the market for the reason that begin of 2023. Main the broad indices to new highs, these seven corporations — all of which have had a market capitalization of not less than $1 trillion in some unspecified time in the future — have develop into the spine of the trendy inventory market. Companies like Alphabet and Apple have demolished most of their opponents, reminiscent of Yahoo and Blackberry.

Traders would possibly suppose it’s inconceivable to compete with the Magnificent Seven tech shares at this level. However that isn’t the case in each sector. Enter Spotify (NYSE: SPOT). The main music and audio streaming service has blazed its personal path worldwide regardless of main competitors from the likes of Apple, YouTube, and others. With the fill up 222% for the reason that begin of 2023, is now the right time to hop on the Spotify development practice?

Beating Apple and YouTube regardless of disadvantages

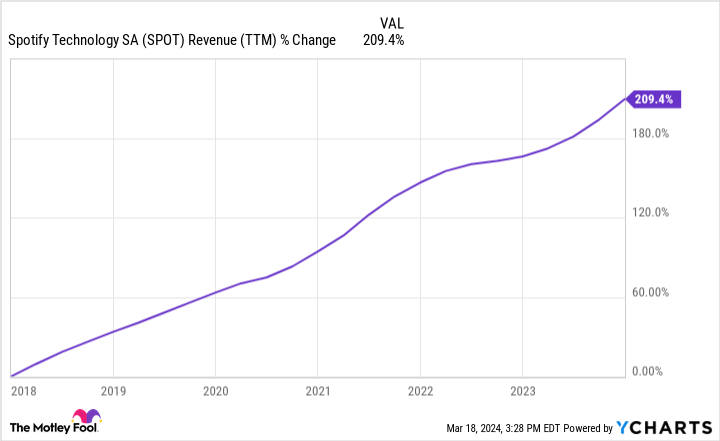

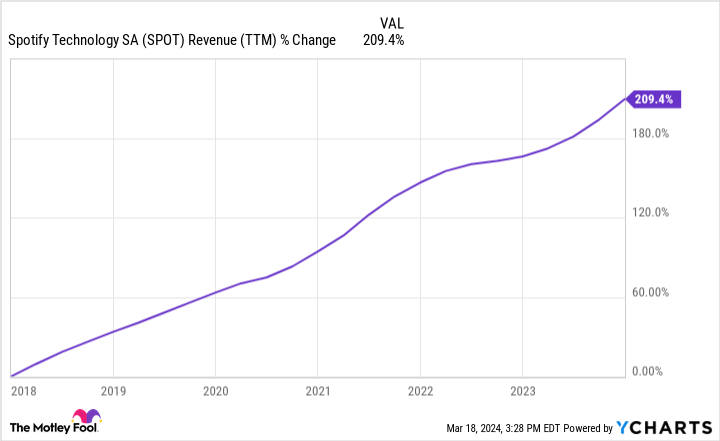

Spotify is well-known for its audio streaming utility. It permits customers to play any music from all over the world — together with podcasts and audiobooks — with solely an web connection. To earn a living, Spotify prices customers a month-to-month subscription to entry music with out ads, together with just a few different options. That is the place nearly all of its $14.4 billion in annual income comes from at the moment. Since going public in 2018, Spotify’s income is up 209% in U.S. {dollars}. Since 2015, its premium subscribers have grown from 28 million to 236 million.

It has completed so regardless of intense competitors from Apple and YouTube (which is owned by know-how conglomerate Alphabet). Apple launched Apple Music in 2015, which was a copycat of Spotify’s service. It has since reached an estimated 100 million paying customers, whereas Spotify has added 200 million paying customers. YouTube Music now has an estimated 100 million paying customers as nicely. Whereas each competing providers are sizable, it’s exceptional that Spotify remains to be profitable, contemplating each Apple’s and YouTube’s providers are bundled with different merchandise at a heavy low cost to Spotify.

These corporations additionally personal the 2 distribution platforms for Spotify’s service: the IOS and Android cellular working techniques. Spotify has claimed for years that each Apple and Alphabet have acted anticompetitively by prioritizing their very own purposes over Spotify’s on their respective cellular app shops. Now, governments are beginning to agree.

Earlier this 12 months, the European Union fined Apple $2 billion for particular anticompetitive habits towards music streaming providers (which means Spotify). Regardless of Apple and Alphabet each making an attempt to cripple Spotify’s enterprise, it continues to thrive. I believe that reveals how highly effective a service it’s in customers’ eyes.

2024 is the 12 months earnings lastly arrive

Spotify has all the time grown shortly however with out producing a revenue. Traders soured on the enterprise in 2022 as administration as soon as once more pushed out earnings to future years. Now, it seems just like the 12 months of earnings is lastly arriving.

The corporate has gone by main layoffs after hiring too many individuals in 2020 and 2021 whereas additionally making an attempt to get rid of redundant prices throughout its enterprise operations. Within the fourth quarter of 2023, Spotify would have generated a optimistic working revenue when you excluded its one-time severance prices.

The enterprise retains rising, even with fewer staff. I believe this implies earnings are possible in 2024. Margins maintain transferring larger, and income remains to be rising at a double-digit charge (16% 12 months over 12 months in This fall, for instance). Over the long run, administration expects the enterprise will hit 10% or larger revenue margins, given its unit economics. These aren’t the sky-high margins you would possibly see at different know-how corporations, however after 2024, will probably be arduous to assert that Spotify has an unviable enterprise mannequin.

Do you have to purchase the inventory?

After its huge run-up, Spotify now sports activities a wholesome market capitalization of $50 billion. Assuming it could possibly attain a ten% revenue margin within the subsequent few years, its $14.4 billion in income would flip into $1.44 billion in earnings. That provides the inventory a (theoretical) price-to-earnings ratio (P/E) of 35, a major premium to the market common.

With Spotify’s premium P/E a number of, traders have to count on the corporate to develop shortly to meet its present valuation — and Spotify is doing simply that, with income rising at a double-digit charge in 2023. There’s nonetheless loads of room for the music streaming market to develop worldwide, with the corporate making giant pushes into podcasts and audiobooks to drive additional good points.

If Spotify can continue to grow income at a wholesome charge, the inventory nonetheless seems fairly valued at these costs. Do not be afraid to purchase shares simply because it’s up over 200% for the reason that begin of 2023.

Do you have to make investments $1,000 in Spotify Know-how proper now?

Before you purchase inventory in Spotify Know-how, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for traders to purchase now… and Spotify Know-how wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 18, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Brett Schafer has positions in Alphabet and Spotify Know-how. The Motley Idiot has positions in and recommends Alphabet, Apple, and Spotify Know-how. The Motley Idiot recommends BlackBerry. The Motley Idiot has a disclosure coverage.

This Progress Inventory Is Beating the “Magnificent Seven”: Ought to You Purchase? was initially revealed by The Motley Idiot