It is a refined buying and selling technique that is turning into extra accessible to retail traders.

The technique: Zero days-to-expiration choices — which is basically a one-day guess on the path of the markets.

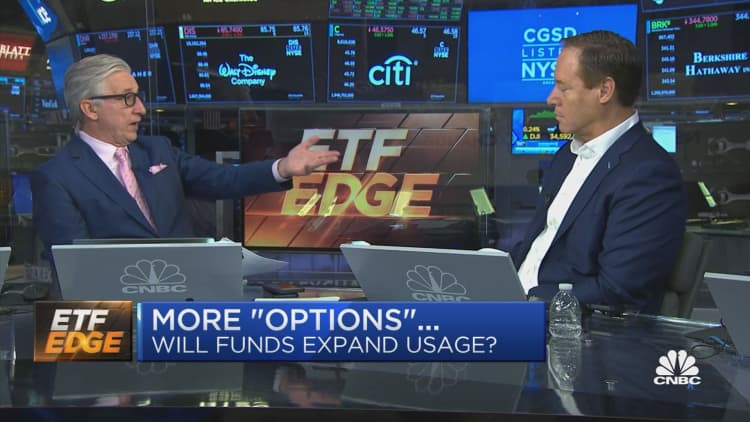

And CBOE International Markets CEO Ed Tilly is within the thick of it. His firm provides all of them 5 weekdays.

“It is actually turn out to be enticing and garnered quite a lot of curiosity in having the ability to categorical that opinion [on the market] within the brief time period,” Tilley instructed CNBC’s “ETF Edge” earlier this week.

Zero days-to-expiration choices are contracts that expire the identical day they’re traded. Tilly believes these choices are interesting to traders by permitting them to take a position on the shortest period of time left in a contract.

“On the finish of the buying and selling day, the subsequent results of that commerce is settled in money — not bodily delivered like a inventory or an ETF,” he mentioned.

Handiest as a software for professionals?

Simplify Asset Administration additionally provides these zero day-to-expiration choices. Michael Inexperienced, the agency’s chief strategist and portfolio supervisor, additionally notes they’ve turn out to be particularly enticing to people.

“A couple of third of [our] trades are coming from retail, and about two-thirds are coming from institutional,” he mentioned.

Regardless of rising retail curiosity, Inexperienced emphasizes zero days-to-expiration choices could also be simplest as a software for professionals.

“We use the phrase refined retail traders, and I believe there’s truly a extremely vital distinction there,” Inexperienced mentioned. “Usually, those that are shopping for choices on a constant foundation are doing extra hypothesis than they really are being refined when it comes to a return profile. It tends to be a dropping guess.”