A number of expertise corporations have just lately undergone inventory splits. Among the extra notable inventory splits within the tech realm in latest reminiscence embody “Magnificent Seven” members Tesla, Nvidia, Amazon, Alphabet, and Apple.

Whereas there are a selection of upcoming inventory splits to concentrate on, there may be one synthetic intelligence (AI) firm that I believe could possibly be subsequent in line: ServiceNow (NYSE: NOW).

Let’s dig into why ServiceNow makes a compelling stock-split candidate and discover the funding deserves of this software-as-a-service (SaaS) chief.

How do inventory splits work?

Earlier than diving into ServiceNow particularly, traders ought to perceive the fundamentals of inventory splits.

Inventory splits are basically a type of monetary engineering. The variety of excellent shares will increase by the ratio within the cut up. For instance, in a 5-for-1 cut up, there might be 5 occasions as many shares following the cut up.

Because of this, the share value of the inventory in query decreases by that very same a number of. This dynamic implies that the market cap of the stock-split inventory doesn’t inherently change.

Why would ServiceNow cut up its inventory?

Some of the frequent causes that an organization decides to separate its inventory is as a result of shares have soared considerably over a comparatively brief timeframe. Because of this, most retail traders understand shares as costly and out of attain.

Once more, though a inventory cut up would not change the worth of the corporate, traders are likely to view shares as cheaper as a result of the inventory value is now decrease. Subsequently, inventory splits are usually adopted by a brand new pool of traders pouring in.

Since its preliminary public providing (IPO) in 2012, ServiceNow’s shares are up 2,970%. Furthermore, since AI has turn out to be a focus amongst expertise shares within the final 18 months or so, ServiceNow shares have risen 77%.

With a share value of $755, ServiceNow inventory would not look low-cost. Contemplating the corporate has by no means cut up its shares and secular themes are fueling the AI panorama, now could possibly be a singular alternative for ServiceNow to observe within the footsteps of its bigger tech friends as additional positive aspects look to be in retailer.

Do you have to put money into ServiceNow inventory?

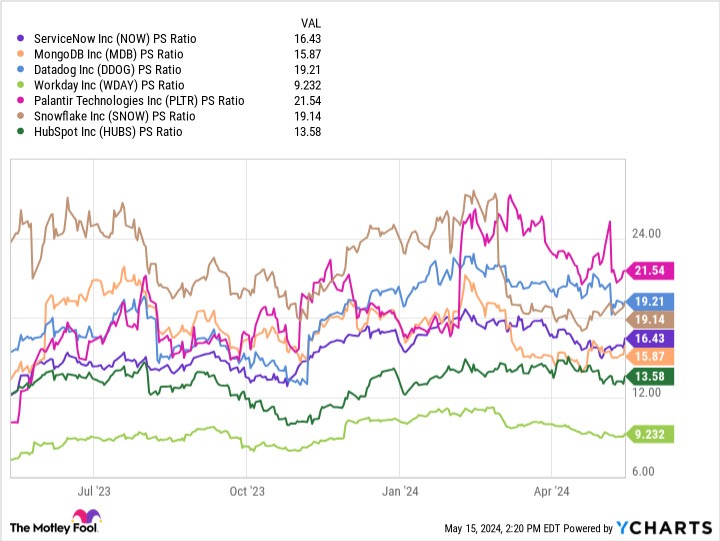

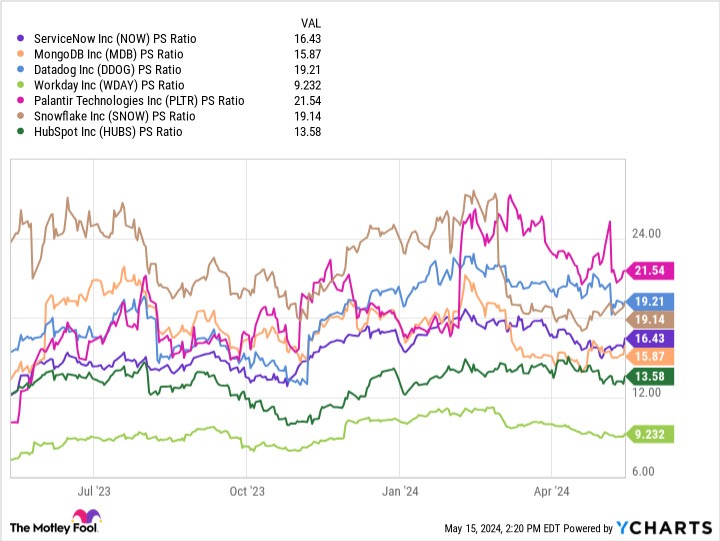

It is essential for traders to know that the share value alone just isn’t what determines a inventory as over or undervalued. In actual fact, the chart beneath illustrates that ServiceNow is essentially buying and selling at a reduction on a price-to-sales (P/S) foundation when benchmarked in opposition to different SaaS progress shares.

After analyzing the info above, there’s a professional case to be made that ServiceNow is undervalued regardless of its seemingly costly share value.

One other method of taking a look at this dichotomy is that it’s not the variety of shares that you just personal that issues; it is the amount of cash you are placing to work. It is virtually definitely a greater concept to personal one share of a $1,000 inventory than 1,000 shares of a $1 inventory. Typically talking, the share value displays the sentiment of the enterprise.

So far as ServiceNow is anxious, there’s one different cause I see the corporate as a possible stock-split alternative. As I just lately expressed, ServiceNow just isn’t as well-known within the expertise and AI arenas as its competitors. A inventory cut up could be a great way for the corporate to make headlines and probably land on the radar of a broader group of traders.

Now, with that stated, I am not suggesting that ServiceNow ought to use a inventory cut up as a PR stunt to juice its value. Buyers can purchase shares in ServiceNow purely primarily based on concrete enterprise outcomes.

During the last a number of quarters, ServiceNow has moved swiftly within the AI world and it is displaying within the firm’s outcomes. Income progress is accelerating due to spectacular buyer retention metrics in addition to ServiceNow’s skill to cross-sell extra services and products.

Furthermore, the corporate has solid partnerships with Microsoft, Nvidia, and Worldwide Enterprise Machines. I see these as essential stepping stones for additional lead era and new gross sales alternatives for long-term progress.

On the finish of the day, ServiceNow is a rock-solid funding alternative no matter a cut up. Now seems like a good time to scoop up some shares and put together to carry for the long run as the expansion story continues to unfold.

Do you have to make investments $1,000 in ServiceNow proper now?

Before you purchase inventory in ServiceNow, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for traders to purchase now… and ServiceNow wasn’t one in every of them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $566,624!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Might 13, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Apple, Microsoft, Nvidia, Palantir Applied sciences, and Tesla. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Datadog, HubSpot, Microsoft, MongoDB, Nvidia, Palantir Applied sciences, ServiceNow, Snowflake, Tesla, and Workday. The Motley Idiot recommends Worldwide Enterprise Machines and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Prediction: This Will Be the Subsequent Synthetic Intelligence (AI) Firm to Cut up Its Inventory was initially printed by The Motley Idiot