Promoting an assortment of merchandise that enchantment to teenagers and preteens, 5 Under (NASDAQ: FIVE) is a retail idea that is gaining floor throughout the nation. However you would not know that from buyers’ response after the corporate reported full-year monetary outcomes for 2023. After the report dropped, 5 Under inventory itself dropped by 15%.

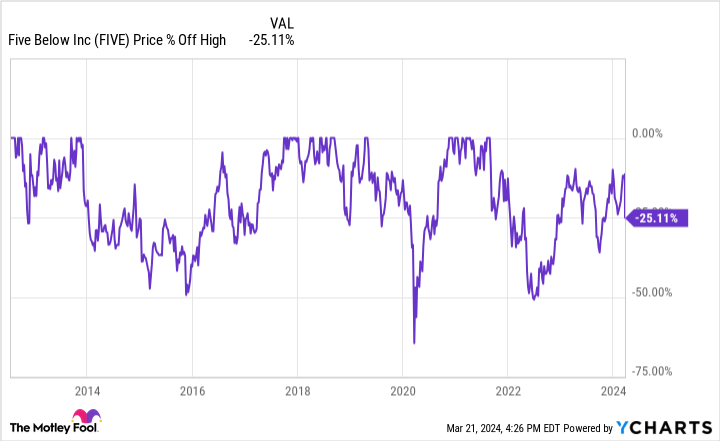

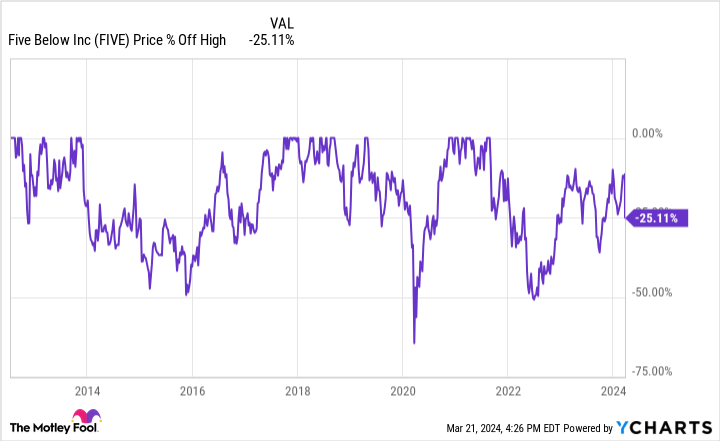

5 Under shareholders are used to pullbacks. Because the firm went public in 2012, it is fallen 15% or extra fairly a number of instances, because the chart under reveals. For affected person buyers with a long-term focus, these pullbacks are nice alternatives. 5 Under is fast-growing, worthwhile, and has giant aspirations that may flip this right into a stable contributor to any inventory portfolio.

Why I really like 5 Under inventory

The 5 Under funding thesis is devilishly easy. The corporate intends to open about 2,000 new retail places by 2030. These places pay for themselves in about one 12 months. This implies the corporate’s money stream shortly soars with out the corporate taking over dangerous financing. As 5 Under’s money stream soars, so too ought to its inventory worth.

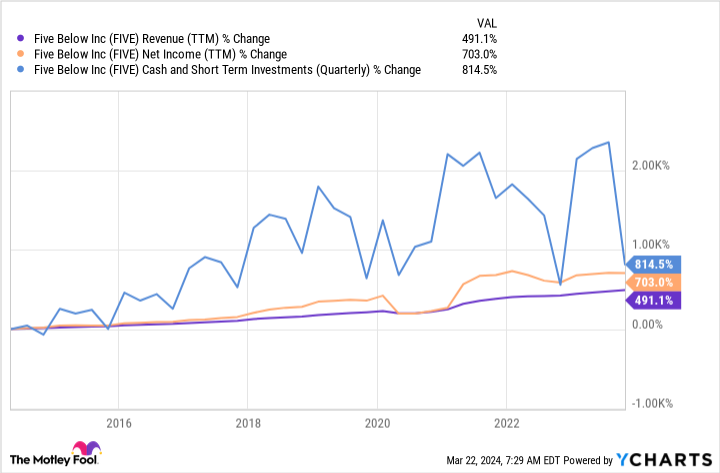

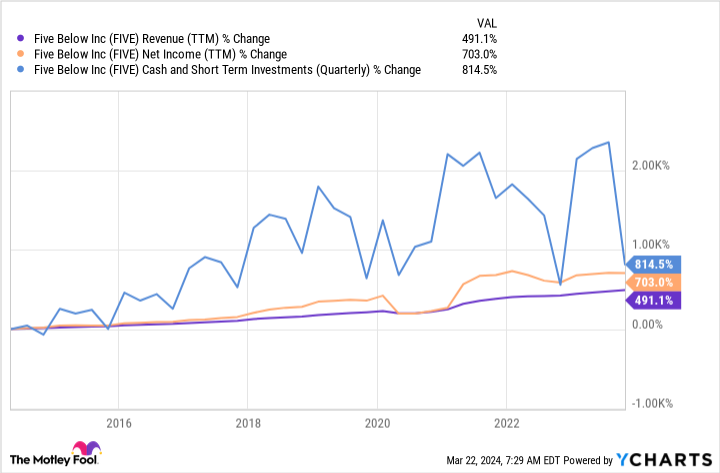

Let’s examine how this has performed out for 5 Under throughout the previous 10 years. On the finish of its fiscal 2013, 5 Under had 304 places. On the finish of fiscal 2023, the corporate had 1,544 places — a rise of 1,240 places. These new places have dramatically elevated total gross sales. And same-store gross sales elevated in eight of the final 10 years, contributing to increased total gross sales as properly.

5 Under’s numbers paint an image of how good these new places have been for the general enterprise. On the finish of 2013, the corporate had simply $50 million in money and $20 million in debt. And its web revenue for the 12 months was $32 million. By comparability, 5 Under generated web revenue of over $200 million in its fiscal 2023, ending the 12 months with $460 million in money, money equivalents, and short-term investments in addition to zero debt.

Why I nonetheless love 5 Under for 2024 and past

In brief, 5 Under has continued doing what it must do to be funding: opening new shops. It has launched over 1,000 worthwhile places, which have shortly paid for themselves, protecting the corporate out of debt and with a rising pile of money. In 2023, 5 Under opened over 200 new places. Similar-store gross sales had been up virtually 3%. And it had web revenue of virtually $100 million.

Maybe some buyers are involved about the long run due to inflation. In any case, 5 Under’s title implies that its merchandise prices lower than $5. In an inflationary time, that will get tougher to do whereas nonetheless sustaining profitability.

Nonetheless, 5 Under has demonstrated that it isn’t caught due to its title. The corporate is now filling a big a part of its shops with a bit it calls “5 Past.” In brief, 5 Past offers it the power to promote merchandise at any worth and its prospects do not appear to care.

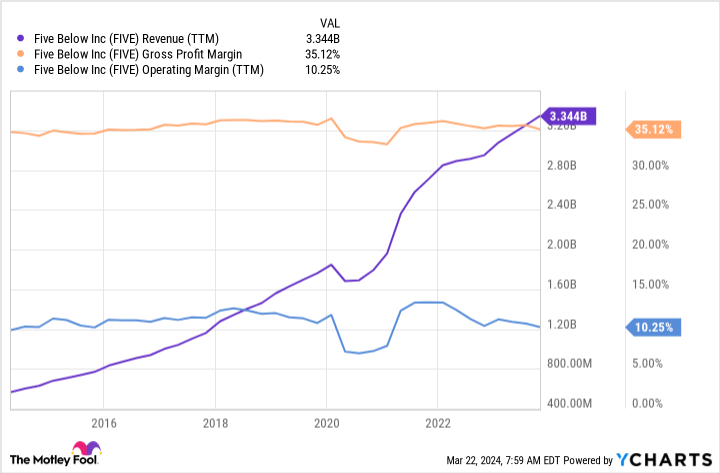

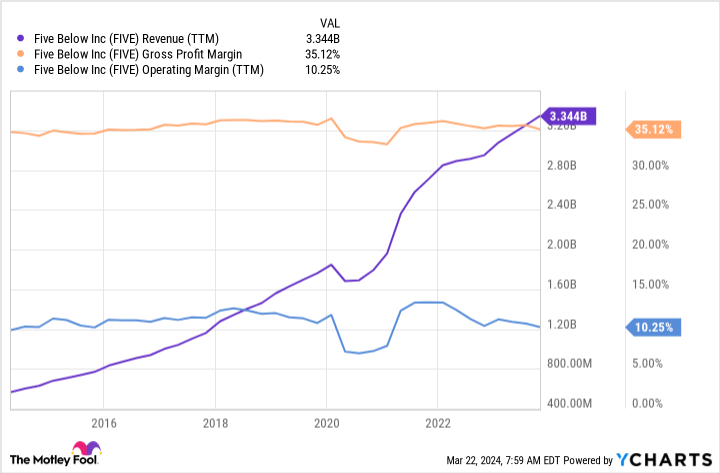

I consider that is a part of the rationale that 5 Under is so per its income. Over the past 10 years, its gross margin has remained within the mid-30% vary. And its working margin has typically been above 10%. Subsequently, I am not anxious about 5 Under’s revenue margins as a result of it isn’t trapped promoting issues at underneath $5.

Now this is the thrilling half: By 2030, 5 Under desires to have greater than 3,500 places — that is virtually 2,000 extra shops than it has immediately. Assuming all of the tendencies with its enterprise mannequin maintain up, this firm might be a cash-flow machine by then with no debt obligations.

From there, 5 Under may return fairly a bit of money to shareholders because it would not have urgent monetary wants. Maybe it may pay a dividend or maybe it may repurchase quite a lot of shares. However both means, it seems to be good for buyers.

Buying and selling at simply 3 instances its trailing gross sales, 5 Under can also be a fairly priced inventory. So for buyers who like development at an inexpensive worth, it is a inventory to purchase and maintain for the long run.

Must you make investments $1,000 in 5 Under proper now?

Before you purchase inventory in 5 Under, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for buyers to purchase now… and 5 Under wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 21, 2024

Jon Quast has positions in 5 Under. The Motley Idiot recommends 5 Under. The Motley Idiot has a disclosure coverage.

This Inventory Dropped After Earnings. However It is Now a Prime Progress Inventory to Purchase in 2024. was initially printed by The Motley Idiot