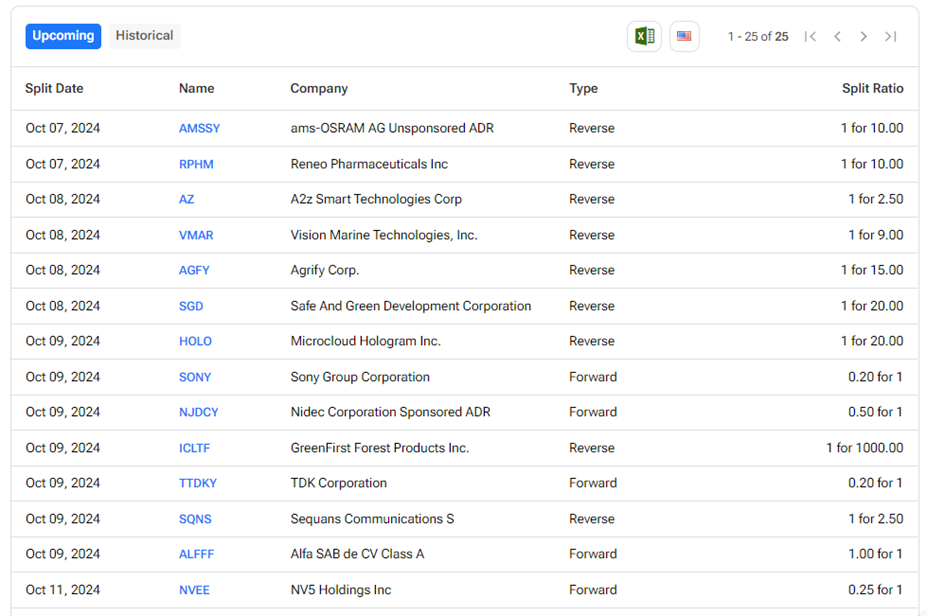

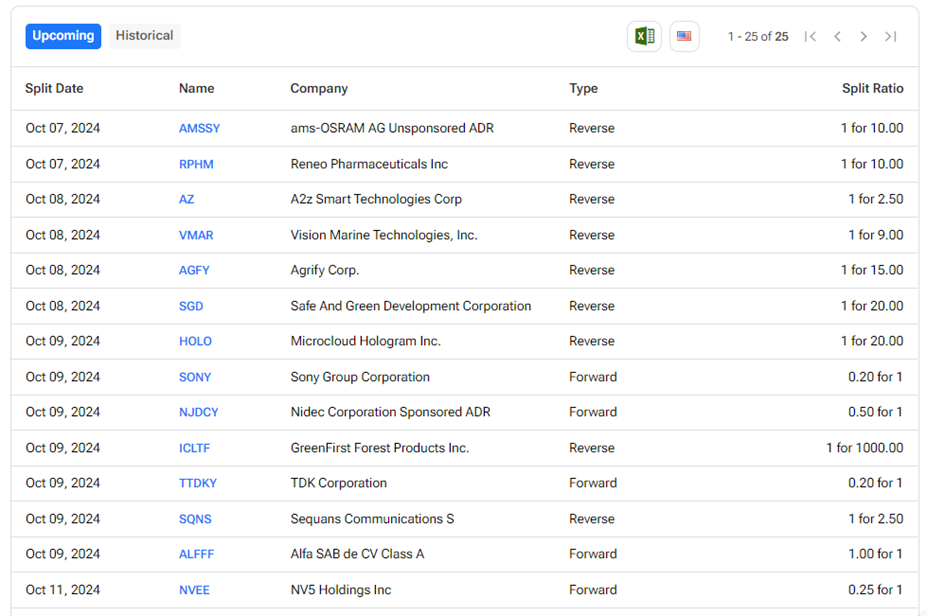

These are the upcoming inventory splits for the week of October 7 to October 11, primarily based on TipRanks’ Inventory Splits Calendar. A inventory break up is a company motion wherein the corporate points extra frequent shares to extend the variety of excellent shares. Accordingly, the inventory value of the corporate’s shares decreases, which maintains the market capitalization earlier than and after the break up.

In distinction, there are additionally reverse inventory splits that scale back the variety of excellent shares (consolidate). On this case, too, the market cap is maintained because the share value will increase following the reverse inventory break up.

Firms typically undertake inventory splits to enhance the liquidity of the frequent shares and make them extra inexpensive for retail traders. Let’s look shortly on the upcoming inventory splits for the week.

ams OSRAM AG (AMSSY) – Austria-based ams OSRAM AG is a semiconductor firm that manufactures superior mild and sensor applied sciences. The corporate’s unsponsored ADRs (American Depositary Receipts) are set to endure a one-for-ten reverse inventory break up. The ADRs are anticipated to begin buying and selling on a split-adjusted foundation on October 7.

Reneo Prescribed drugs (RPHM) – Reneo Prescribed drugs is a clinical-stage biopharmaceutical firm centered on growing precision medicines that focus on biologically validated drivers of cancers which can be underserved by out there therapies. On October 4, Reneo accomplished its merger with OnKure Therapeutics. For the merger, Reneo effected a one-for-ten reverse inventory break up of its frequent inventory. Shares are anticipated to begin buying and selling on a split-adjusted foundation and below the brand new ticker image “OKUR” on October 7.

A2Z Good Applied sciences Corp. (AZ) – Israel-based A2Z Good Applied sciences Corp. develops and markets sensible technological techniques for the retail market in addition to for the protection and safety markets. A2Z introduced a one-for-2.5 reverse inventory break up of its frequent inventory, efficient October 8. The aim of the break up is to adjust to the Nasdaq’s minimal bid value requirement for continued itemizing.

Imaginative and prescient Marine Applied sciences (VMAR) – Imaginative and prescient Marine Applied sciences designs and manufactures electrical outboard marine powertrain techniques and associated expertise. On October 4, VMAR introduced a one-for-nine reverse inventory break up of its frequent inventory. The break up, which will probably be efficient on October 8, is being undertaken to extend the per share market value of VMAR’s frequent inventory and regain compliance with the Nasdaq’s minimal bid value requirement.

Agrify Corp. (AGFY) – Agrify supplies modern cultivation and extraction options for the hashish trade. On October 4, Agrify introduced a one-for-15 reverse inventory break up of its frequent inventory to fulfill the minimal bid value requirement of the Nasdaq’s itemizing guidelines for continued itemizing. Shares are anticipated to begin buying and selling on a split-adjusted foundation on October 8.

Secure & Inexperienced Improvement Corp. (SGD) – Secure & Inexperienced Improvement Corp. operates by means of its unit SG DevCorp, which is an actual property improvement firm. It focuses on constructing modern and inexperienced, single or multifamily tasks throughout all revenue and asset courses. SGD introduced a one-for-20 reverse inventory break up of its frequent inventory to regain compliance with the Nasdaq’s minimal bid value requirement. Shares are anticipated to start buying and selling on a split-adjusted foundation on October 8.

MicroCloud Hologram (HOLO) – China-based MicroCloud provides software program and {hardware} holographic options. The corporate’s holographic expertise is utilized in a number of fields, together with content material companies, sensible automotive holographic fields, and holographic cloud information processing. On October 2, HOLO introduced a one-for-20 reverse inventory break up of its Class A odd shares, efficient October 9. The inventory break up will assist HOLO regain compliance with the Nasdaq’s minimal bid value requirement for continued itemizing.

Sony Group Company (SONY) – Japan-based Sony Group manufactures and markets digital devices, tools, gadgets, recreation consoles, and data technology-related merchandise. Sony’s ADRs (American Depositary Receipts) are anticipated to endure a five-for-one inventory break up efficient October 9.

Nidec Corp. (NJDCY) – Japan-based Nidec Corp. manufactures and distributes industrial and electrical motors. The corporate introduced a two-for-one inventory break up of its frequent inventory, efficient October 9.

GreenFirst Forest Merchandise (ICLTF) – Canada-based GreenFirst Forest Merchandise engages in sustainable forest administration and lumber manufacturing. On September 27, the corporate introduced a one-for-1,000 reverse inventory break up of its frequent inventory. Shares are anticipated to begin buying and selling on a split-adjusted foundation on October 9.

TDK Corp. (TTDKY) – Japan-based TDK Corp. is a complete electronics elements producer. TDK introduced a five-for-one inventory break up of its ADRs (American Depositary Receipts), efficient October 9.

Sequans Communications SA (SQNS) – Sequans is a semiconductor firm that produces a portfolio of 5G/4G operator-certified chips and modules. On September 27, SQNS introduced a one-for-2.5 reverse inventory break up of its ADS (American Depositary Shares). The inventory break up will change the ratio of ADS to odd shares from one-to-four to one-to-ten. Efficient October 9, the ADS will begin buying and selling on a split-adjusted foundation.

Alfa SAB de CV Class A (ALFFF) – Mexico-based Alfa SAB de CV or Alfa Group manufactures and markets specialty chemical compounds for industrial makes use of. The corporate introduced a rights subject of its shares within the ratio 1:1, with an ex-date of October 9.

NV5 International (NVEE) – NV5 International supplies expertise and consulting companies for private and non-private sector purchasers associated to infrastructure, utility, and constructing property and techniques. On September 25, NVEE introduced a four-for-one inventory break up of its frequent inventory to extend the liquidity and attractiveness of its shares. Shares are anticipated to begin buying and selling on a split-adjusted foundation on October 11.

To seek out extra details about historic and upcoming inventory splits, go to the TipRanks Inventory Splits Calendar.

Disclosure