A model of this submit first appeared on TKer.co

Shares closed greater final week with the S&P 500 climbing 0.4%. The index is now up 12% 12 months thus far, up 20.2% from its October 12 closing low of three,577.03, and down 10.4% from its January 3, 2022 report closing excessive of 4,796.56.

On Thursday, we lastly acquired affirmation that the bear market led to October and that we have been in a brand new bull market ever since.

We’re additionally realizing this 12 months’s market strikes thus far have been far exterior consensus expectations in a bullish manner.

Let’s flip again the clock.

An ‘overstated’ concern 🤏

In December, I revealed a roundup of Wall Road strategists’ 2023 outlook for shares. The takeaway on the time: “Strategists count on a unstable first half to be adopted by a neater second half, which might see shares climb modestly greater.”

The large concern was {that a} transient earnings development recession, which has sorta come to fruition, would include renewed promoting in shares

However on the time, a handful of analysts, like Oppenheimer’s Ari Wald, ran the numbers and concluded “issues are overstated.”

Not solely is there a really weak linear relationship between one 12 months’s earnings change and one 12 months’s S&P 500 worth change, however there’s really some proof {that a} trough in earnings is definitely a lagging market indicator. Moreover, historical past reveals there are extra situations when shares didn’t fall however rose in years when earnings fell.

A ‘hottest’ concern 👯♀️

There was additionally the problem that many consultants had been overtly calling for inventory market weak spot within the first half of the 12 months. The prediction even made the cover of Barron’s!

On the time, two of the savviest Wall Road strategists I observe remarked on this. From the December 18, 2022 TKer:

“I do suppose that we’re going to go down after which up… The issue is that’s an more and more consensus view. So I believe the larger danger heading into the primary half is definitely not being invested in equities.” – BofA’s Savita Subramanian, Dec. 7.

“All people and their mom, brother, sister, cousin, and uncle is unfavorable on the primary half of the 12 months… So we’ll come out and be somewhat bit totally different. I believe the weak spot might be not going to be so long as everyone thinks.” – BMO Capital Markets’ Brian Belski, Dec. 16

The factor about dangers is that they change into much less of an issue for markets the extra market individuals discuss them as a result of which means the dangers are in all probability priced in.

Certainly, it’s mid-June and the inventory market has spent the primary 5 and a half months of the 12 months largely trending greater. The S&P 500 went modestly into the crimson on January 3 and 5; each different day it’s been within the inexperienced.

“The most well-liked prediction headed into 2023 was that markets would undergo by means of a tough first half however rally by 12 months’s finish,” Michael Arone, State Road International Advisors, wrote on Tuesday. “Nonetheless, shares and bonds have refused to adjust to the consensus forecast.”

In current weeks, the consensus has shifted with strategists throughout Wall Road revising up their year-end worth targets for the S&P 500, together with Goldman Sachs’ David Kostin (to 4,500 from 4,000), BMO Capital Markets’ Brian Belski (to 4,550 from 4,300), BofA’s Savita Subramanian (to 4,300 from 4,000), and RBC Capital Markets’ Lori Calvasina (to 4,250 from 4,100).

The large image 🤔

To be clear, this isn’t meant to be a celebration of bearish market-timers being flawed.

Moderately, the purpose is that it’s extremely troublesome to foretell short-term strikes with any accuracy, even when you recognize the place the basics are headed.

And it may be notably harmful to make bearish strikes in a inventory market that often goes up. You danger lacking out on important short-term beneficial properties, doing irreversible harm to your potential long-term returns.

Reviewing the macro crosscurrents 🔀

There have been a number of notable information factors and macroeconomic developments from final week to contemplate:

🛍️ Shopper spending is holding up. From Financial institution of America: “Financial institution of America inside information suggests shopper spending was broadly steady in Might, with Financial institution of America complete card spending per family up 0.1% month-over-month (MoM), seasonally adjusted. The year-over-year (YoY) development price stays unfavorable at -0.2% YoY.”

From JPMorgan: “As of 04 Jun 2023, our Chase Shopper Card spending information (unadjusted) was 2.2% above the identical day final 12 months. Primarily based on the Chase Shopper Card information by means of 04 Jun 2023, our estimate of the US Census Might management measure of retail gross sales m/m is 0.46%.“

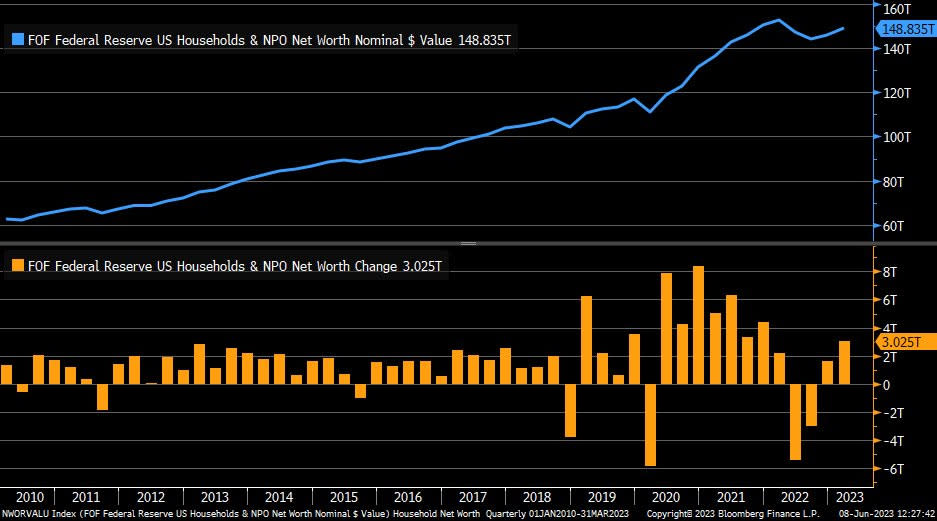

💵 Family internet value rises. Right here’s Bloomberg reporting on new Federal Reserve information: “Family internet value rose $3 trillion, or 2.1%, within the January-March interval to $148.8 trillion after climbing $1.6 trillion within the prior quarter, a Federal Reserve report confirmed Thursday. The worth of fairness holdings elevated about $2.4 trillion within the first quarter, whereas the worth of actual property held by households fell roughly $617 billion.”

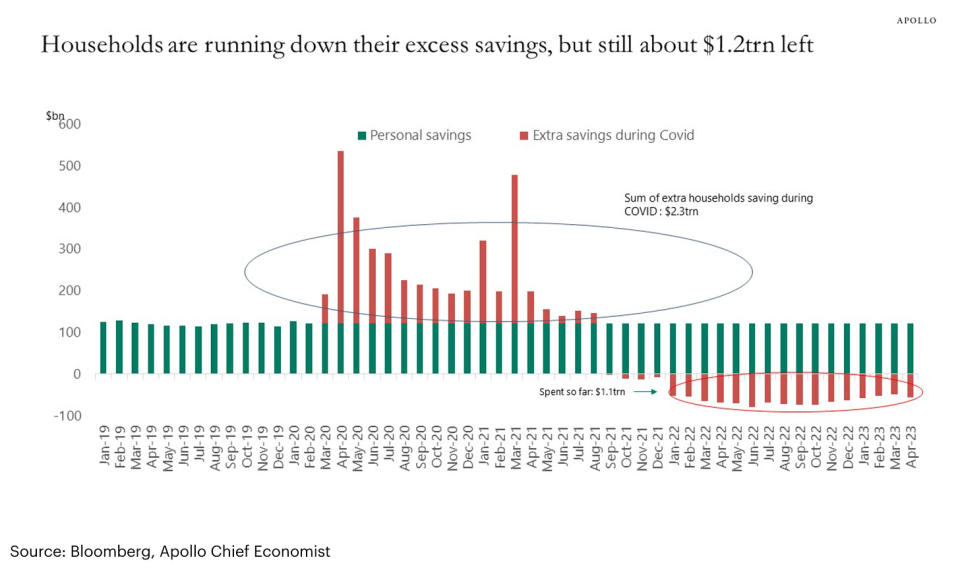

💵 Customers have extra financial savings. Apollo International’s Torsten Slok estimates households are nonetheless sitting on $1.2 trillion in extra financial savings.

It is a bit greater than the $500 billion just lately estimated by the San Francisco Fed. Regardless, the underside line is that customers have plenty of extra financial savings, which explains why spending continues to be resilient.

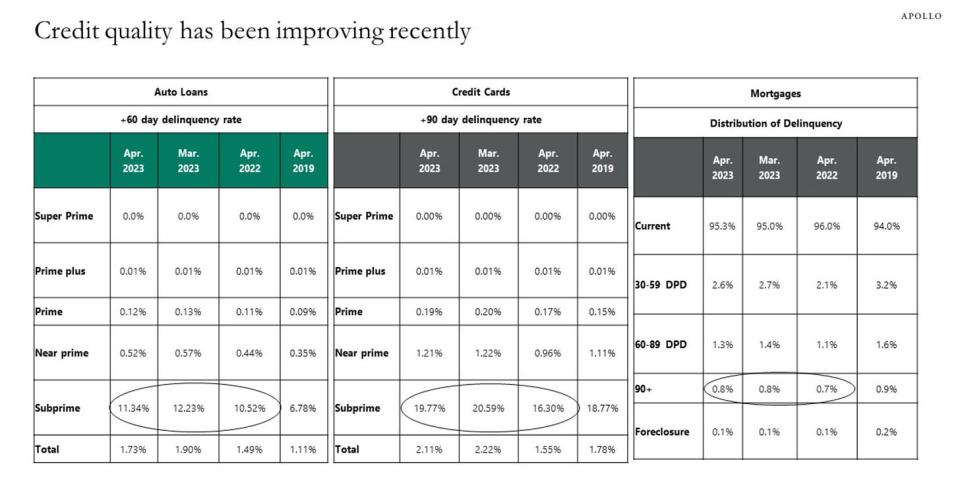

💳 Delinquency charges enhance. Right here’s Apollo International’s Slok on month-to-month Transunion information: “The newest information reveals a modest enchancment in bank card delinquency charges and auto mortgage delinquency charges for subprime, close to prime, and prime debtors, see chart under. That is the other of what can be anticipated with the Fed making an attempt to tighten monetary situations.”

💸 Wage development is cooling. From Certainly Hiring Lab: “Wages and salaries marketed in Certainly job postings grew 5.3% year-over-year in Might, in accordance with the Certainly Wage Tracker. That is down significantly from the excessive of 9.3% set in January 2022, however nonetheless properly above the 2019, pre-pandemic common tempo of three.1%.”

💼 Unemployment claims tick up. Preliminary claims for unemployment advantages climbed to 261,000 in the course of the week ending June 3, up from 233,000 the week prior. Whereas that is up from the September low of 182,000, it continues to development at ranges related to financial development.

From JPMorgan economists: “The transfer might properly be distorted by the Memorial Day vacation, which is difficult to seasonally alter. Furthermore, it is only one week’s transfer. Nonetheless, ought to this degree persist, it might level to a extra materials softening within the labor market.“

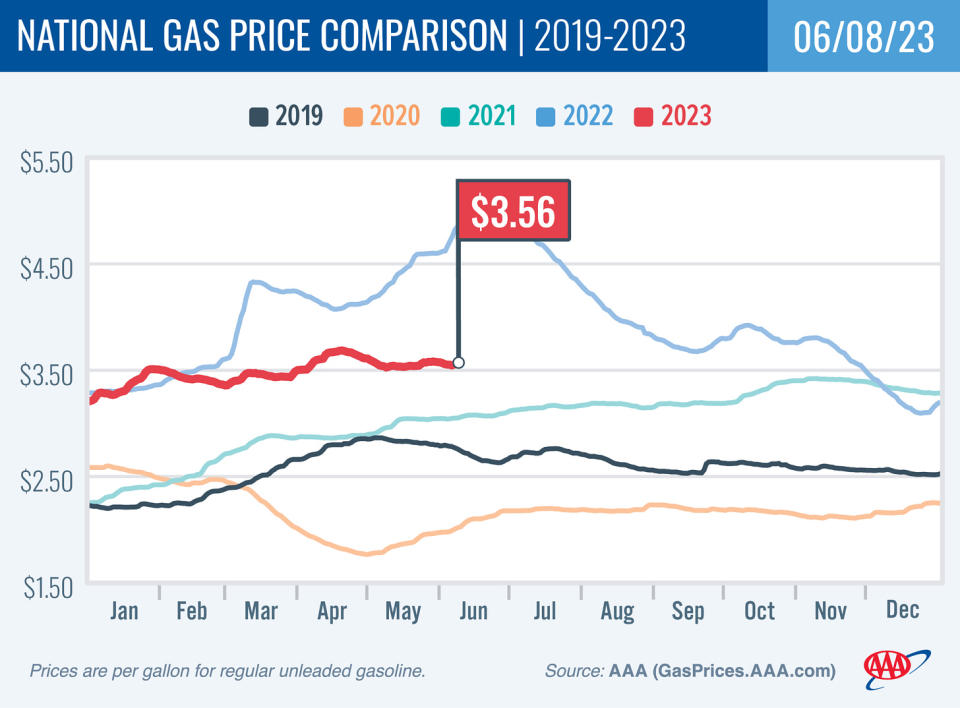

🛢️Fuel costs cool as summer season driving season kicks off. From AAA: “For the primary time since 2021, home gasoline demand was over 9 million barrels each day for a 3rd straight week. But regardless of the sturdy numbers, pump costs barely budged because the low price of oil is countering a spike for now. The nationwide common for a gallon of gasoline dipped a penny since final week to $3.56… Immediately’s nationwide common of $3.56 is three cents greater than a month in the past however $1.39 lower than a 12 months in the past.”

⛽️ Customers are hitting the street. Weekly EIA information by means of June 2 present gasoline demand is up from a 12 months in the past.

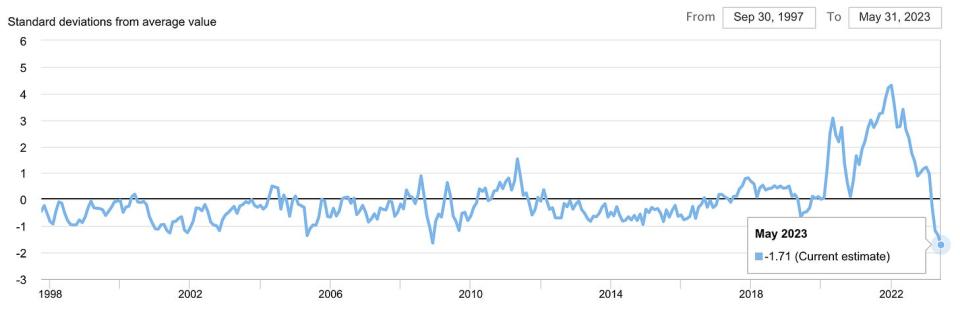

⛓️ Provide chain pressures ease additional. The New York Fed’s International Provide Chain Stress Index

1— a composite of assorted provide chain indicators — fell in Might and is properly under ranges seen even earlier than the pandemic. It is manner down from its December 2021 provide chain disaster excessive. From the NY Fed: “There have been important downward contributions from Nice Britain backlogs and Taiwan supply occasions. Euro Space supply occasions and backlogs exhibited the biggest sources of upward stress in Might. Trying on the underlying information, readings for all areas tracked by the GSCPI are under their historic averages.“

👍 Companies surveys had been blended, however mirrored development. S&P International’s U.S. Companies PMI climbed to 54.9 in Might, signaling an acceleration in development. From the report: “Companies in sectors comparable to journey, tourism, recreation and leisure are having fun with a mini post-pandemic growth as spending is switched from items to providers. The survey information are indicative of GDP rising at an annualized price of simply over 2%, and an upturn in enterprise expectations factors to development remaining sturdy as we head additional into the summer season.“

The Might ISM Companies PMI fell to 50.3, signaling decelerating development within the sector as new order development cooled. Although inventories returned to development. Additionally, worth development decelerated.

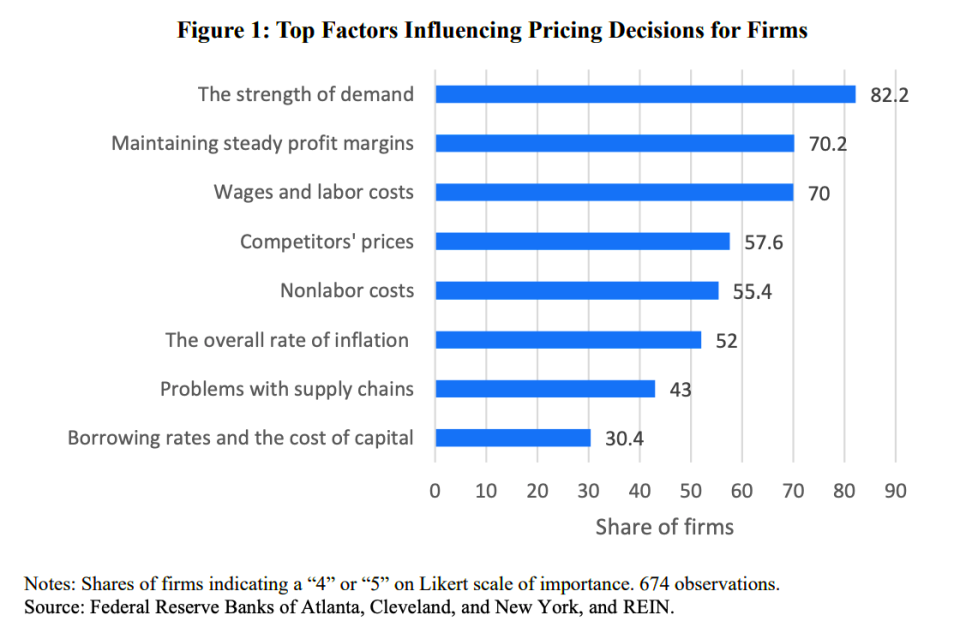

🎈 Revenue margins drive inflation. A New York Fed paper (HT Tracy Alloway) discovered “sustaining regular revenue margins” to be the second most essential issue influencing pricing choice for companies.

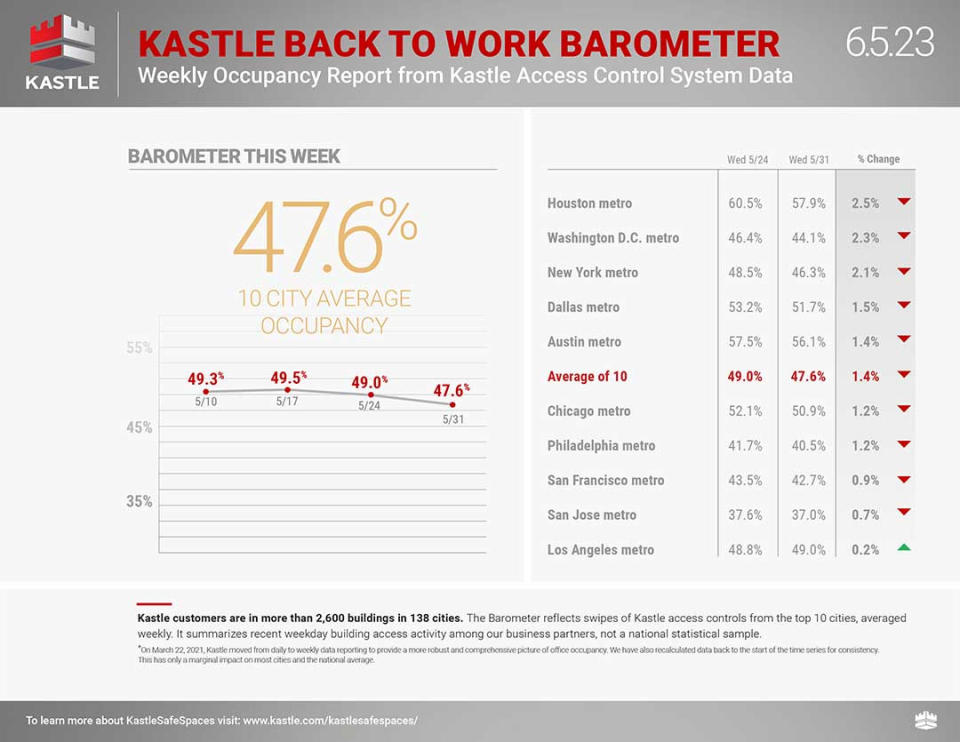

🏢 Workplaces are very empty. From Kastle Techniques: “Workplace occupancy fell 1.4 factors to 47.6% this previous vacation week, in accordance with Kastle’s 10-city Again to Work Barometer. The drop in occupancy was widespread, with all tracked cities seeing declines aside from Los Angeles. The town rose two tenths of a degree to 49% occupancy.“

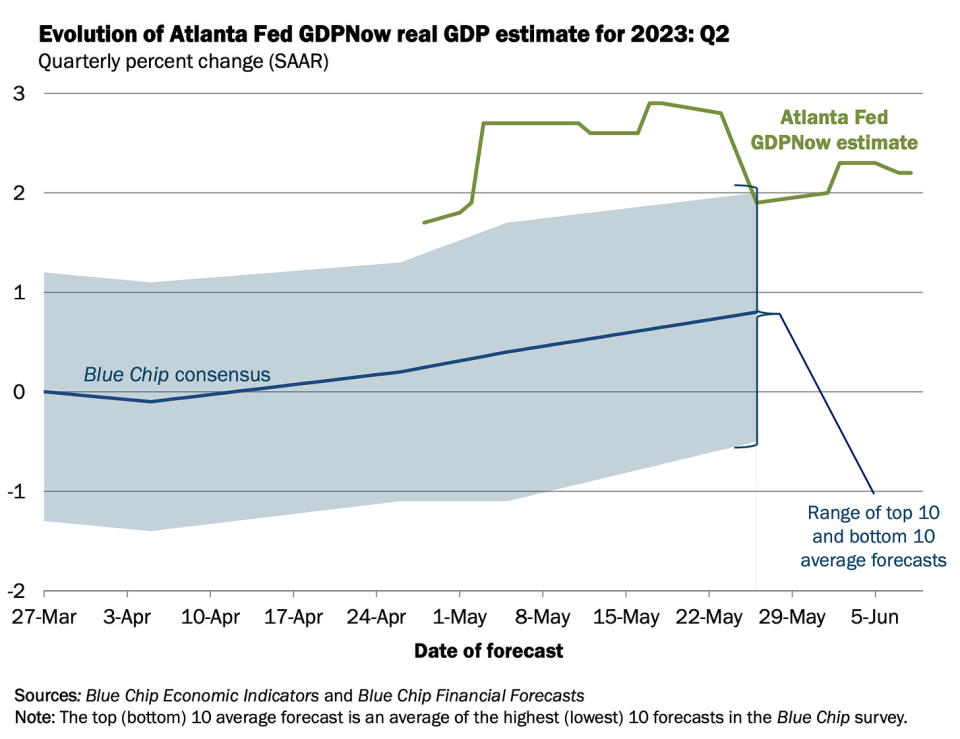

📈 Close to-term GDP development estimates stay rosy. The Atlanta Fed’s GDPNow mannequin sees actual GDP development climbing at a 2.2% price in Q2. Whereas the mannequin’s estimate is off its excessive, it’s however up significantly from its preliminary estimate of 1.7% development as of April 28.

Placing all of it collectively 🤔

Regardless of current banking tumult, we proceed to get proof that we might see a bullish “Goldilocks” comfortable touchdown state of affairs the place inflation cools to manageable ranges with out the financial system having to sink into recession.

The Federal Reserve just lately adopted a much less hawkish tone, acknowledging on February 1 that “for the primary time that the disinflationary course of has began.“ And on Might 3, the Fed signaled that the top of rate of interest hikes could also be right here.

In any case, inflation nonetheless has to come back down extra earlier than the Fed is snug with worth ranges. So we should always count on the central financial institution to maintain financial coverage tight, which suggests we needs to be ready for tight monetary situations (e.g. greater rates of interest, tighter lending requirements, and decrease inventory valuations) to linger.

All of this implies the market beatings could proceed in the meanwhile, and the chance the financial system sinks right into a recession will likely be comparatively elevated.

On the similar time, it’s essential to keep in mind that whereas recession dangers are elevated, customers are coming from a really sturdy monetary place. Unemployed persons are getting jobs. These with jobs are getting raises. And lots of nonetheless have extra financial savings to faucet into. Certainly, sturdy spending information confirms this monetary resilience. So it’s too early to sound the alarm from a consumption perspective.

At this level, any downturn is unlikely to show into financial calamity provided that the monetary well being of customers and companies stays very sturdy.

And as at all times, long-term buyers ought to keep in mind that recessions and bear markets are simply a part of the deal whenever you enter the inventory market with the purpose of producing long-term returns. Whereas markets have had a reasonably tough couple of years, the long-run outlook for shares stays constructive.

A model of this submit first appeared on TKer.co