Markets skilled a pointy downturn Thursday afternoon following an preliminary surge to historic highs in technology-heavy inventory indices, pushed by Nvidia Corp.‘s (NASDAQ:NVDA) spectacular AI-driven earnings report.

The CBOE Volatility Index (VIX), also called the market concern index, surged over 7% after hitting its lowest degree since November 2019 earlier within the session.

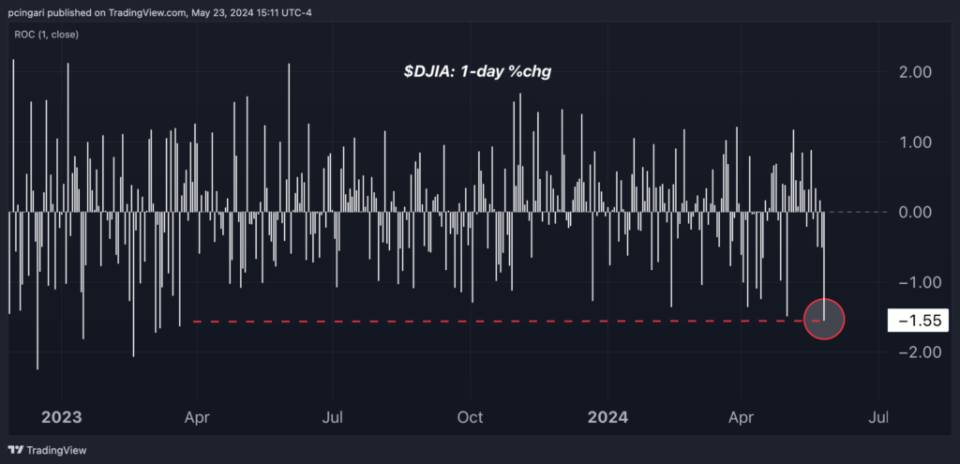

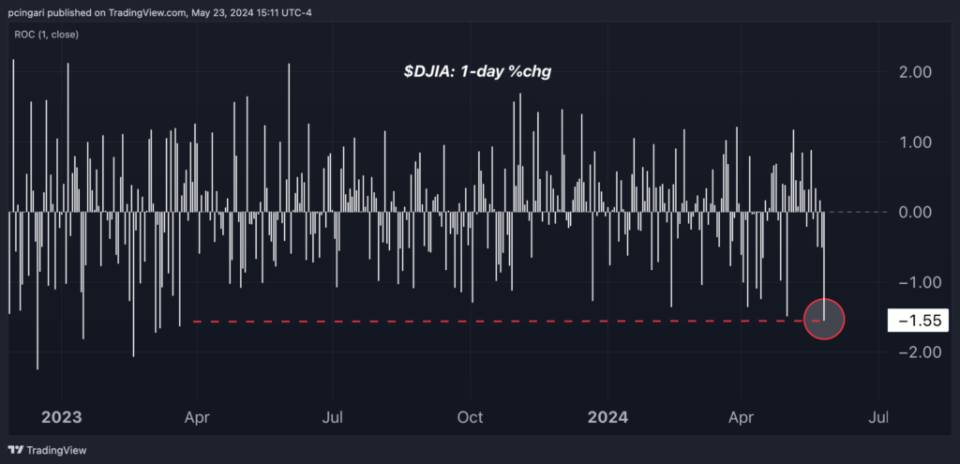

Blue-chip shares have been significantly affected in a broad sector selloff. The Dow Jones Industrial Common, tracked by the SPDR Dow Jones Industrial Common ETF (NYSE:DIA), was down 1.5% at 3:00 p.m. in New York, on observe for its worst efficiency since March 2023.

Each the S&P 500, tracked by the SPDR S&P 500 ETF Belief (NYSE:SPY), and the Nasdaq 100, monitored by way of the Invesco QQQ Belief (NASDAQ:QQQ), fell 0.9%.

Chipmakers have been the one business within the inexperienced, with the VanEck Semiconductor ETF (NYSE:SMH) up 0.8%, because of Nvidia’s 8.7% rally.

Chart: Dow Eyes Worst Day In Over A 12 months

What Occurred: Sentiment took a success after S&P World launched its Could personal sector exercise surveys. The Composite PMI Index, a gauge of total enterprise well being, confirmed the very best enlargement charge in two years.

This would possibly seem to be excellent news, however the satan is within the particulars.

“Enter costs continued to rise sharply in Could, with the speed of inflation accelerating to register the second-largest month-to-month enhance seen over the previous eight months,” S&P World reported.

Particularly, producers skilled a steep enhance, going through the most important value rise in a yr and a half. This was attributed to larger provider costs for all kinds of inputs, together with metals, chemical compounds, plastics, and timber-based merchandise, in addition to larger power and labor prices.

Chris Williamson, chief enterprise economist at S&P World, indicated that promoting worth inflation has elevated, persevering with to sign modestly above-target inflation.

He highlighted that the first inflationary strain now originates from manufacturing somewhat than companies. This shift has resulted in elevated charges of inflation for each prices and promoting costs in comparison with pre-pandemic requirements, implying that reaching the “Fed’s 2% goal nonetheless appears elusive”

Why It Issues: Stronger-than-expected enterprise sentiment development and renewed inflationary issues pushed Treasury yields up throughout the board, main traders to reassess the probability of Fed rate of interest cuts.

Notably, there was a major shift in charge reduce expectations. Fed futures are at present pricing in solely 34 foundation factors of charge cuts by year-end, translating to only one charge reduce.

Whereas traders had anticipated a charge reduce by September as of Wednesday, this expectation has now been postponed to November, in response to the CME Group Fed Watch Instrument.

The speed-sensitive two-year Treasury yield leaped by 6 foundation factors to 4.93%, eyeing the very best shut since Could 1.

The greenback was the one gainer amongst main asset lessons, with the Invesco DB USD Bullish Index Fund ETF (NYSE:UUP), up 0.2%.

Now Learn: Boeing Inventory Falls As CFO Forecasts Damaging Money Movement, Supply Delays Amid Regulatory Scrutiny

Picture: Shutterstock

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Sport with the #1 “information & every part else” buying and selling software: Benzinga Professional – Click on right here to start out Your 14-Day Trial Now!

Get the newest inventory evaluation from Benzinga?

This text VIX Spikes, Dow Sinks As Inflation Jitters Slaughter Fed Easing Hopes: Merchants Now Worth In Solely One Charge Lower In 2024 initially appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.