-

There’s nonetheless important upside potential within the inventory market, based on Financial institution of America.

-

The financial institution mentioned the S&P 500 might surge 25% throughout the subsequent yr primarily based on a bullish indicator.

-

“Analyst consensus long-term development expectations right now recommend large positive aspects,” BofA’s Savita Subramanian mentioned.

The S&P 500 might surge greater than 25% over the following 12 months primarily based on a bullish inventory market indicator that measures sentiment amongst Wall Avenue analysts, based on a Friday word from Financial institution of America’s Savita Subramanian.

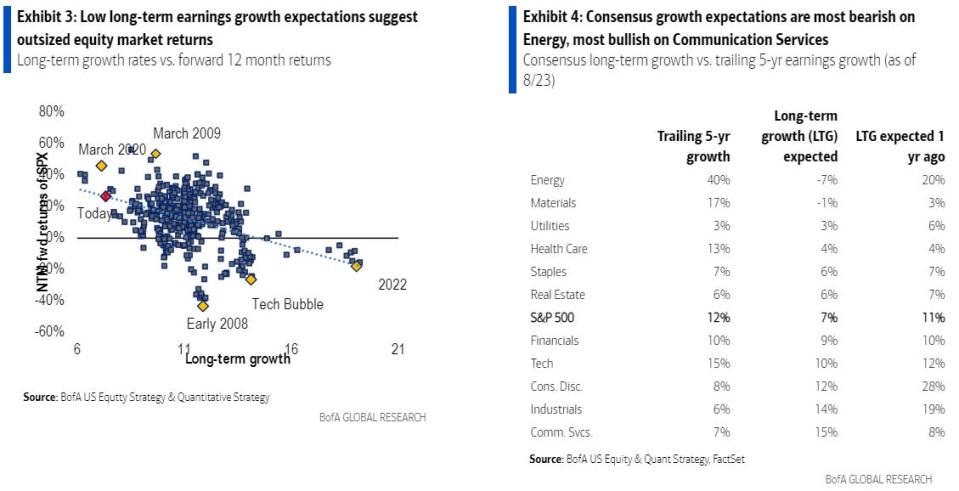

Subramanian noticed that long-term revenue development expectations amongst Wall Avenue analysts are close to document low ranges, which alerts pervasive pessimism. Usually, when there’s such a excessive stage of pessimism in direction of future company income, the inventory market delivers spectacular returns.

“Valuation is a robust long-term forecasting software, however sentiment has been extra predictive of near-term returns, and analysts consensus long-term development expectations right now recommend large positive aspects,” Subramanian mentioned. “Forecast long-term development plummeted from 2022, [and] sits close to COVID lows.”

Wall Avenue at the moment expects complete long-term revenue development of about 7% for the S&P 500, which is at comparable ranges seen throughout March 2020 and March 2009, two intervals when shares delivered outsized positive aspects over the next yr.

Analysts anticipated the S&P 500 to ship long-term revenue development of 11% a yr in the past, whereas the trailing 5-year stage of development has been 12%.

Simply as low long-term revenue expectations amongst Wall Avenue analysts has confirmed to be a bullish indicator for shares, elevated development expectations has confirmed to be a bearish sign for shares.

“Low long-term development [expectations] has been bullish. In truth in November 2021, we cited lofty expectations as a bearish set-up, given the robust inverse relationship between long-term development and future S&P 500 returns,” Subramanian mentioned. The inventory market went on to enter a year-long bear market only a couple months later.

The bullish inventory market setup, as steered by this contrarian sentiment indicator, is being pushed by analysts anticipating a large slow-down in revenue development for almost all sectors, together with vitality. However Subramanian disagrees.

“Vitality corporations have newfound provide self-discipline. Oil provide is constrained typically,” Subramanian argued, suggesting that oil corporations will be capable to navigate any potential decline within the value of oil.

And there are causes to consider that revenue development can beat analyst expectations going ahead, based on the word, together with a renewed company deal with effectivity, “which is bullish for margin preservation.”

“Capex is robust, and if communication providers goes to develop even near 2x as quick, incremental grid/infrastructure spend are essential and will profit vitality, metals, utilities, and even retail (stickier wage development,” Subramanian mentioned.

Learn the unique article on Enterprise Insider