Discovering the best inventory is the important thing to profitable investing, but it surely’s by no means as simple as that sounds. The reply to the query, which inventory to purchase? is not any secret, however it’s hidden, within the avalanche of knowledge that the markets produce. What’s wanted is a few clear sign that may reduce by means of the noise and point out the best shares for the occasions.

The amount of knowledge, and the sheer impossibility of parsing all of it in actual time, makes a formidable barrier to profitable inventory selecting – however Wall Avenue’s analysts have that half underneath management, which turns the query into one which’s way more manageable: which analysts to observe? The fast reply is, observe the top-ranked analysts.

That may take us to Raymond James analyst John Freeman. This 5-star inventory skilled is a perennial dweller among the many top-rated analysts contributing to the TipRanks database; the 66% success charge of his inventory calls, and the 39% common return these calls would carry to traders who observe them, have Freeman standing tall amongst his friends on Wall Avenue. He is at present ranked #2 out of 8,170 analysts.

In current weeks, Freeman has picked out three shares that he believes are primed for over 70% good points. Let’s open up the TipRanks database and get the lowdown.

Marathon Oil Company (MRO)

The primary ‘Freeman decide’ we’ll have a look at is Marathon Oil, a $17.4 billion oil business chief. Marathon spun off from the father or mother firm Marathon Petroleum in 2011, to concentrate on hydrocarbon exploration and manufacturing operations, and since then has constructed its enterprise on among the finest manufacturing areas for oil and pure fuel within the US. The Texas-based firm has main manufacturing actions within the Bakken, Eagle Ford, Delaware, and Stack/Scoop areas, unfold from Texas to Montana.

These in depth operations generated stable manufacturing numbers, the inspiration of Marathon’s monetary success. In Q322, the corporate common 295,000 web barrels of oil equal per day, with oil manufacturing making up 166,000 web barrels of that complete. The corporate realized $2.25 billion in complete revenues from that manufacturing, a complete that was up 55% year-over-year.

Different monetary metrics in Q3 had been additionally stable. Web earnings got here in at $817 million, or $1.22 per share; on an adjusted foundation, these numbers had been $832 million and $1.24. The adjusted EPS was up greater than 217% y/y. Money flows, which assist the dividend and different shareholder returns, had been additionally robust; Marathon had $1.556 billion in web working money for the quarter, and after accounting for working capital, nonetheless reported $1.44 billion in money movement. This included $1.03 billion in adjusted free money movement.

Marathon returned $1.2 billion to shareholders throughout the quarter, primarily by means of share repurchases – but additionally by means of a modest dividend. That fee, within the final declaration, was set at 9 cents per widespread share for payout on December 12. This dividend annualizes to 36 cents per share, and yields a modest 1.3%; the important thing level within the dividend is the fast charge at which Marathon has been elevating it – for the reason that February quarter of 2021, the dividend has been elevated by 200%.

Freeman sees Marathon’s robust dedication to sustaining share worth – and to returning that share worth to stockholders – as one in all this inventory’s most tasty options.

“Marathon represents one of many few corporations in our protection with regular/rising per-share metrics because of their extremely aggressive buyback program. 4Q22 would be the low level, with MRO stating they intend to repurchase ~$300M of inventory throughout the quarter, representing an estimated 51% of CFFO on the 12 months. Assuming the identical payout subsequent 12 months, we estimate a 13% yield on buybacks and 15% complete shareholder return,” Freeman famous.

“Given Marathon’s robust steadiness sheet, and prime tier return technique, we reiterate our Robust Purchase ranking,” the highest analyst summed up. That ranking comes with a $48 value goal that suggests a one-year acquire of ~82%. (To look at Freeman’s monitor report, click on right here)

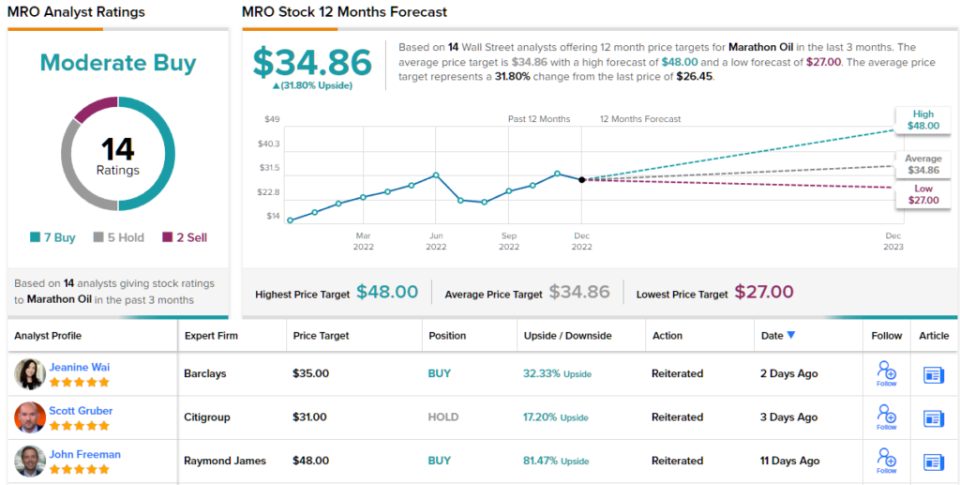

Total, the Avenue’s consensus ranking on Marathon Oil is a Average Purchase, primarily based on 14 current analyst critiques that embody 7 Buys, 5 Holds, and a pair of Sells. The shares are priced at $26.38 and their common value goal of $34.86 suggests an upside potential of ~32% on the one-year horizon. (See MRO inventory forecast on TipRanks)

Northern Oil and Gasoline (NOG)

Subsequent up is Northern Oil and Gasoline, an exploration and manufacturing firm within the North American market. Northern focuses its operations in North Dakota and Montana, particularly within the Williston Basin, but additionally has actions within the Marcellus shale area of Pennsylvania and West Virginia, and within the Permian Basin on the Texas-New Mexico border.

Like Marathon above, Northern’s current Q3 outcomes present that stable manufacturing numbers are underlying sound outcomes. The corporate produced 79,123 barrel of oil equal per day in Q3, an organization report, for a 37% improve from the year-ago interval. Of the full, 57% was oil, and the remaining was pure fuel and pure fuel merchandise.

Northern realized $276.8 million in GAAP money movement throughout the quarter, with money from operations coming in at $269.3 million. This was up 7% quarter-over-quarter, and included $110.6 million in free money movement. The FCF was up 99% year-over-year.

Throughout Q3, Northern closed on a serious acquisition within the Texas Delaware Basin. The corporate picked up properties from Alpha Power Companions, for a settlement of $155.1 million in money. This can be a bolt-on acquisition, with anticipated manufacturing subsequent 12 months of three,000 to three,500 barrels of oil equal per day.

For return-minded traders, we must always notice that Northern began paying dividends within the June quarter of final 12 months, at 3 cents per widespread share; the corporate has elevated the fee in each quarterly declaration since then, and the newest, for 30 cents per widespread share, represents a rise of 20% during the last payout. The 30-cent div is scheduled for fee on January 31, 2023. At that charge, it’s going to annualize to $1.20 and yield 3.7%.

Freeman notes that Northern noticed higher-than-expected capital expenditures throughout Q3, primarily associated to the corporate’s current acquisition strikes. Wanting forward, he writes of Northern’s capital steerage: “NOG’s capital steerage was bumped considerably with full 12 months up 11% to $485M on the midpoint. The bump isn’t with out advantages, as web spuds elevated by 3% and web wells added to manufacturing elevated by 6.5%. It additionally stands to motive that NOG has had a bit extra floor sport success this 12 months than that they had forecast.”

“The corporate has made substantial additions to wells in progress each quarter this 12 months, from 49.1 in Q1 to 61.5 in Q3. We aren’t naive sufficient to suppose NOG will likely be insulated from inflationary pressures, however 5% improve in AFEs from final quarter stands up fairly effectively to business friends,” Freeman added.

To this finish, Freeman charges NOG a Robust Purchase, whereas his $60 value goal suggests an 85% value acquire within the 12 months forward.

Total, Northern Oil and Gasoline will get a Robust Purchase ranking from the analyst consensus, primarily based on 10 current critiques which break down 9 to 1 in favor of Purchase over Maintain. With a buying and selling value of $31.32 and a mean value goal of $50.30, Northern has a mean upside potential of ~61% for the approaching 12 months. (See NOG inventory forecast on TipRanks)

Antero Assets (AR)

The final inventory on our record of Freeman picks is AR, or Antero Assets. This firm is a pure fuel producer working within the space of the higher Ohio River, within the Marcellus and Utica shale formations the place Pennsylvania, Ohio, and West Virginia come collectively. This space, within the coronary heart of Appalachia, has lengthy been referred to as one of many richest pure fuel basins within the US. Antero boasts effectively over half 1,000,000 web acres of productive holdings, with greater than 17.7 trillion cubic ft of confirmed pure fuel reserves.

The corporate’s web manufacturing throughout 3Q22 was 3.2 billion cubic ft per day of pure fuel, a complete that features 171 thousand barrels per day of pure fuel liquids. This introduced in a web money from operations of $1.1 billion, a free money movement of $797 million, and a non-GAAP adjusted web earnings of $531 million.

Antero doesn’t pay out a dividend, however the firm has a powerful share buyback program – which noticed the corporate purchase again over $382 million shares throughout the third quarter. In Antero’s Q3 monetary launch, the corporate introduced that it was growing its buyback authorization by $1 billion, to a brand new complete of $2 billion.

Along with supporting the share value by means of repurchases, Antero can also be dedicated to decreasing debt, and the corporate paid of $404 million throughout the quarter. As of September 30, Antero had $1.17 billion in excellent debt, a complete that’s down almost $1 billion to this point this 12 months.

Freeman sees Antero benefiting from continued will increase in pure fuel demand, and his forecast for subsequent 12 months paints a reasonably image of the corporate’s prospects.

“Whereas 2023 steerage stays 1 / 4 away, RJe 2023 manufacturing of ~3.4 Bcfe/d (~in step with Avenue) represents a ~5% improve y/y, which units them other than most of their Marcellus friends pushed by each 1) elevated ethane manufacturing by way of Shell’s Petrochemical Complicated and a pair of) a net-gain of ~3.75% WI on every effectively drilled post-March 2023, following conclusion of AR’s Quantum three way partnership,” Freeman famous.

“At the moment,” the analyst added, “AR trades at only a ~3.7X ahead EBITDA a number of and sports activities a 22% 2023 FCF yield — each finest amongst large-caps.”

Quantifying his stance, Freeman offers Antero’s inventory a Robust Purchase ranking with a value goal of $55, which signifies his confidence in a 72% upside over the subsequent 12 months. (To look at Freeman’s monitor report, click on right here)

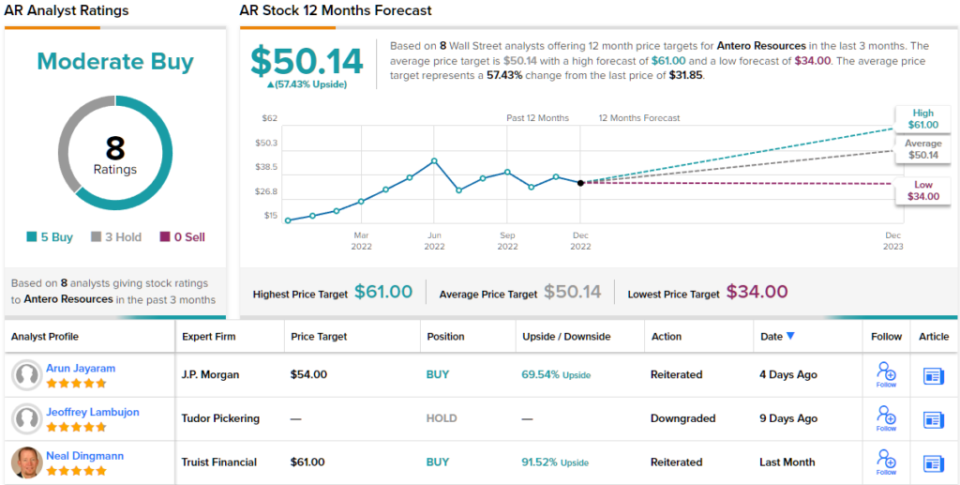

All in all, there are 8 current analyst critiques on file for Antero, and so they embody 5 Buys and three Holds – which supplies the inventory a Average Purchase consensus ranking. In the meantime, the common value goal of $50.14 implies a 57% upside from the present buying and selling value of $31.82. (See Antero inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely essential to do your individual evaluation earlier than making any funding.