March 18 (Reuters) – UBS AG (UBSG.S) was inspecting on Saturday a takeover of its embattled Swiss peer Credit score Suisse (CSGN.S), sources stated, a transfer that might allay fears that an unfolding disaster may destabilise the worldwide banking system.

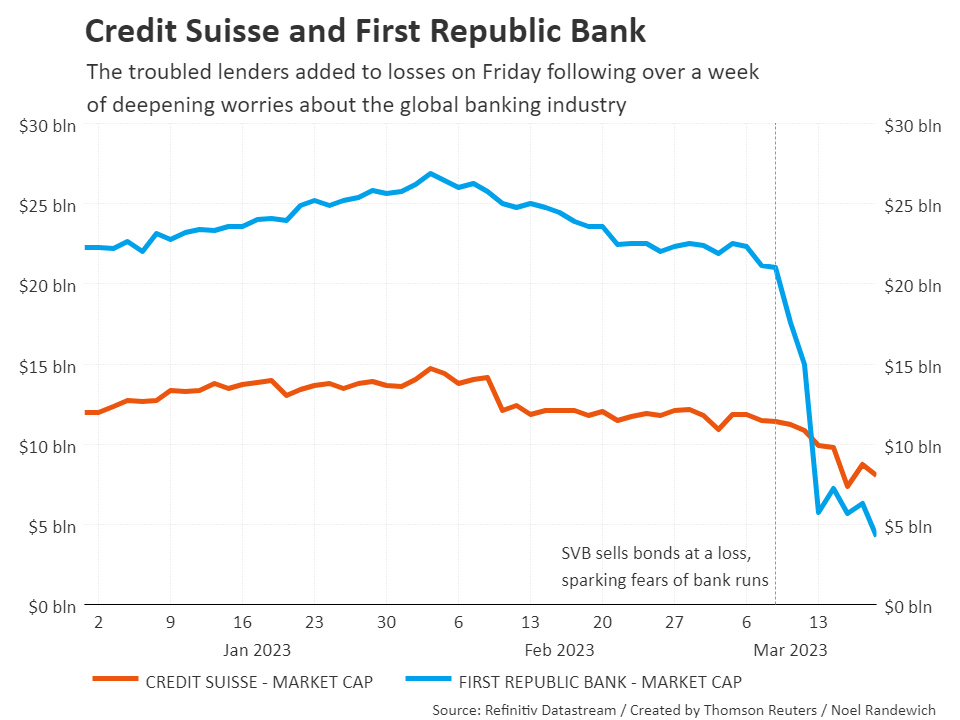

The 167-year-old Credit score Suisse is the largest identify ensnared out there turmoil unleashed by the collapse of U.S. lenders Silicon Valley Financial institution and Signature Financial institution over the previous week, throughout which the Swiss financial institution misplaced 1 / 4 of its inventory market worth.

To get the disaster underneath management, UBS was coming underneath strain from the Swiss authorities to hold out a takeover of its native rival, two folks with data of the matter stated. The plan may see the Swiss authorities supply a assure towards the dangers concerned, whereas Credit score Suisse’s Swiss enterprise might be spun off.

UBS, Credit score Suisse and Switzerland’s monetary regulator FINMA declined to remark.

The Monetary Occasions cited folks acquainted with the matter as saying UBS, Credit score Suisse and regulators have been speeding to finalise a deal on a merger as quickly as Saturday night.

Credit score Suisse Chief Monetary Officer Dixit Joshi and his groups have been assembly over the weekend to evaluate their choices for the financial institution, folks with data of the matter informed Reuters, and the have been a number of stories of curiosity from rivals.

U.S. monetary large BlackRock (BLK.N) stated it had no plans or curiosity in a rival bid for Credit score Suisse, whereas Bloomberg reported that Deutsche Financial institution was the potential for shopping for among the financial institution’s property.

Credit score Suisse’s share worth swung wildly throughout the week, and it was compelled to faucet $54 billion in central financial institution funding.

The temper in Switzerland, lengthy thought-about an icon of banking stability, was pensive as executives wrestled with the way forward for the nation’s greatest lenders.

“Banks in everlasting stress” learn the entrance web page headline of the Neue Zuercher Zeitung newspaper on Saturday.

Credit score Suisse ranks among the many world’s largest wealth managers and is taken into account one among 30 international systemically necessary banks whose failure would trigger ripples all through the whole monetary system.

In an indication of its vulnerability, at the least 4 of Credit score Suisse’s main rivals, together with Societe Generale SA (SOGN.PA) and Deutsche Financial institution AG (DBKGn.DE), have put restrictions on their trades involving the Swiss financial institution or its securities, 5 folks with direct data of the matter informed Reuters.

Goldman Sachs reduce its suggestion on publicity to European financial institution debt, saying an absence of readability on Credit score Suisse’s future would put strain on the broader sector within the area.

The sector’s fundamentals have been stronger and the worldwide systemic linkages weaker than on the time of the worldwide monetary disaster, Goldman analyst Lotfi Karoui wrote in notice to purchasers. This development drastically restricted the chance of a possible vicious circle of counterparty credit score losses, Karoui famous.

“Nonetheless, a extra forceful coverage response is probably going wanted to deliver some stability,” Karoui stated.

MARKET TROUBLES LINGER

Already this week, massive U.S. banks supplied a $30 billion lifeline for smaller lender First Republic (FRC.N), whereas U.S. banks altogether have sought a report $153 billion in emergency liquidity from the Federal Reserve in current days.

This mirrored “funding and liquidity strains on banks, pushed by weakening depositor confidence,” stated scores company Moody’s, which this week downgraded its outlook on the U.S. banking system to detrimental.

In Washington, focus turned to higher oversight to make sure that banks and their executives are held accountable.

U.S. President Joe Biden referred to as on Congress to present regulators higher energy over the sector, together with imposing larger fines, clawing again funds and barring officers from failed banks.

Banking shares globally have been battered since Silicon Valley Financial institution collapsed, elevating questions on different weaknesses within the monetary system.

U.S. regional financial institution shares fell sharply on Friday and the S&P Banks index (.SPXBK) posted its worst two-week calendar loss because the pandemic shook markets in March 2020, slumping 21.5%.

First Republic Financial institution ended Friday down 32.8%, bringing its losses over the past 10 classes to greater than 80%.

Whereas assist from among the greatest names in U.S. banking prevented First Republic’s collapse, buyers have been startled by disclosures on its money place and the way a lot emergency liquidity it wanted.

The failure of SVB, in the meantime, introduced into focus how a relentless marketing campaign of rate of interest hikes by the U.S. Federal Reserve and different central banks – together with the European Central Financial institution this week – was placing strain on the banking sector.

Many analysts and regulators have stated SVB’s downfall was resulting from its specialised, tech-focused enterprise mannequin, whereas the broader banking system was rather more sturdy due to reforms adopted within the years after the worldwide monetary disaster.

However a senior official at China’s central financial institution stated on Saturday that prime rates of interest within the main developed economies may proceed to trigger issues for the monetary system.

Reporting by Reuters bureaus; Writing by Lincoln Feast and Toby Chopra; Enhancing by William Mallard, Kirsten Donovan and Hugh Lawson

: .