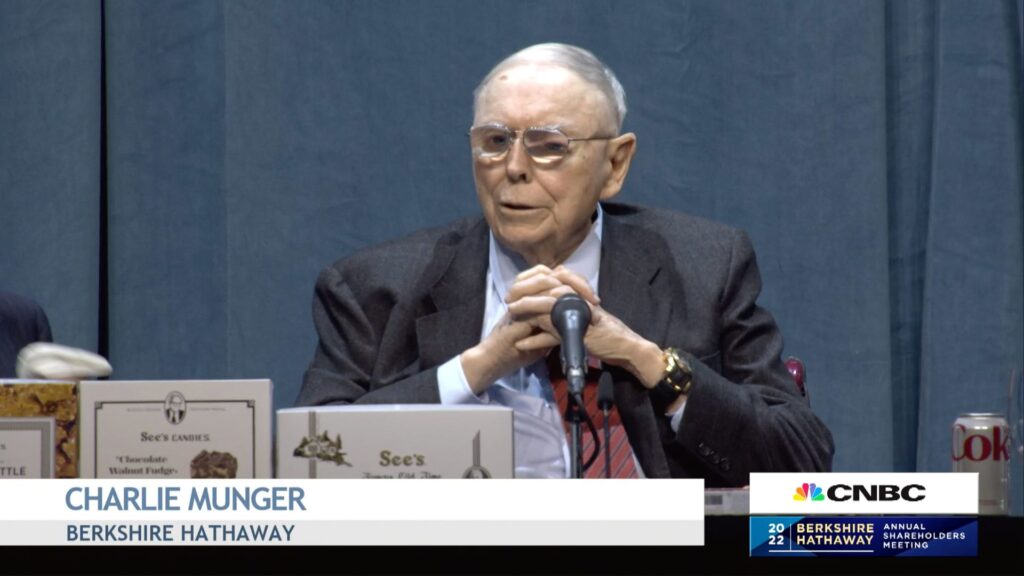

Charlie Munger on the Berkshire Hathaway press convention, April 30, 2022.

CNBC

Berkshire Hathaway Vice Chairman Charlie Munger urged the U.S. authorities to ban cryptocurrencies, as China has executed, arguing {that a} lack of regulation enabled wretched extra and a playing mentality.

“A cryptocurrency isn’t a foreign money, not a commodity, and never a safety,” the 99-year-old Munger stated in an op-ed printed in The Wall Road Journal Thursday.

“As a substitute, it is a playing contract with an almost 100% edge for the home, entered into in a rustic the place playing contracts are historically regulated solely by states that compete in laxity,” Munger stated. “Clearly the U.S. ought to now enact a brand new federal regulation that forestalls this from taking place.”

Munger and his enterprise associate Warren Buffett are longtime cryptocurrency skeptics, contending they don’t seem to be tangible or productive property. Munger’s newest feedback got here because the crypto business was plagued with issues from failed tasks to a liquidity crunch, exacerbated by the autumn of FTX, as soon as one of many world’s largest exchanges.

The cryptocurrency market misplaced greater than $2 trillion in worth final 12 months. The worth of bitcoin, the world’s largest cryptocurrency, plunged 65% in 2022 and it has rebounded about 40% to commerce round $23,824, based on Coin Metrics.

The famend investor stated in recent times privately owned firms have issued 1000’s of latest cryptocurrencies, they usually have grow to be publicly traded with none governmental preapproval of disclosures. Some have been bought to a promoter for nearly nothing, after which the general public buys in at a lot greater costs with out totally understanding the “pre-dilution in favor of the promoter,” Munger stated.

He listed two “fascinating precedents” that will information the U.S. into sound motion. First, China has strictly prohibited companies providing buying and selling, order matching, token issuance and derivatives for digital currencies. Second, from the early 1700s, the English Parliament banned all public buying and selling in new widespread shares and stored this ban in place for about 100 years, Munger stated.

“What ought to the U.S. do after a ban of cryptocurrencies is in place? Effectively, yet one more motion would possibly make sense: Thank the Chinese language communist chief for his splendid instance of unusual sense,” Munger stated.

(Learn the total piece within the Journal right here.)