2024 has actually gotten rolling, and the chief difficulty for buyers is discovering the most effective portfolio composition to benefit from a possible bullish atmosphere. John Stoltzfus, chief funding strategist at Oppenheimer, believes that the principle components to think about this 12 months will doubtless be continued financial resilience and a coverage shift by the Federal Reserve towards cuts in rates of interest. Stoltzfus sees as many as 4 fee cuts coming this 12 months, however means that three are extra doubtless.

Attending to specifics, Stoltzfus advises buyers to stay with shares – but in addition to diversify. A broader base of portfolio holdings is a good suggestion, typically. In present situations, combining each bullish sentiment and a level of market uncertainty, a various funding base, to Oppenheimer, appears to be like like the easiest way to money in on the markets.

As Stoltzfus places it, “The latest turnaround confirmed worth in ‘staying the course.’ In our view, the sharp reversal within the course of bond yields and the attendant rally in shares illustrated the significance of investor persistence and adherence to diversified portfolio allocations. The rally in bonds and the upturn in inventory indexes occurred in a comparatively quick time period, from the top of October into November, highlighting a necessity to remain invested… We stay constructive in our outlook for shares as prospects for improved fundamentals this 12 months present potential to be realized.”

Following this course, the inventory analysts at Oppenheimer have been choosing out a diversified array of equities for buyers to think about. These are the shares that the funding financial institution recommends as Buys, believing now could be the time to “pull the set off” on them. We’ve used the TipRanks database to search out out what the remainder of the Road has to say about their latest picks. Let’s take a more in-depth look.

Albemarle Company (ALB)

We’ll begin within the chemical business, with Albemarle. This firm, from its North Carolina base, operates by means of three most important divisions: lithium refining, bromine refining, and chemical catalysts. Albemarle has, lately, turn out to be a significant participant on the US lithium scene, and is a vital home provider of battery-grade lithium within the electrical car business. The corporate is energetic within the world lithium chain, and sources the factor from a number of places, together with mines in Nevada, Australia, and Chile.

One in every of Albemarle’s extra vital strikes is its 49% stake in Talison, a West Australian agency working in each the manufacturing and refining of lithium. Talison has been working its Greenbushes mining ops for over 20 years, and lately launched into a $320 million enlargement mission, constructing out a second chemical-grade lithium focus manufacturing facility.

That is a part of Albemarle’s ongoing work to take care of itself as a worldwide chief within the dependable provide of high-quality lithium. The corporate places a precedence on constructing a accountable extraction and provide community for the lithium business.

Headwinds within the lithium business, together with drops in uncooked materials costs and decrease costs on the lithium commodity markets, put strain on Albemarle over the previous 12 months. The corporate noticed declines in each revenues and earnings throughout 2023, and its share worth has fallen by greater than 52% within the final 12 months. The final quarter, nonetheless – 4Q23 – confirmed a possible turnaround, as each the highest and backside strains beat the forecasts.

In its 4Q23 report, Albemarle confirmed quarterly revenues of $2.36 billion. Whereas down virtually 10% year-over-year, this determine beat expectations by $180 million. The corporate’s backside line earnings got here to $1.85 per share by non-GAAP measures, an EPS that was 74 cents forward of the forecast. The corporate additionally introduced a set of energetic measures designed to ‘unlock’ greater than $750 million in money circulation going ahead. These measures embody reductions in capital expenditures and prices.

From Oppenheimer, 5-star analyst Colin Rusch sees purpose to purchase ALB shares now, citing the corporate’s lately improved monetary efficiency and its transfer towards money era. He writes, “With ALB resetting expectations on monetary efficiency and tweaking the way it reviews EBITDA relative to the Talison JV, we consider the corporate is establishing a flooring on estimates for money circulation, ROI on new capex, and demonstrating its capability to successfully navigate the underside of the lithium development cycle. We’re inspired to see the optionality in ALB’s capex spend giving it flexibility to regulate timing and stay in compliance with debt covenants. We consider cell and car inventories are rebalancing and channel well being will doubtless enhance with regular seasonal energy in car sale as climate improves. We anticipate the following 4-8 weeks will likely be instructive on timing for a restoration on lithium costs. We stay bullish…”

Placing this into quantifiable phrases, Rusch goes on to offer the shares an Outperform (Purchase) ranking, with a $188 worth goal that suggests a 12-month acquire for the inventory of 64%. (To observe Rusch’s observe report, click on right here)

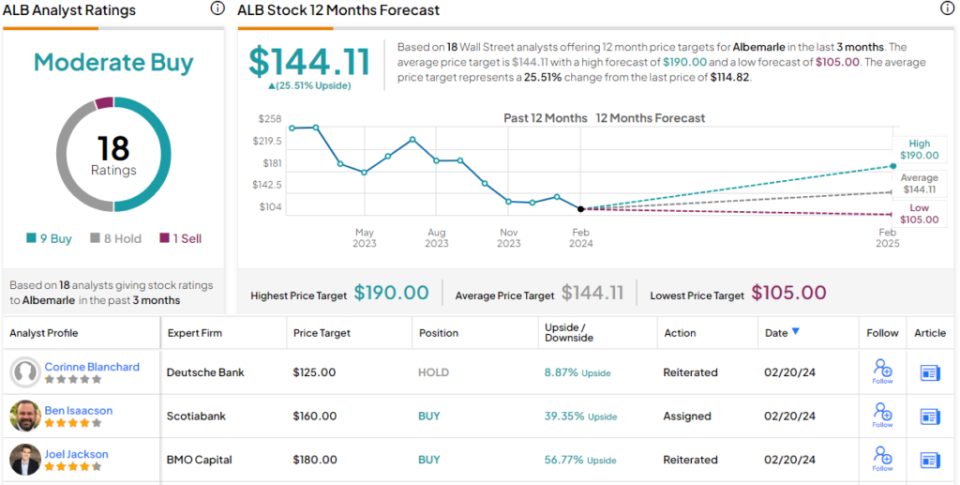

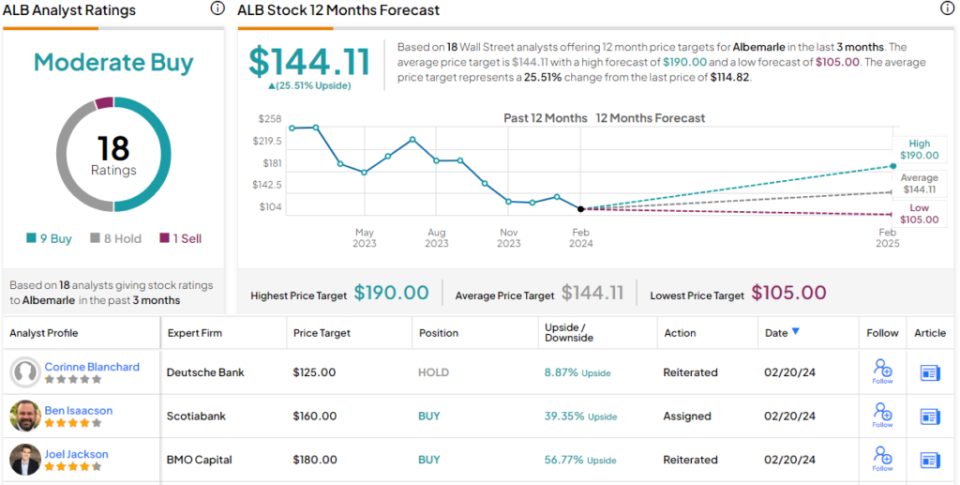

The Oppenheimer view is without doubt one of the Road’s extra bullish ones. The 18 latest analyst critiques right here break all the way down to 9 Buys, 8 Holds, and 1 Promote, for a Reasonable Purchase consensus ranking – whereas the $114.82 buying and selling worth and $144.11 common goal worth collectively counsel the inventory will admire 25.5% by the top of this 12 months. (See Albemarle’s inventory forecast.)

DraftKings (DKNG)

Subsequent up is DraftKings, a pacesetter on this planet of on-line sports activities betting and fantasy sports activities leagues. DraftKings is greatest identified for its on-line sportsbooks, that enable clients to wager on a complete bundle {of professional} sport leagues, and for its fantasy leagues, that allow clients construct their ‘dream groups’ and wager on their efficiency. DraftKings makes its on-line sports activities betting and different merchandise accessible in 23 states, and covers most home and worldwide skilled sports activities, together with soccer, baseball, basketball, hockey, and worldwide soccer. As well as, the corporate additionally covers faculty basketball, which isn’t skilled however is enormously common. The corporate has additionally made inroads into on-line on line casino gaming.

DraftKings bases its success on a easy system, of getting sports activities followers extra excited in regards to the sport – sufficient to put bets. The corporate sums that up by saying that the video games are extra alive when followers have some pores and skin in them.

Earlier this month, DraftKings introduced an vital acquisition, one which guarantees a strong enlargement of the corporate’s on-line playing choices. On February 15, DraftKings introduced an settlement to accumulate Jackpocket, the chief amongst US on-line lottery apps. The transaction is valued at $750 million, of which 55% will likely be paid in money and 45% will likely be paid in inventory. DraftKings expects that the Jackpocket acquisition will drive between $60 million and $100 million price of adjusted EBITDA by fiscal 12 months 2026. Pursuant to shareholder approvals, the deal is predicted to shut throughout 2H24.

Additionally this month, DraftKings launched its monetary outcomes for This fall and financial 12 months 2023. For the quarter, the corporate had a high line of $1.231 billion, up 44% when in comparison with the prior-year interval’s $855 million. The corporate had an adjusted EPS of $0.29 in non-GAAP measures, in comparison with the 14-cent EPS loss in 4Q22. When in comparison with the forecasts, the This fall income got here in simply $10 million under expectations, whereas the EPS beat by 11 cents per share. DraftKings completed 2023 with deep pockets, reporting $1.27 billion in money and different liquid belongings.

Oppenheimer analyst Jed Kelly covers DraftKings, and he’s impressed by the corporate’s capability to navigate the troublesome regulatory panorama, noting that guidelines can change from state to state, however this firm finds methods to make them work in its favor. He’s additionally upbeat on the Jackpocket acquisition. Summing up, Kelly writes, “Investor conversations suggest all-time excessive sentiment, and out of doors any unexpected regulatory developments, we see a conducive working atmosphere to reaching medium-term profitability targets (one significant competitor). We consider Jackpocket acquisition (5.5x ‘24 income, rising 70%) will improve cross-selling alternatives whereas offering useful databases in states akin to TX. Moreover, DKNG’s regulatory relationships doubtless speed up states adopting digital lottery capabilities. Anticipating NC to have related launch dynamics as OH/MA (each states achieved contribution revenue in two months. Forecasting ‘24E incremental margins of 55% on income rising 2,800bps quicker than Opex.”

These feedback assist Kelly’s Outperform (Purchase) ranking right here, and the analyst raised his worth goal to $60 (from $55), to counsel a one-year upside potential of 45%. (To observe Kelly’s observe report, click on right here)

That Wall Road likes DraftKings is obvious from the Robust Purchase consensus ranking, based mostly on 27 latest critiques that embody 23 Buys, 3 Holds, and 1 Promote. The shares are at the moment priced at $41.32 and the typical worth goal of $47.62 implies a acquire of 15% on the 12-month horizon. (See DraftKings’ inventory forecast)

Hannon Armstrong (HASI)

Final on our Oppenheimer-endorsed listing is an Annapolis-based funding firm that focuses on taking a ‘local weather constructive’ stance on capital investments. Hannon Armstrong has over $12 billion in managed belongings on the books, primarily in belongings that can facilitate an vitality transition to a cleaner future. The corporate has taken a proactively constructive stance on this, requiring that each one of its potential investments be both impartial or adverse on incremental carbon emissions, or barring that, that they provide another tangible profit to the long-term local weather future.

Hannon Armstrong has been standing on this precept for over 40 years, and has constructed up a formidable portfolio of belongings that fall into three broad classes. The most important is ‘behind the meter,’ coping with vitality effectivity and distributed photo voltaic storage; the following largest is ‘grid related,’ which is direct belongings in wind and solar energy era and energy storage; and the smallest portfolio part is ‘fuels, transport, and nature,’ a set of belongings concerned in renewable pure fuel, fleet decarbonization, and ecological restoration.

The corporate follows 4 most important theses in selecting its investments, to make sure a top quality return on climate-friendly capital deployment. The theses embody extra environment friendly expertise, for a better financial return; decrease portfolio danger by means of smaller-scale investments; aligning belongings with each scientific consensus and societal beliefs, to scale back regulatory prices; and at last, selecting belongings with connections to diminished carbon emissions.

Following these guidelines, Hannon Armstrong delivered whole income of $86.58 million in 4Q23, up a formidable 48.5% year-over-year, though lacking the forecast by $7.5 million. On the backside line, the corporate delivered EPS of $0.53, additionally falling shy of the forecast – by 5 cents. For dividend buyers, Hannon Armstrong has declared a 41.5-cent cost for 1Q24, representing a rise of 5% over the earlier quarterly dividend. Monitoring ahead, the brand new dividend will annualize to $1.66 per share and provides a yield of 6.4%.

Regardless of the latest misses, Noah Kaye, one other of Oppenheimer’s 5-star analysts, takes an optimistic take a look at Hannon Armstrong inventory, noting the corporate’s dedication to each sustainable local weather funding and offering strong returns. He says of this chance, “We view HASI as a sustainable finance play on the expansion of vitality effectivity and renewables with a robust administration workforce, a differentiated funding technique, an growing deal pipeline, and a observe report of earnings and dividend development. We consider HASI’s enterprise mannequin will allow the corporate to navigate rate of interest danger and determine high-yield area of interest investments.”

Kaye goes on to set an Outperform (Purchase) ranking right here, together with a $48 worth goal that exhibits his confidence in an 85% potential acquire for the 12 months forward. (To observe Kaye’s observe report, click on right here.)

As soon as once more, we’re taking a look at a inventory with a Robust Purchase consensus ranking. The 8 latest critiques right here embody 6 to Purchase and a couple of to Maintain, and the $37.14 common worth goal implies a 43% improve from the present share worth of $25.93. (See HASI inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather vital to do your personal evaluation earlier than making any funding.