The U.S.-China commerce struggle being fought over know-how has been surprisingly one-sided. However that is altering.

X

For almost 4 years, Beijing held again — even after the U.S. went for the jugular final fall with broad-based bans on gross sales of design software program, semiconductor manufacturing gear and superior chips from corporations like Nvidia (NVDA) and Superior Micro Gadgets (AMD) to Chinese language corporations.

These measures amounted to a “coverage of actively strangling massive segments of the Chinese language know-how trade — strangling with an intent to kill,” wrote Middle for Strategic and Worldwide Research senior fellow Gregory Allen.

China Appeared Penned In

But Beijing seemed to be in no place to retaliate. It was penned in by its harsh Covid lockdowns and a extra unified entrance among the many U.S. and allies amid China’s implicit assist of Russia’s Ukraine invasion.

China lastly returned hearth March 31, saying a safety overview of U.S. memory-chip large Micron Know-how (MU).

Lower than per week later got here information that China could limit exports of uncommon earth metals. It is the world’s fundamental supply of the metals, that are essential to semiconductor manufacturing, EV motors, missile programs and rather more.

China’s return hearth places American multinationals at greater danger. Beijing is driving dwelling the message that nations lining up behind the U.S. commerce struggle pays a steep worth. The U.S. additionally faces the specter of wider financial disruption if China battles again towards decoupling by closing off exports of indispensable applied sciences and supplies that it dominates.

U.S.-China Commerce Conflict Over Tech

The heating up of the U.S.-China commerce struggle for technological supremacy comes as Congress and the White Home transfer nearer to banning TikTok or forcing China’s ByteDance to promote it.

But Congress has proceeded with little concern about retaliation.

“Chinese language leaders are fearful about expert high-tech producers relocating manufacturing to India and Vietnam and won’t need to speed up these traits,” wrote Adam Segal, who chairs the Council on International Relations program on nationwide safety and rising know-how.

If that is proper, Beijing might even see little upside in going after Apple (AAPL) or Tesla (TSLA), which each manufacture merchandise in China for export in addition to home gross sales.

Beijing Fires Again After China Semiconductor Bans

However Beijing seems to have settled on methods to retaliate towards U.S.-led chip restrictions with out going through such blowback. A ban on exports of uncommon earth metals may give tech producers extra cause to remain in China. China processes 90% of uncommon earths.

However Beijing seems to have settled on methods to retaliate towards U.S.-led chip restrictions with out going through such blowback. A ban on exports of uncommon earth metals may give tech producers extra cause to remain in China. China processes 90% of uncommon earths.

Focusing on Micron provides Beijing a strategy to punish the U.S. whereas strengthening Chinese language chip corporations. China additionally delivered an implicit menace to South Korea, whose reminiscence giants Samsung and Hynix have main operations there.

In fiscal 2022, corporations primarily based in China and Hong Kong accounted for almost $5 billion, or 16%, of Micron Know-how’s income. These gross sales could possibly be in jeopardy if Beijing restricts Micron. An outright ban, even on gross sales to international corporations whose merchandise are made in China, could possibly be a much-bigger blow.

Micron Know-how provides reminiscence chips for the Apple iPhone. Regardless of latest Apple efforts to ramp up manufacturing in India, most iPhones are nonetheless made in China. Since one reminiscence chip may be subbed for one more, blacklisting Micron would not trigger main disruption for its clients. So China would not danger an exodus of high-tech producers.

U.S.-China Commerce Conflict Background

As not too long ago as September, Apple deliberate to make use of cheaper chips from China’s Yangtze Reminiscence Know-how for iPhones offered domestically. However Apple needed to rapidly reverse course after the U.S. unloaded its final weapon towards China’s know-how ambitions.

Till then, the U.S. had moved to dam entry to key applied sciences for tons of of entities on a case-by-case foundation. Export bans focused corporations or analysis facilities linked to China’s army. Additionally these engaged in surveillance of the Muslim Uyghur inhabitants or charged with violating export guidelines or mental property theft.

But these restrictions had been too porous to noticeably blunt China’s technological progress. That will clarify why Beijing resisted the urge to retaliate.

“Technological innovation has turn into the primary battleground of the worldwide enjoying subject, and competitors for tech dominance will develop unprecedentedly fierce,” President Xi Jinping mentioned in a Might 2021 handle.

Be part of IBD specialists as they analyze actionable shares within the inventory market rally on IBD Dwell

‘Strategic’ Flip For U.S.-China Relations

China regarded prone to prevail, in response to a December 2021 overview from Harvard’s Belfer Middle for Science and Worldwide Affairs. In key twenty first century applied sciences, equivalent to AI, semiconductors, quantum computing and inexperienced vitality, the authors concluded that China “had already turn into No. 1” in some areas. And it was on a path to overhaul the U.S. inside a decade in others — except one thing main modified. And one thing main did change beginning final September.

In a Sept. 16 speech, Nationwide Safety Advisor Jake Sullivan mentioned U.S. export controls beforehand aimed to keep up know-how management — staying “solely a few generations forward” of geopolitical rivals — however did not try for dominance.

“That isn’t the strategic atmosphere we’re in right now,” Sullivan mentioned. As an alternative, he mentioned, the U.S. faces a competitor prepared to dedicate almost limitless sources to attaining management in applied sciences that may act as “drive multipliers.”

The brand new purpose have to be to “preserve as massive of a lead as attainable.”

Biden China Semiconductor Restrictions

The Biden administration in September blocked gross sales of high-end AI chips from Nvidia and AMD to Chinese language corporations. Then on Oct. 7, the U.S. introduced sweeping export guidelines geared toward blocking China’s chip progress at each chokepoint.

The foundations do not simply set up a presumption of denial for Chinese language purchases of probably the most superior AI chips. In addition they deny China the software program to design these chips and the gear to provide them. In addition they reduce off the important thing elements that go into high-level chip gear and entry to the world’s most superior chip fabrication services. Lastly, the principles goal to deprive the Chinese language chip trade of mind energy. They require a license for any U.S. citizen, resident or agency to contribute to superior semiconductor manufacturing in China.

The export guidelines set the ground for chip gear exports above the 14-nanometer manufacturing achieved by China’s largest chipmaker, SMIC, as early as 2019. Because the trade strives to make ever-smaller circuits, which translate to sooner and extra power-efficient semiconductors, the U.S. goals to degrade China’s semiconductor functionality. When the U.S. first restricted exports to the state-owned SMIC in 2020, it allowed gear gross sales above 10 nanometers.

Taiwan Semiconductor (TSM) not too long ago celebrated the beginning of mass manufacturing utilizing its 3-nanometer know-how. TSMC is constructing a 3nm fab in Arizona as a part of a $40 billion funding.

Catch The Subsequent Massive Successful Inventory With MarketSmith

Allies Be part of U.S.-China Commerce Conflict Over Tech

Success of the U.S. export controls is determined by the cooperation of key allies. Information on that entrance has been largely optimistic. Taiwan, Japan and Netherlands are largely acceding to U.S. needs. Netherlands is dwelling to ASML (ASML), the one provider of utmost ultraviolet lithography gear wanted for the most-advanced chips. In actual fact, ASML has agreed to go additional. It is also proscribing exports of deep ultraviolet lithography gear. That gear reportedly let SMIC obtain 7-nanometer manufacturing.

South Korea, although in search of assurances about its chipmakers’ ongoing investments in China, additionally seems to be on board.

In a March speech to Chinese language companies, Xi blasted the U.S. coverage of “all-round containment, containment and suppression on our nation, bringing unprecedented extreme challenges to our improvement.”

France Grumbles

French President Emmanuel Macron, recent from a China journey with a delegation together with CEOs from Airbus (EADSY) and Alstom, voiced his personal frustration with U.S. technique and the presumption that Europe will fall in line.

“Is it in our curiosity to speed up (a disaster) on Taiwan? No,” Macron was quoted as saying.

Carnegie Endowment for Worldwide Peace fellow Matt Sheehan had cautioned that America’s “strongly zero sum method” to confront China on know-how won’t be widespread.

That method “is not equally compelling to nations that do not see themselves as locked in a battle to be the one dominant world superpower.”

But Macron’s criticisms have been an outlier within the escalating U.S.-China commerce struggle. In a March 30 speech, European Fee President Ursula von der Leyen painted an image of “a China that’s turning into extra repressive at dwelling and extra assertive overseas.”

Xi has maintained his “no limits” friendship with Russian President Vladimir Putin, imposed management over Hong Kong and signaled that Taiwan’s flip could come prior to later. All that has constructed assist for America’s escalation of the technological chilly struggle with China.

5 Greatest Chinese language Shares To Watch Now

China-Taiwan Flashpoint

Some analysts consider Biden is taking a calculated gamble. The guess is that slowing China’s know-how progress within the intermediate time period is definitely worth the danger that China’s semiconductor sector will emerge stronger and self-sufficient in the long term.

But near-term considerations are preeminent. Taiwan boasts 90% of the manufacturing capability for the world’s most superior chips, a 2021 Boston Consulting Group examine estimated. The U.S. has launched into a serious growth of semiconductor manufacturing to de-risk its provide chain. That features $52 billion in subsidies from the 2022 Chips Act. Europe and South Korea are making comparable efforts.

That might not be Biden’s solely gamble. Because the U.S. primarily weaponizes Taiwan’s superior chipmaking, may Beijing attempt to assert its will over Taiwan by drive?

That is an virtually unimaginable situation, one which appears sure to plunge the worldwide financial system into chaos.

But China is “significantly” contemplating an financial blockade of Taiwan, with the concept of “successful the struggle with out an precise combat,” deputy international minister Roy Chun Lee advised Bloomberg this week. Nonetheless, a blockade might simply escalate into army confrontation, he mentioned.

Early this yr, a situation solely reasonably much less explosive briefly appeared like an actual danger. The U.S. aired intelligence suggesting China may start arming Russia to attempt to assist Putin end off Ukraine.

Each U.S. and European officers warned Beijing that crossing that “pink line” would deliver critical reprisals.

China Flexes Its Financial Energy

But, for now, Xi is exhibiting no inclination to cross pink strains as he prioritizes China’s financial energy, undercutting America the place he can.

China scored a PR coup of kinds in March, seemingly filling the vacuum left by U.S.-Saudi frictions, when it introduced collectively Iran and Saudi Arabia as they restored diplomatic relations. Then, claiming neutrality within the Russia-Ukraine battle, Xi paid a go to to Putin to debate China’s peace plan.

Though Kyiv sees the plan as a nonstarter, Macron, on his Beijing go to, credited Xi for a critical peace effort. And that wasn’t Macron’s solely present. Airbus introduced plans for a second meeting line close to Beijing because the European aerospace large supplants Boeing (BA) amid heightened U.S.-China commerce and geopolitical tensions.

Beijing is seizing each alternative to make use of its financial may to drive a wedge between the U.S. and its allies.

U.S.-China Commerce Conflict Complicates Battery Cost

Just a few days after the Airbus information, Tesla (TSLA) CEO Elon Musk tweeted that the corporate will break floor this yr on a brand new Shanghai manufacturing unit that may produce 10,000 Megapack battery items to fulfill rising vitality storage demand.

In the meantime, Ford (F) has reached a take care of China-owned Modern Amperex Know-how, also called CATL, to provide lithium ferrous phosphate EV batteries at a brand new manufacturing unit in Michigan. Tesla reportedly has had comparable discussions with CATL. But the Ford-CATL partnership has drawn hearth from U.S. lawmakers indignant {that a} Chinese language agency may profit, if solely not directly, from Inflation Discount Act subsidies. Beijing, for its half, reportedly plans to scrutinize the deal out of concern Ford will acquire entry to delicate applied sciences.

The Ford-CATL partnership is “a logo of how tough it’s for america to stability the pursuits of personal trade with the will to scale back dependence on Chinese language applied sciences,” wrote Council on International Relations researcher Seaton Huang.

China Contemplating Proscribing Exports

Because the federal authorities places up tons of of billions of {dollars} in subsidies to speed up the build-out of a U.S.-centric provide chain, Beijing could also be mulling methods to disrupt issues.

Because the federal authorities places up tons of of billions of {dollars} in subsidies to speed up the build-out of a U.S.-centric provide chain, Beijing could also be mulling methods to disrupt issues.

China is contemplating proscribing exports of know-how and gear for making photovoltaic cells for giant photo voltaic panels.

Micron, which is constructing a $20 billion chip manufacturing unit in New York, not too long ago warned in regards to the influence of a ban on Chinese language exports of uncommon earths.

The U.S. is working to diversify its uncommon earth provide. MP Supplies (MP), a serious uncommon earths miner by way of its Mountain Cross, Calif., advanced, has lengthy shipped its unseparated bulk focus to China for processing. However it’s starting to separate the uncommon earths it mines. The following step is finishing a Texas manufacturing facility that may produce sufficient magnets to energy 500,000 EVs per yr. Normal Motors (GM) is a strategic associate.

U.S.-China Relations Tense, Economies Intertwined

In uncommon earths and photo voltaic, the U.S. has the capability to diversify away from China, analysts say. However the course of could also be a multiyear one with excessive prices.

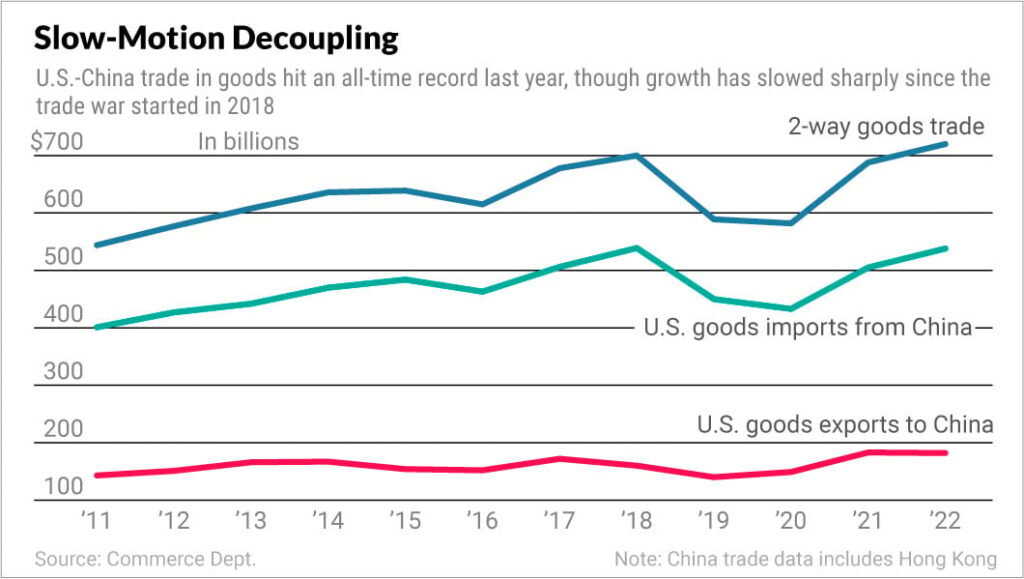

5 years after former President Donald Trump launched his China commerce struggle, the world’s two largest economies are nonetheless very a lot intertwined. Two-way U.S.-China commerce, together with Hong Kong, hit a document $725 billion in 2022, up 2.5% from 2018.

That is to not say there is no decoupling. Commerce in semiconductors and Boeing jets has tumbled. Agricultural exports to China have surged, however that is because of meals inflation.

Over the identical interval, U.S.-Vietnam commerce exploded by $80 billion to $139 billion. China’s exports to Vietnam, nonetheless, greater than doubled over the previous 5 years, word Carnegie Endowment fellows Yukon Huang and Genevieve Slosberg. A lot of the expansion in exports to Vietnam got here in areas like pc equipment and telecom gear, the place Chinese language exports to the U.S. fell.

The implication: “China could also be exporting much less to america immediately, however it’s now not directly exporting extra.”

YOU MAY ALSO LIKE:

Why This IBD Instrument Simplifies The Search For Prime Shares

Greatest Progress Shares To Purchase And Watch

IBD Digital: Unlock IBD’s Premium Inventory Lists, Instruments And Evaluation Right now

Time The Market With IBD’s ETF Market Technique

How To Deal with This Unstable Market; 5 Key Earnings Forward