Semiconductor specialist Cirrus Logic (NASDAQ: CRUS) will not be a family title like a few of its trade friends, however the firm has carried out impressively properly available on the market thus far this yr with good points of 69% as of this writing.

Cirrus, which is thought for supplying chips for Apple‘s (NASDAQ: AAPL) merchandise, has outpaced the broader Nasdaq-100 Know-how Sector index’s good points of 10% by an enormous margin. The excellent news is that Cirrus’ excellent progress is right here to remain, and the corporate may end the yr strongly due to its largest buyer. What’s extra, the arrival of synthetic intelligence (AI)-enabled smartphones is more likely to unlock a large long-term progress alternative for Cirrus Logic.

Let’s take a better have a look at the explanation why traders ought to contemplate shopping for Cirrus Logic inventory hand over fist earlier than it is too late.

Cirrus Logic’s current outcomes level towards a vivid future

Cirrus Logic launched fiscal 2025 first-quarter outcomes (for the three months ended June 29) on Aug. 6. The corporate’s income elevated 18% yr over yr to $374 million and was properly forward of the consensus estimate of $318 million. What’s extra, Cirrus’ adjusted earnings jumped a strong 67% yr over yr to $1.12 per share, crushing Wall Road’s $0.61 per share estimate.

The constructive information did not finish right here, as Cirrus expects its fiscal Q2 income to land between $490 million and $550 million. The midpoint of the steering vary stands at $520 million, and that is properly above the Wall Road estimate of $485 million. Cirrus clocked income of $481 million in the identical quarter final yr, indicating that its high line is on monitor to extend by 8% on a year-over-year foundation.

Cirrus’ high line may land nearer to the upper finish of its steering vary due to its largest buyer, Apple, which accounted for a whopping 88% of its high line final quarter. Cirrus administration identified on the current earnings convention name that its income exceeded the highest finish of its unique steering vary due to “stronger than anticipated shipments into smartphones.”

As a result of Apple is Cirrus’ largest buyer, the stronger-than-expected efficiency implies that Cirrus bought extra orders for its chips final quarter. That is not stunning, as Apple appears to be getting ready for an aggressive rollout of its next-generation iPhones which are all set to assist generative AI options.

Apple’s rumored iPhone 16 is predicted to hit the market subsequent month and the tech large is predicted to ship 90 million models of its up to date smartphone lineup this yr. That will be a ten% enhance over final yr. However on the identical time, provide chain experiences point out that Apple is stocking up on 120 million show panels, suggesting that it could find yourself manufacturing extra models than what the market is presently anticipating.

If that is certainly the case, Cirrus Logic’s progress within the present quarter is more likely to exceed expectations as soon as once more. However extra importantly, the mixing of the Apple Intelligence suite of generative AI options into the tech large’s upcoming smartphones is predicted to set off a strong improve cycle. Apple’s smartphone shipments are anticipated to extend by 10% in fiscal years 2025 and 2026, in accordance with JPMorgan‘s estimates.

Cirrus is predicted to land extra greenback content material within the subsequent era of iPhones, which implies that it ought to be capable of obtain extra income from every unit of the iPhone that Apple produces. So, the stage appears set for Cirrus Logic to finish the yr strongly, and it ought to be capable of maintain its newly discovered momentum sooner or later as properly due to Apple’s entry into the AI smartphone market, an area that is presently in its early phases of progress.

A pair extra causes to purchase the inventory

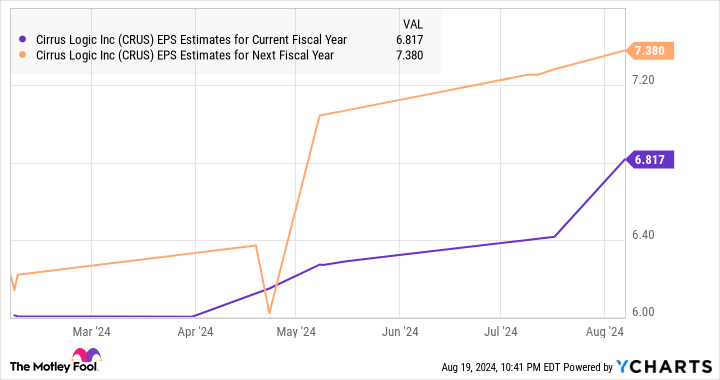

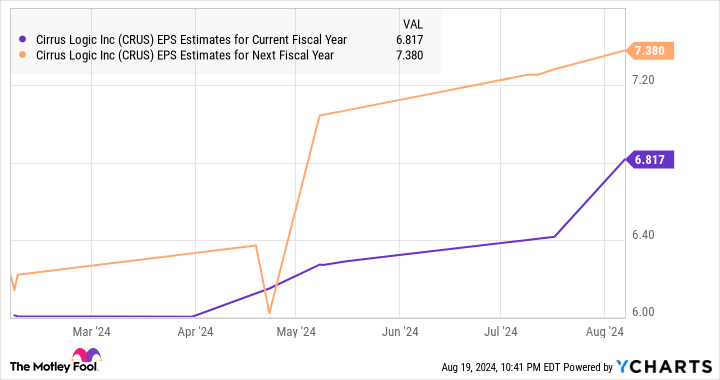

Analysts have been fast to boost their earnings progress expectations for Cirrus Logic, as is clear from the chart beneath.

Cirrus Logic completed fiscal 2024 (ended on March 30) with non-GAAP earnings of $6.59 per share. The above chart tells us that analysts weren’t anticipating a rise in Cirrus’ earnings within the present fiscal yr, however that has modified of late. Moreover, the corporate’s bottom-line progress forecast for the following fiscal yr factors towards an enchancment in its progress fee.

Nonetheless, if Apple certainly decides to ramp up the manufacturing of its upcoming iPhones and Cirrus finally ends up supplying extra content material to the tech large, there’s a good probability of Cirrus’ earnings simply outpacing analysts’ expectations going ahead.

That is why now can be a superb time for traders to purchase this semiconductor inventory. It is buying and selling at simply 26 occasions trailing earnings, a reduction to the Nasdaq-100 index’s earnings a number of of 31. And the AI-driven progress within the smartphone market and Cirrus’ tight relationship with one of many largest gamers on this house may result in better-than-expected progress going ahead.

Do you have to make investments $1,000 in Cirrus Logic proper now?

Before you purchase inventory in Cirrus Logic, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for traders to purchase now… and Cirrus Logic wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $792,725!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 22, 2024

JPMorgan Chase is an promoting accomplice of The Ascent, a Motley Idiot firm. Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple and JPMorgan Chase. The Motley Idiot recommends Cirrus Logic. The Motley Idiot has a disclosure coverage.

Up 69% in 2024, This Purple-Sizzling Synthetic Intelligence (AI) Progress Inventory Might Hold Hovering was initially printed by The Motley Idiot