Celsius Holdings (NASDAQ: CELH) might be greatest described as a fad inventory, although it’s labeled as a client staples firm. PepsiCo (NASDAQ: PEP) is a client staples inventory that will doubtless be considered a boring {industry} large. However in the event you examine the efficiency of those two shares, PepsiCo seems like the higher alternative for traders. And that is earlier than contemplating its unimaginable long-term positive factors.

What does Celsius do?

Celsius makes vitality drinks. Vitality drinks are a beautiful section of the beverage sector, and the corporate’s merchandise have largely been nicely acquired. However step again and have a look at the broader beverage sector, which is much bigger than simply vitality drinks. Primarily, Celsius is a one-trick pony.

To be honest, that trick is fairly good proper now. The corporate claims that its merchandise accounted for 47% of all vitality drink class progress within the second quarter of 2024. It held the No. 3 place for market share within the interval, as nicely. Whereas that is all notable, it would not bear in mind the inherent limitations of promoting into only one area of interest of a much wider market.

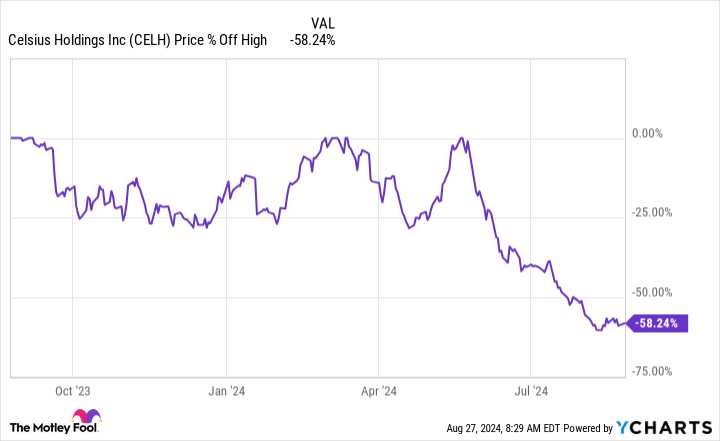

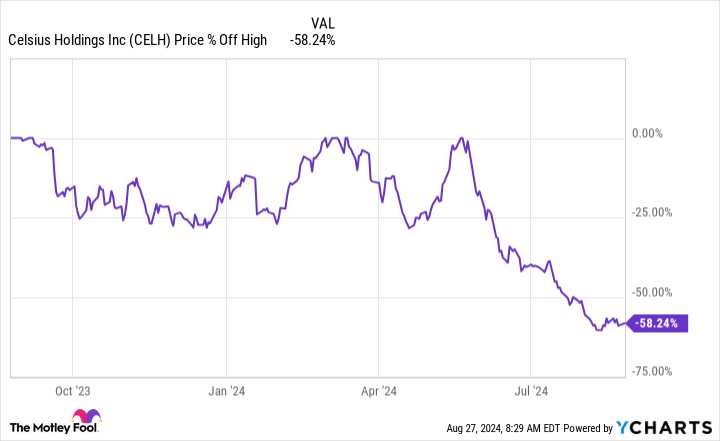

When the corporate’s efficiency ebbs or traders merely transfer on to the following massive funding concept, the inventory is prone to be dropped rapidly. Working example: The inventory has fallen greater than 50% from its 52-week highs. It is price noting that the height was in Might, which suggests there was a really steep decline in a really brief time period.

There’s nothing inherently unsuitable with Celsius, per se. However in the event you imagine that is the inventory that may make you a fast million, chances are you’ll find yourself dissatisfied. A much better alternative could be to get wealthy “slowly” with a bigger, extra diversified client staples firm like PepsiCo.

PepsiCo is thrashing Celsius?

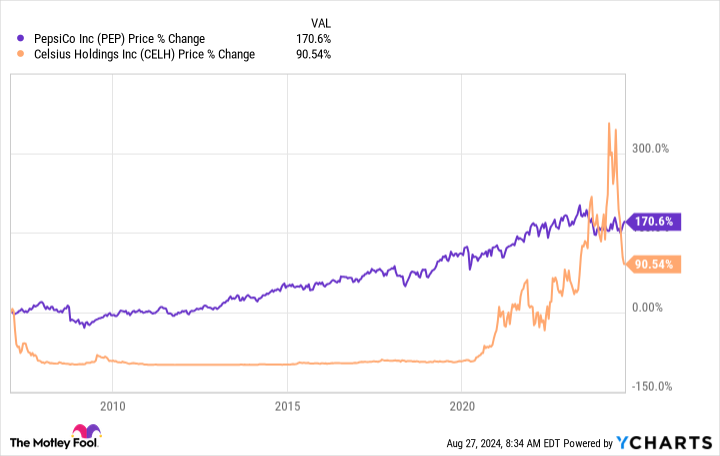

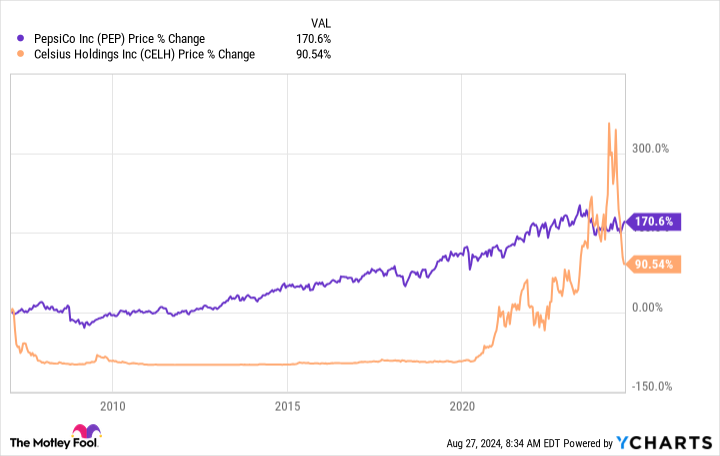

The very very first thing to contemplate when evaluating PepsiCo to Celsius is the inventory positive factors every firm has produced. From Celsius’ IPO in early 2007, the inventory is now up round 90%. That features the steep share value drop over the previous few months. Over that very same span, PepsiCo inventory is up 170%. Though PepsiCo inventory has fallen over the previous few months, too, the decline hasn’t been wherever close to as dramatic.

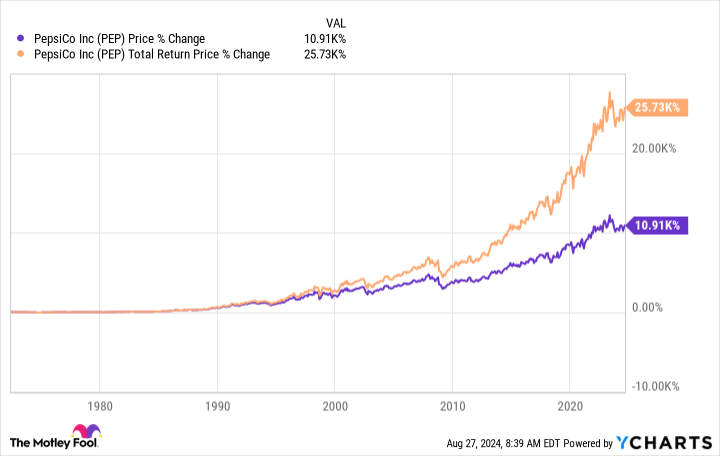

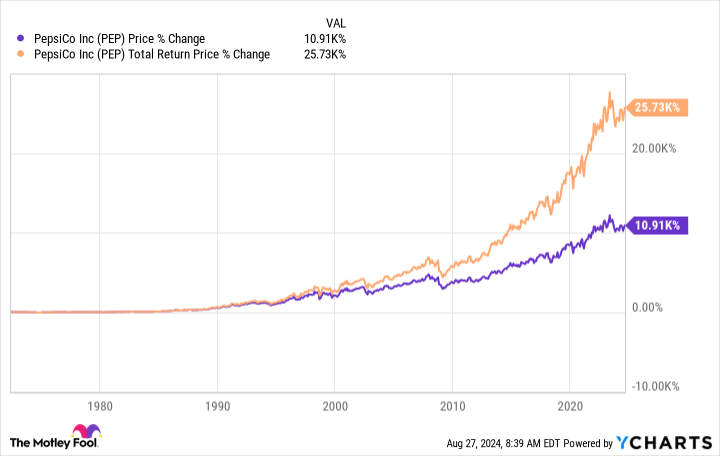

However what occurs if you look additional again? Since mid-1972, PepsiCo’s inventory has risen over 10,000%! That stated, PepsiCo pays a dividend, not like Celsius. The yield is at present round 3% and is backed by over 5 many years of annual dividend will increase (making PepsiCo a extremely elite Dividend King).

PepsiCo is clearly no flash-in-the-pan firm — it has confirmed its capacity to regulate and develop together with the world round it. To essentially perceive investor returns right here, it is advisable to have a look at whole return, which assumes dividend reinvestment. PepsiCo’s whole return since mid-1972 is an unimaginable 25,000%!!!

Though that is historic efficiency, you will need to perceive the advantages of being an {industry} chief within the client staples sector. PepsiCo has a secure of iconic manufacturers, a world distribution system, and highly effective advertising chops. It’s exhausting to compete with PepsiCo, significantly for small start-ups. And, this is the important thing: When a smaller firm does make very important inroads, PepsiCo is massive sufficient to pursue that firm as an acquisition goal. This permits PepsiCo to regulate its enterprise over time so it stays related with customers. That is in all probability one of many largest the reason why diversified PepsiCo is prone to find yourself being a greater long-term funding than Celsius.

Sluggish and regular wins this race

It’s utterly attainable that Celsius will regain investor favor and the shares will rocket greater once more, maybe getting again to, and even above, their 52-week highs. That may result in some fairly enticing short-term positive factors. Nevertheless, over the long run, corporations have to execute and develop over time, and Celsius remains to be a comparatively small one-trick pony.

PepsiCo, however, has deftly managed to grow to be an {industry} chief within the beverage area of interest and the broader client staples sector. With its industry-leading place, it has the wherewithal to continue to grow, albeit slowly, and to purchase up smaller opponents like Celsius which have enticing manufacturers.

Making an attempt to get wealthy rapidly by using sizzling shares greater opens you as much as steep drawdowns just like the one Celsius has skilled. It is much less dangerous to construct a million-dollar portfolio in the event you fill it with dominant {industry} leaders like PepsiCo.

Must you make investments $1,000 in Celsius proper now?

Before you purchase inventory in Celsius, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Celsius wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $731,449!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 26, 2024

Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Celsius. The Motley Idiot has a disclosure coverage.

Neglect Celsius Holdings: This Inventory Has Made Far Extra Millionaires was initially printed by The Motley Idiot