A full quarter of 2024 is behind us now, and it’s clear that we’re within the midst of one other bullish run, much like final 12 months. The positive factors are substantial; markets reached a trough in October 2023, and the S&P 500 is up ~24.5% from that time whereas the NASDAQ has rebounded 29%. 12 months-to-date, the indexes are up 9% and 10%, respectively.

And, whereas final 12 months’s positive factors rested on the slender base of mega-cap tech companies, the positive factors this 12 months are constructed on a broader basis, offering traders with extra choices for funding. The skilled inventory analysts are taking be aware, as effectively, and aren’t shy about tagging shares as ‘Buys’ for the remainder of this 12 months.

With that as backdrop, we’ve dug up the small print on two names the analysts at monetary big Wells Fargo have turned bullish on. They’ve just lately upgraded their rankings on them – so, it’s ‘time to hit purchase,’ in different phrases. Utilizing the TipRanks database, we are able to see that these shares have already got ‘Purchase’ rankings and double-digit upsides, whereas the Wells Fargo view sees positive factors of as much as ~60%. Listed below are the small print.

GoodRx Holdings (GDRX)

The primary Wells Fargo decide on our listing is GoodRx, an organization that takes pharmacy providers and joins it to each on-line tech and the rising telehealth trade to create a bundle deal designed to streamline the distribution of prescription drugs. The corporate is predicated in Santa Monica, California, has been in enterprise since 2011, and its operations are based mostly on a key perception about healthcare shoppers: that giving them entry to higher info will end in higher client choices – and higher healthcare outcomes.

Increasing upon that perception, GoodRx at the moment provides its customers the data they want – together with value transparency and affordability options, based mostly on handy telehealth consultations. The result’s an internet pharmacy that’s patient-oriented, designed to advertise larger medicine compliance and sooner remedy regimens, all for a greater affected person consequence.

GoodRx’s chief service is entry to prescription drugs, with low cost pricing. Sufferers can seek the advice of with physicians and pharmacists, can use digital coupons, and may choose from generic drug equivalents. The system is optimized to ensure that every affected person will get the right prescription, with the right directions, crammed conveniently. The service is out there straight by way of the corporate’s web site, the place customers also can discover informative articles from medical professionals, so as to add context to the prescription providers.

By the numbers, GoodRx has constructed up a considerable enterprise. The corporate offers greater than 200 billion pricing factors every day, and estimates that 80% of transactions are repeat enterprise – a powerful indication of happy prospects. General, GoodRx estimates it has saved its prospects roughly $60 billion over time.

Turning to the outcomes, we discover that GoodRx confirmed a top-line of $196.6 million in 4Q23, a determine that beat the forecast by a modest $730,000 and was up practically 7% year-over-year. On the bottom-line, EPS of ($0.06) missed the estimates by a penny.

Assessing the corporate’s prospects, Wells Fargo analyst Stan Berenshteyn thinks GoodRx is effectively set-up to outperform. He writes, “Evaluation of strategic pivots during the last two years factors to doable progress headwinds, however income visibility (and draw back danger) look like materially improved. We expect this units up GoodRx to ship on a beat & elevate narrative in 2024 with upside to consensus expectations in 2025. We count on this dynamic to assist GDRX shut the valuation hole to its friends, in flip organising the inventory to see significant outperformance over the following 12 months.”

As such, the analyst just lately upgraded his GDRX ranking from Equal Weight (Impartial) to Obese (Purchase), whereas his $10 value goal (up from $7.5) signifies a one-year upside of 49%. (To observe Berenshteyn’s observe file, click on right here.)

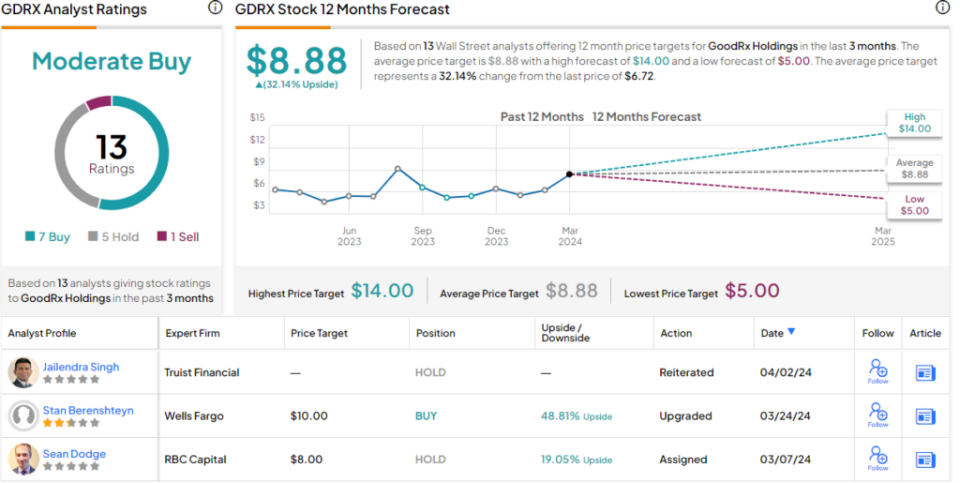

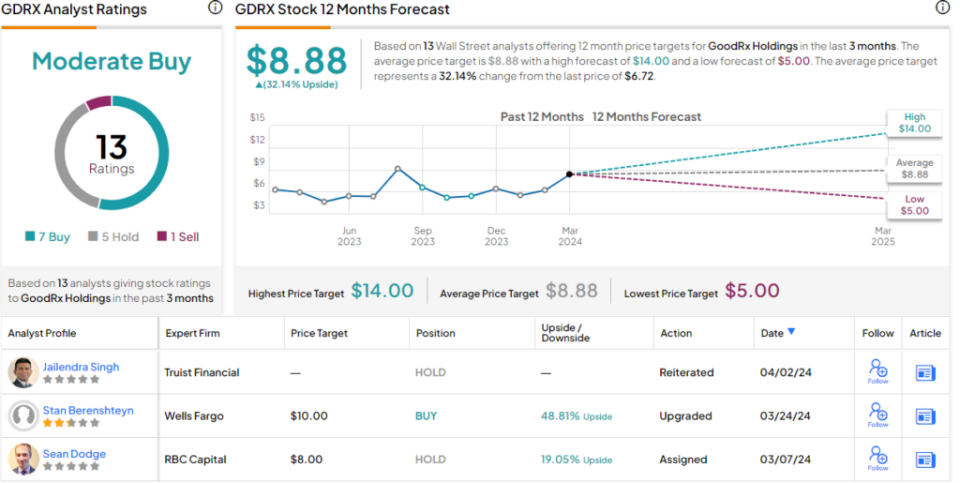

This inventory has 13 latest analyst evaluations, breaking all the way down to 7 Buys, 5 Holds, and 1 Promote, for a Reasonable Purchase consensus ranking. The shares are buying and selling for $6.72 and their $8.88 common goal value suggests a 32% upside potential for the 12 months forward. (See GoodRx’s inventory forecast.)

NeuroPace (NPCE)

Subsequent up is NeuroPace, one other California firm within the medical discipline. NeuroPace focuses on the remedy of epilepsy. The corporate has developed the RNS system, a medical system designed to detect and forestall seizures with out the usage of medicine. This is a crucial advance, as some sorts of epilepsy are recognized to be medication-resistant.

NeuroPace’s system acts straight within the mind, the place it will probably monitor and file electrical exercise, and apply nervous stimulation when seizures are indicated. As a result of the system additionally data EEG knowledge, sufferers and physicians are capable of fine-tune the stimulation and higher monitor the tempo and frequency of seizure exercise. Sufferers utilizing the system report a major discount in seizure exercise, and 1 in 5 sufferers had been reported as ‘seizure-free’ at their final medical verify.

The corporate’s revenues have proven an nearly constant upward development because the second half of 2022. Within the final quarter reported, for 4Q23, income got here to $18 million, up 41% from the $12.8 million reported in 4Q22. The agency’s EPS, reported as a lack of 23 cents per share, was 8 cents higher than had been anticipated. For the full-year 2024, the corporate has guided for revenues between $73-$77 million, in comparison with 2023’s $65.4 million.

Nevertheless, Wells Fargo’s Vik Chopra thinks the corporate could be taking part in it secure right here. “Our evaluation demonstrates potential upside to 2024 numbers and past as NPCE expands entry to RNS exterior of Degree 4 CECs,” Chopra mentioned. “We don’t consider that mgmt has contemplated significant revs in 2024 information from Mission CARE and as such, we see potential for upside revisions… we just like the setup as NPCE expands into the neighborhood setting and don’t consider the Mission CARE alternative is priced in.”

Conveying his confidence, Chopra charges the shares as Obese (Purchase – upgraded final month) and his value goal of $20 implies an upside of 62% on the one-year horizon. (To observe Chopra’s observe file, click on right here.)

There’s common settlement on the Road that it is a inventory to purchase; the Robust Purchase consensus ranking is predicated on 7 latest evaluations that embrace 6 Buys to 1 Maintain. The shares have a mean value goal of $17.71, suggesting a 43% one-year improve from the present share value of $12.37. (See NeuroPace’s inventory forecast.)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally essential to do your individual evaluation earlier than making any funding.