Kate_sept2004 | E+ | Getty Pictures

Investing can appear overly difficult, and that complexity could paralyze People into doing nothing.

However investing — and doing so neatly — does not should be exhausting. Actually, getting began could be comparatively simple, in response to monetary consultants.

“You do not have to be a rocket scientist. Investing isn’t a recreation the place the man with the 160 IQ beats the man with 130 IQ,” Warren Buffett, chairman and CEO of Berkshire Hathaway, famously mentioned.

For many individuals, investing is a necessity to develop one’s financial savings and supply monetary safety in retirement. Beginning early in a single’s profession advantages the investor as a result of an extended time horizon for curiosity and funding returns to compound.

Whereas acceptable long-term targets could differ from individual to individual, one rule of thumb is to avoid wasting roughly 1x your wage by age 30, 3x by 40 and in the end 10x by 67, in response to Constancy Investments.

A ‘fabulous, easy answer’ for inexperienced persons

Goal-date funds, often called TDFs, are the only entry level to investing for the long run, in response to monetary execs.

“I feel they are a fabulous, easy answer for novice traders — and any investor,” mentioned Christine Benz, director of private finance and retirement planning at Morningstar.

TDFs are based mostly on age: Buyers select a fund based mostly on the 12 months wherein they intention to retire. For instance, a present 25-year-old who expects to retire in roughly 40 years could decide a 2065 fund.

These mutual funds do many of the exhausting work for traders, like rebalancing, diversifying throughout many various shares and bonds, and selecting a comparatively acceptable stage of threat.

Asset managers routinely throttle again threat as traders age by lowering the share of shares within the TDF and elevating the publicity to bonds and money.

The way to decide a target-date fund

TDFs are a superb place to begin for “do nothing” traders who search a hands-off strategy, mentioned Lee Baker, a licensed monetary planner and founding father of Apex Monetary Providers in Atlanta.

“That is the simplest factor for lots of people,” mentioned Baker, a member of CNBC’s Advisor Council.

Buyers want solely select their TDF supplier, their goal 12 months and the way a lot to take a position.

Benz recommends deciding on a TDF that makes use of underlying index funds. Index funds, not like actively managed funds, intention to duplicate broad inventory and bond market returns, and are usually cheaper; index funds (also called passive funds) are likely to outperform their actively managed counterparts over the long run.

“You undoubtedly need a passive TDF,” mentioned Carolyn McClanahan, a CFP and the founding father of Life Planning Companions in Jacksonville, Florida.

Benz additionally advises traders hunt down funds from among the many greatest TDF suppliers, like Constancy, Vanguard Group, Charles Schwab, BlackRock or T. Rowe Value.

Different ‘strong selections’ for novice traders

Buyers who need to be a bit extra hands-on relative to TDF traders produce other easy choices, consultants mentioned.

Some could go for a target-allocation fund, for instance, Baker mentioned. These funds are like TDFs in that asset managers diversify amongst shares and bonds in response to a selected asset allocation — say, 60% shares and 40% bonds.

However this allocation is static: It does not change over time as with TDFs, that means traders could ultimately have to revisit their alternative. They’ll decide which fund is perhaps a superb place to begin by filling out a web-based threat profile questionnaire, Baker mentioned.

Extra from Private Finance:

Why Social Safety COLAs could also be smaller in 2025 and past

‘Take the emotion out of investing’ throughout an election 12 months

Why Social Safety is so essential for ladies

As another choice, traders could as an alternative go for a worldwide market index fund, an all-stock portfolio diversified throughout U.S. and non-U.S. equities, Benz mentioned. As with target-allocation funds, these funds do not de-risk as one ages.

“I feel typically novice traders query the straightforward magnificence of a few of these very strong selections,” Benz mentioned. “Folks crave one thing extra complicated as a result of they assume it must be higher, nevertheless it’s not.”

Ask your self: Why am I investing?

Younger, long-term traders ought to usually guarantee their fund — whether or not TDF or in any other case — has a excessive allocation to shares, round 90% or extra, mentioned McClanahan, a member of CNBC’s Advisor Council.

Retirement traders underneath age 50 would seemingly be well-suited with a portfolio tilted largely to shares, with some money reserves put aside within the occasion of emergencies like job loss or well being points, Benz mentioned.

You do not have to be a rocket scientist. Investing isn’t a recreation the place the man with the 160 IQ beats the man with 130 IQ.

Warren Buffett

chairman and CEO of Berkshire Hathaway

One caveat: Buyers saving for a short- or intermediate-term want — perhaps a home or automotive — would seemingly be higher served placing allotted cash in safer autos like cash market accounts or certificates of deposit, McClanahan mentioned.

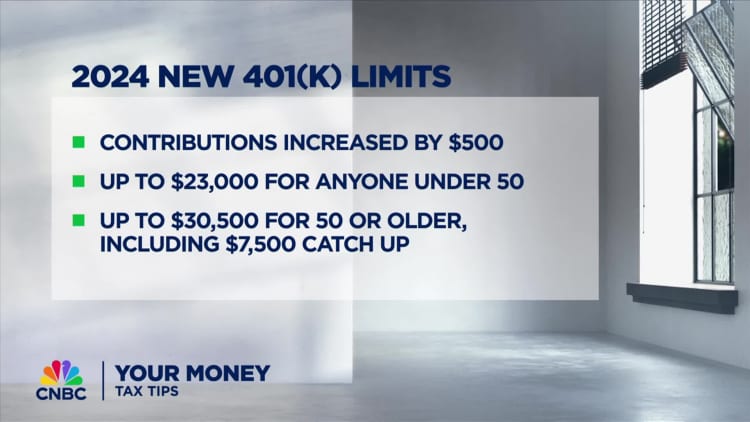

The best place for long-term traders to avoid wasting is a office retirement plan like a 401(okay) plan. These with an employer match ought to intention to take a position no less than sufficient to get the total match, McClanahan mentioned.

“The place else do you get 100% in your cash?” she mentioned.

Buyers who haven’t got entry to a 401(okay)-type plan can as an alternative save in a person retirement account — one other sort of tax-preferred retirement account — and arrange computerized deposit, McClanahan mentioned.

TDF traders who save in a taxable brokerage account could get hit with an surprising tax invoice, consultants mentioned. As a result of TDFs repeatedly rebalance, there are prone to be transactions throughout the fund that set off capital-gains taxes if not held in a tax-advantaged retirement account.