(Bloomberg) — Inflation exhibits few indicators of cooling within the economic system. The identical can’t be stated of markets, that are beginning to seem to be the one factor the Federal Reserve has going for it today.

Most Learn from Bloomberg

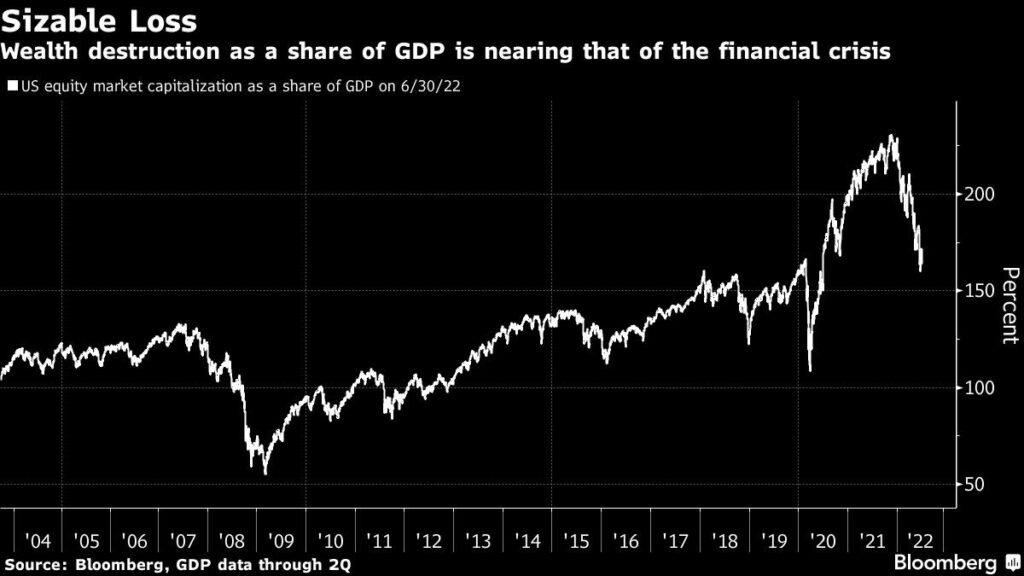

Even with Thursday’s massive bounce, the S&P 500 has misplaced 1 / 4 of its worth this yr. Surprising as that’s been for buyers, it’s one of many few issues occurring anyplace that really accords with the Fed’s aim of draining the economic system of bloat. Not too long ago, the toll by way of wealth destroyed — about $15 trillion thus far — has began to strategy that of the 2008 monetary disaster, when measured in opposition to US gross home product.

And whereas the inventory market isn’t the economic system, it’s a sign and an enter into it, affecting every thing from shopper sentiment to the worth of personal enterprises. Declines on a par with what’s already occurred in equities have been a good proxy for reversals in inflation greater than a dozen instances for the reason that late Nineteen Fifties, based on analysis from Doug Ramsey, chief funding officer on the Leuthold Group.

“The wealth impact performed a higher position than it ever had in inciting the inflationary spiral, and it’s additionally going to play an excellent position in lowering it,” Ramsey stated in an interview at Bloomberg’s headquarters in New York. “When you concentrate on the inventory market declining in standard proportion phrases on the index, that understates the quantity of wealth that it wipes out.”

Buttressed by easy-money insurance policies and big fiscal stimulus, the S&P 500 greater than doubled between its pandemic low and this yr’s excessive, making Individuals who owned shares really feel richer, if solely on paper. All that has modified in 2022, with the Fed elevating charges on the quickest tempo in many years.

Plunging fairness costs wiped 4.1% off Individuals’ mixture internet value to $144 trillion within the quarter ending June 30. That was the second-biggest decline since 2008.

It hasn’t taken a notable toll on shopper psyches but, with Thursday’s studying on shopper costs for September exhibiting stubbornly excessive inflation. By Ramsey’s logic, it should sometime, serving to the central financial institution obtain its targets. A extra frugal shopper gained’t be the one pressure behind moderating inflation — which additionally will depend on rates of interest and strikes within the greenback — however it could assist.

The scope of the hit to wealth on this rout is getting tougher to disregard. Between its November document and late final month, the Wilshire 5000 Index had plunged about 27%. Expressed as a proportion of GDP, the loss equals to 54%, near the 61% that evaporated through the monetary disaster, knowledge compiled by Leuthold present.

Tumbling asset costs have traditionally proven a monitor document of both assuaging inflationary pressures or signaling their discount.

Between 1957 and final yr, the S&P 500 had posted 15 corrections of 19% or extra. In 10 of the circumstances, inflation was decrease 12 months later, declining a median 2.3%, based on knowledge collated by Leuthold.

And it’s not simply the inventory market. Rising borrowing prices have roiled aspiring dwelling consumers, making dwelling possession — an enormous supply of wealth for Individuals — out of attain for some. The affordability of housing is deteriorating at a quicker tempo than at any level previously three many years, estimates compiled by Morgan Stanley present.

“A lot of Individuals’ wealth resides in dwelling fairness and financial-market portfolios, each of which have taken massive hits this yr,” Ed Yardeni, founding father of his namesake analysis agency, stated in a be aware to purchasers. “We see pink flags within the weak point of the housing market, the adverse wealth impact, and the power of the greenback.”

Bridgewater Associates LP’s Bob Prince painted a considerably excessive state of affairs over the summer time, saying the Fed’s try and pursue two targets — convey down inflation whereas avoiding an unacceptably deep recession — may trigger policymakers to pause their rate-hiking cycle, ultimately doing two rounds of tightening as an alternative of 1.

This state of affairs, presently off-charts for the market, “presents the best threat of large wealth destruction,” the agency’s co-chief funding officer stated in be aware.

Whereas painful within the brief run, the decline of the fairness market’s dimension relative to that of the economic system could be seen as a wholesome improvement for market bulls.

Plunging asset costs have lastly pushed the stock-market capitalization relative to nationwide gross home revenue out of the highest quintile of historic readings, which has preceded fairness declines within the subsequent yr, three and 5 years, knowledge compiled by Ned Davis Analysis present.

“The wealth impact is being felt not solely in equities and monetary markets, but additionally housing costs taking place,” Mona Mahajan, senior funding strategist at Edward Jones, stated in an interview. “That diminished wealth impact is what could be a self-fulfilling cycle: customers could rein of their purses, and that has a ripple impact on the economic system. We could also be getting there.”

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.