Buyers on the hunt for shares able to making the most of the unreal intelligence (AI) chip increase most likely do not have Lam Analysis (NASDAQ: LRCX) on their radar. Nevertheless, a more in-depth take a look at the corporate’s prospects and the potential acceleration in its progress signifies that it actually must be. This chip inventory is on its approach to capitalizing on a scorching know-how development.

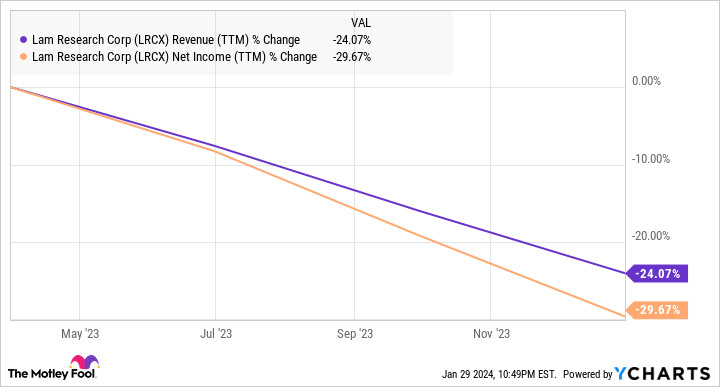

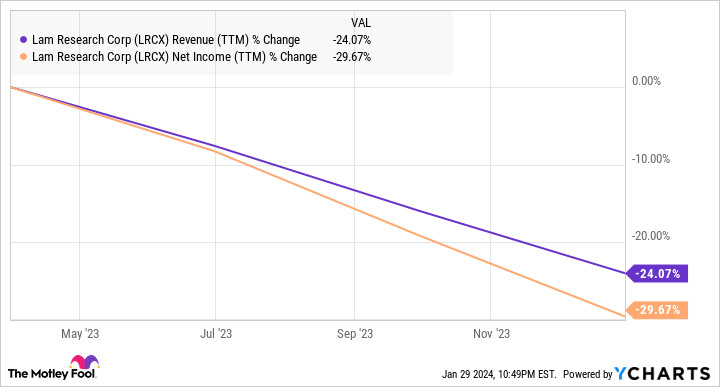

Nonetheless, a take a look at the inventory’s efficiency of late reveals that some traders are clued into its potential. Shares of Lam Analysis headed greater after the corporate launched fiscal 2024 second-quarter outcomes (for the three months ended Dec. 24, 2023) on Jan. 24. The inventory now sits on spectacular inventory worth beneficial properties of 75% prior to now yr. Which will appear a tad shocking, contemplating the tempo at which its income and earnings declined this previous yr.

What they possible are discovering is that Lam Analysis’s newest outcomes point out it’s on the cusp of a turnaround. Let’s try the explanation why this semiconductor firm might maintain its spectacular inventory market rally.

A turnaround in semiconductor tools spending will energy Lam Analysis’s progress

Lam Analysis reported fiscal Q2 income of $3.76 billion, down 29% from the year-ago interval. The corporate’s non-GAAP earnings shrunk to $7.52 per share from $10.71 per share in the identical quarter final yr. This sharp year-over-year decline may be attributed to weak spending on semiconductor tools in 2023, particularly for reminiscence chips.

Semiconductor tools spending was forecast to drop 15% in 2023 to $84 billion. The reminiscence tools market took a much bigger hit as spending was down 46% final yr. Lam Analysis will get 48% of its income from promoting reminiscence tools, so the massive decline on this market owing to an oversupply of reminiscence chips weighed closely on the corporate’s monetary efficiency.

The excellent news is that Lam Analysis’s steerage for the present quarter signifies that its monetary efficiency is ready to enhance remarkably. The corporate guided for $3.7 billion in income and $7.25 per share in adjusted earnings for the continuing quarter, which can finish on March 31. That factors towards a smaller year-over-year decline of 4% in income, whereas the underside line is ready to enhance from the year-ago interval’s determine of $6.99 per share.

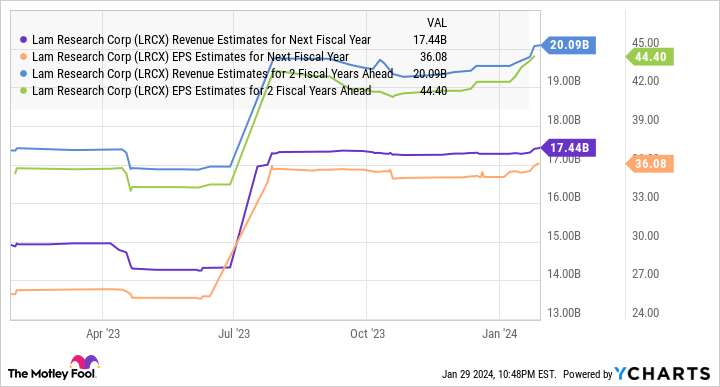

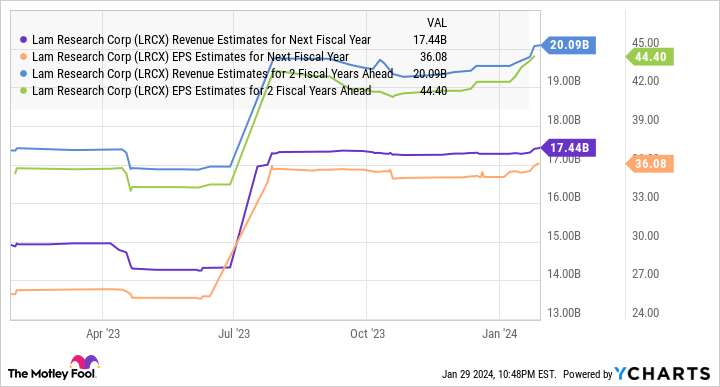

Analysts anticipate Lam Analysis’s full-year 2024 income to drop nearly 16% to $14.7 billion. Its earnings are anticipated to shrink to $27.93 per share from $34.16 per share within the year-ago interval. Nevertheless, Lam’s prime and backside traces are anticipated to return to strong progress from the brand new fiscal yr, which can start in September 2024.

It’s straightforward to see why Lam’s steerage and analysts’ expectations level to sunny days forward. Total spending on semiconductor tools is anticipated to leap 15% in 2024 to $97 billion. The reminiscence tools market, however, is predicted to clock even sooner progress of 65% in 2024, clocking $27 billion in income. The proliferation of AI in a number of markets goes to be a key issue driving the turnaround in spending on reminiscence tools particularly and semiconductor tools on the whole.

AI adoption goes to be a key catalyst for the corporate

Lam Analysis administration identified on the most recent earnings convention name that they’ve “secured further superior packaging wins for high-bandwidth reminiscence, which is crucial for enabling superior AI servers.” It’s price noting that the demand for high-bandwidth reminiscence (HBM) has been rising quickly to hurry up the method of transporting knowledge to AI processors.

Gartner estimates that HBM bit demand might develop eightfold between 2022 and 2027. That is not shocking as main AI-focused chipmakers comparable to Nvidia (NASDAQ: NVDA) combine extra HBM into their AI chips. Nvidia’s flagship H100 AI processor, for instance, carries 80 gigabytes (GB) of HBM. Nevertheless, the corporate has been targeted on including larger HBM into its chips to keep up its aggressive benefit.

As an example, Nvidia’s just lately introduced GH200 Grace Hopper Superchip comes with a large 282GB of HBM. In the meantime, Nvidia’s upcoming H200 AI processor, which is the successor to the H100, is predicted to pack 141GB of HBM. Not surprisingly, Nvidia has reportedly made large funds of $1.3 billion to reminiscence makers comparable to SK Hynix and Micron Expertise (NASDAQ: MU) to safe extra HBM provide.

This explains why Micron identified on its December earnings name that will probably be supplying HBM for Nvidia’s Grace Hopper GH200 and H200 platforms beginning this yr. The reminiscence specialist has already began the manufacturing ramp of its newest technology HBM chips and expects to “generate a number of hundred hundreds of thousands of [sic] {dollars} of HBM income in fiscal 2024.” Even higher, Micron says that HBM demand ought to proceed to develop in 2025 as effectively.

Alternatively, Micron says that the adoption of AI in smartphones and private computer systems (PCs) will create the necessity for extra reminiscence chips. That is as a result of every AI-enabled smartphone or PC might have an extra 4GB to 8GB of DRAM per unit. As such, the foremost issue that was weighing down Lam Analysis — weak reminiscence demand and oversupply — shouldn’t be an issue for the corporate going ahead.

We’ve got already seen that analysts anticipate a pleasant leap in Lam’s income and earnings over the subsequent couple of fiscal years. Assuming Lam Analysis does hit $44 per share in earnings in fiscal 2026 and maintains its ahead earnings a number of of 29 at the moment — which is in keeping with the Nasdaq-100‘s ahead earnings a number of — its inventory worth might improve to $1,276 in simply over two years.

That represents a 50% leap from present ranges. So, traders can nonetheless take into account shopping for Lam Analysis as this AI inventory’s rally appears set to proceed due to enhancing situations within the reminiscence market, which can finally result in strong progress within the firm’s income and earnings.

Must you make investments $1,000 in Lam Analysis proper now?

Before you purchase inventory in Lam Analysis, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Lam Analysis wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 29, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Lam Analysis and Nvidia. The Motley Idiot recommends Gartner. The Motley Idiot has a disclosure coverage.

Up 75% in a 12 months, This Synthetic Intelligence (AI) Chip Inventory Might Skyrocket One other 50% was initially printed by The Motley Idiot