One ETF has taken in extra money than all others up to now in 2023, with a large $11.3 billion in inflows as of June sixth, in keeping with FactSet. However it’s not a sizzling new AI fund or an ETF capitalizing on different en-vogue tech developments, though it gives you some publicity to them. As an alternative, it’s arguably some of the boring, vanilla ETFs on the market, however this doesn’t imply it might’t assist you to to develop your portfolio. It’s the Vanguard S&P 500 ETF (NYSEARCA:VOO). In truth, whether or not you might be simply starting your investing journey or in case you are already a veteran dealer who has spent years within the investing sport, this unassuming however large ETF can function a sound constructing block on your portfolio. Right here’s why.

Harness the Energy of the Total S&P 500 in Your Portfolio

The Vanguard S&P 500 ETF boasts over $300 billion in property below administration (AUM), making it the third-largest ETF out there right now. Whereas there are numerous advanced investing methods and merchandise on the market that declare to supply buyers a leg up in the marketplace, VOO retains it easy. It invests within the S&P 500, the index that consists of about 500 of the most important 500 U.S. shares and arguably an important and influential index within the investing world.

The S&P 500 covers all sectors of the U.S. economic system, so slightly than having to guess on particular person sectors, an ETF like VOO offers you publicity to all of them — from tech leaders like Apple and Microsoft to outdated economic system industrial giants like Caterpillar and Deere and every little thing in between.

The wonderful thing about VOO is that it permits buyers to harness the ability and innovation of a giant swath of the U.S. economic system in a single funding car with out having to select favourite sectors or shares. An funding in VOO is basically a guess on round 500 of the highest publicly-listed corporations in the US persevering with to innovate and revenue over time, which has traditionally been a profitable proposition.

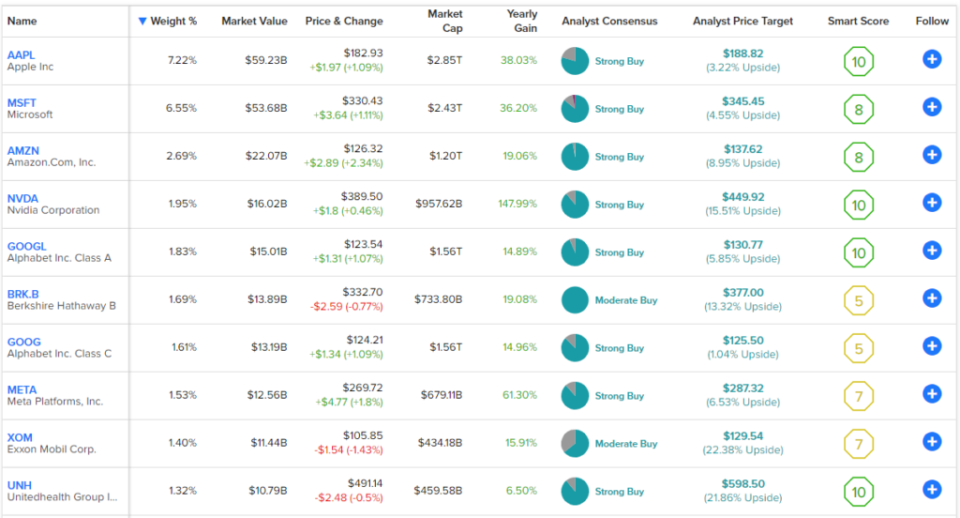

Beneath, you’ll discover an outline of VOO’s high 10 holdings, created utilizing TipRanks’ holdings software.

As a result of it tracks the S&P 500 index itself, the fund is awfully diversified, holding 504 shares, and its high 10 positions make up simply 27.8% of property. As you may see, high holding Apple accounts for a 7.2% place within the fund, adopted by Microsoft, which has a 6.6% weighting, with Amazon, Nvidia and Alphabet (Class A) rounding out the highest 5 holdings. Nonetheless, it’s not simply tech shares, Warren Buffett’s Berkshire Hathaway and vitality large ExxonMobil observe intently behind.

As you may see within the desk, VOO’s high holdings characteristic a reasonably stable assortment of Sensible Scores. In truth, 4 of its high 10 holdings, Apple, Nvidia, Alphabet, and UnitedHealth Group, characteristic ‘Excellent 10’ Sensible Scores. The Sensible Rating is a proprietary quantitative inventory scoring system created by TipRanks. It offers shares a rating from 1 to 10 based mostly on eight market key components. A rating of 8 or above is equal to an Outperform ranking, and VOO itself has a powerful ETF Sensible Rating of 8 out of 10.

Is VOO Inventory a Purchase, Based on Analysts?

So the quantitative components charge VOO favorably, however what do Wall Avenue analysts assume? VOO earns a Average Purchase consensus ranking on TipRanks based mostly on analysts’ rankings, and the typical VOO inventory value goal of $445.50 implies upside potential of 11.9%. Of the 6,212 analyst rankings on the identify, 59.13% are Buys, 35.33% are Holds, and simply 5.54% are Sells.

Investor-Pleasant Charges

Along with this ample diversification and broad publicity, one other enticing characteristic of VOO is its low expense ratio. It’s arduous to beat VOO’s minuscule expense ratio of simply 0.03%. An investor placing $10,000 into VOO would pay simply $3 in charges in 12 months one. This sort of investor-friendly expense construction helps buyers defend the principal of their portfolios over time with out coughing up an excessive amount of in charges. For instance, assuming this payment stays fixed and that the fund returns 5% a 12 months for the subsequent 10 years, an investor pays simply $39 in charges over the course of the last decade. Examine this to the multitude of ETFs in the marketplace with expense ratios of 0.75%, the place buyers are paying $75 in charges on a $10,000 funding in simply 12 months one, and you actually see the worth proposition of an ETF like VOO.

Stable Lengthy-Time period Efficiency

With this diversification and investor-friendly expense ratio, it’s straightforward to see why this large ETF is the most well-liked ETF when it comes to inflows up to now this 12 months. Nonetheless, there’s additionally one other issue resulting in its reputation — its long-term efficiency observe file. VOO has constantly produced double-digit annualized whole returns for its buyers for a very long time. It doesn’t matter what time horizon you’re looking over, VOO has delivered. As of the top of Could, VOO had an annualized whole return of 12.8% over a three-year time-frame. Over a five-year time horizon, the huge ETF has delivered 11% whole returns yearly. Additional, over the previous 10 years, VOO returned 11.9% yearly. VOO has been round since 2010, and since its inception that 12 months, it has returned a stellar 13.3% on an annualized foundation.

Preserving Issues Easy Can Pay Off

It doesn’t damage to maintain it easy. Whereas there are many unique funding methods on the market, few beat an ETF like VOO over the long run. Whereas this S&P 500 ETF isn’t the kind of funding that’s going to offer you a multi-bag return in a 12 months, the fact is that few investments are. Nonetheless, the excellent news is that investing in a broad-market ETF like this and permitting these good points to compound through the years is a time-tested solution to construct long-term wealth. Buyers can dollar-cost common over time after they have a surplus of money and/or when the S&P 500 falls whereas reinvesting dividends to amplify these outcomes much more.

VOO’s sturdy efficiency observe file, investor-friendly expense ratio, and portfolio of round 500 of the highest U.S. shares have made it a winner for a very long time, and it’s prone to stay a winner for the foreseeable future.

Disclosure