Treasury Secretary Scott Bessent mentioned Tuesday that particular person traders, who’ve largely been holding their positions by means of the latest market turmoil, think about President Donald Trump’s tariff coverage.

“Particular person traders have held tight, whereas institutional traders have panicked … particular person traders belief President Trump,” Bessent mentioned throughout a press briefing alongside White Home press secretary Karoline Leavitt.

“Vanguard, one of many largest cash administration corporations in America, mentioned that over the previous 100 days, 97% of Individuals have not executed a commerce,” Bessent, a former hedge fund CEO, mentioned, citing a Washington Put up story with the information.

Trump’s rollout and subsequent suspension of the best tariffs on imports in generations fueled the worst sell-off in shares because the onset of the Covid-19 pandemic in 2020. The S&P 500 briefly tumbled right into a bear market earlier than recouping a few of the losses, and the fairness benchmark is now about 10% off its February all-time excessive.

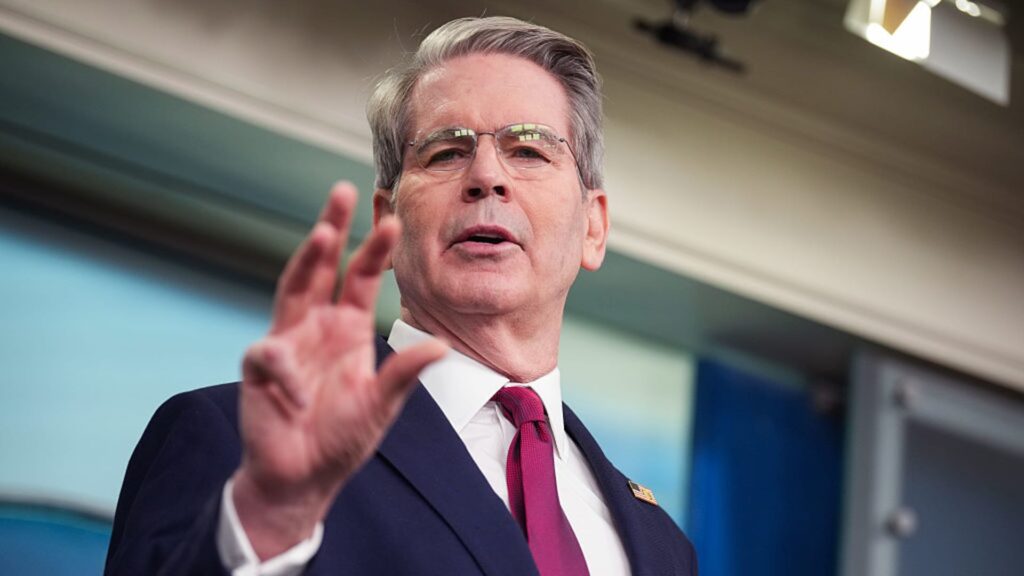

U.S. Treasury Secretary Scott Bessent speaks through the each day press briefing within the Brady Press Briefing Room on the White Home on April 29, 2025 in Washington, DC.

Andrew Harnik | Getty Photographs Information | Getty Photographs

In the course of the depth of the April rout, retail traders swooped in to snap up shares at depressed values. On the identical time, hedge funds {and professional} merchants ran for the exit whereas piling on bearish wagers towards the market.

Establishments have grown more and more apprehensive that steep tariffs will weigh closely on shoppers and decelerate the financial system, presumably tipping it right into a recession.

Torsten Slok, chief economist at Apollo, now sees a summer time recession hitting the U.S. as shoppers begin to see trade-related shortages in shops subsequent month. Ken Griffin, founder and CEO of Citadel, mentioned Trump’s world commerce battle dangers spoiling the “model” of the U.S. and tarnishing the attract of U.S. Treasury debt.