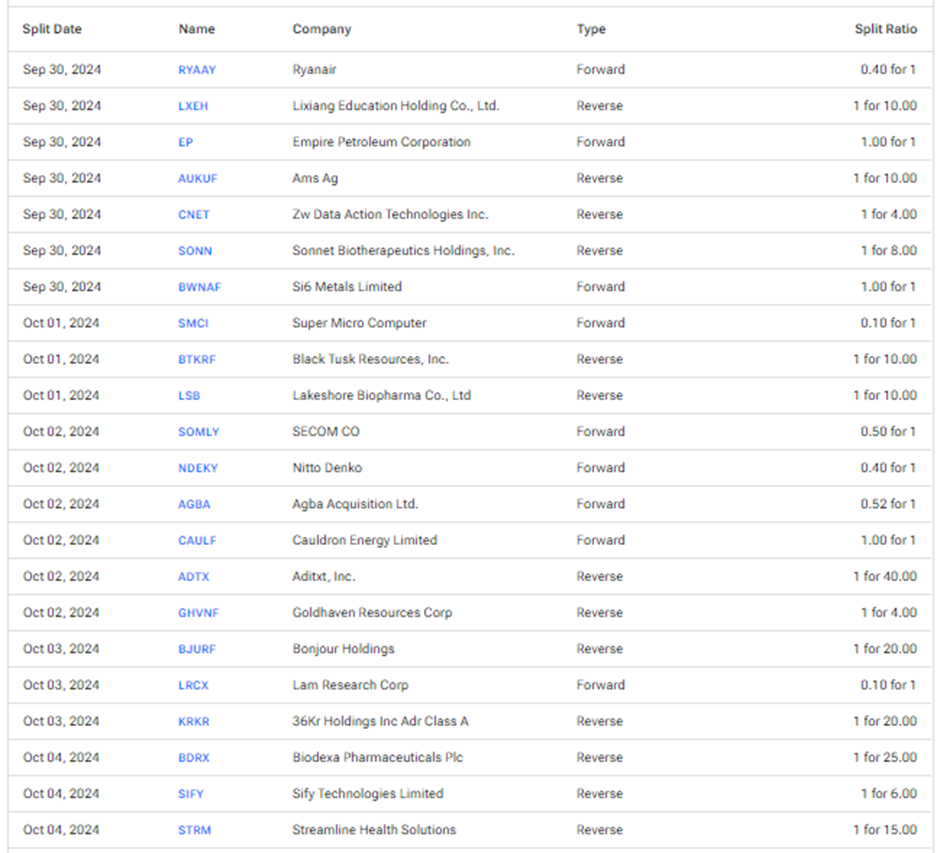

These are the upcoming inventory splits for the week of September 30 to October 4, primarily based on TipRanks’ Inventory Splits Calendar. A inventory cut up is a company motion by which the corporate points further frequent shares to extend the variety of excellent shares. Accordingly, the inventory worth of the corporate’s shares decreases, which maintains the market capitalization earlier than and after the cut up.

In distinction, there are additionally reverse inventory splits that scale back the variety of excellent shares (consolidate). On this case, too, the market cap is maintained because the share worth will increase following the reverse inventory cut up.

Corporations usually undertake inventory splits to enhance the liquidity of the frequent shares and make them extra inexpensive for retail traders. Let’s look shortly on the upcoming inventory splits for the week.

Ryanair Holdings (RYAAY) – Dublin-based Ryanair Holdings is a low-cost air provider throughout the European route community. On September 15, RYAAY introduced a five-for-two inventory cut up of its ADS (American Depositary Shares). The inventory cut up will change the ratio of ADS to strange shares from one-to-five to one-to-two. Efficient September 30, the ADS will begin buying and selling on a split-adjusted foundation. Ryanair’s ADS holders will obtain one and one and half further ADSs for every ADS held by them.

Lixiang Training Holding Co. (LXEH) – China-based Lixiang Training Holding offers non-public major and secondary training providers. On September 26, LXEH introduced a one-for-ten reverse inventory cut up of its ADS (American Depositary Shares). The reverse inventory cut up will change the ratio of strange shares to ADS from one-to-ten to one-to-100. Efficient September 30, the ADS will begin buying and selling on a split-adjusted foundation.

Empire Petroleum (EP) – Empire Petroleum is a production-driven oil and gasoline firm with present producing belongings in New Mexico, North Dakota, Montana, Texas, and Louisiana. The corporate introduced a rights subject of its shares within the ratio 1:1, with an ex-date of September 30 to extend capital. EP intends to lift roughly $10 million in gross proceeds from the rights subject.

ams OSRAM (AUKUF) – Austria-based ams OSRAM AG is a semiconductor firm that manufactures superior mild and sensor applied sciences. On June 14, the shareholders accredited a ten-for-one reverse inventory cut up of its frequent shares, with the efficient date for buying and selling being September 30.

ZW Knowledge Motion Applied sciences (CNET) – ZW Knowledge Motion Applied sciences recognized beforehand as ChinaNet On-line Holdings offers cloud computing, large knowledge, synthetic intelligence (AI), and different applied sciences {and professional} providers. On September 25, ZW Knowledge Motion Applied sciences introduced a one-for-four reverse inventory cut up of its frequent inventory to regain compliance of Nasdaq’s minimal bid worth requirement for continued itemizing. Shares are anticipated to begin buying and selling on a cut up adjusted foundation on September 30.

Sonnet Biotherapeutics (SONN) – Sonnet Biotherapeutics is a clinical-stage biotechnology firm that focuses on growing 5 cytokine-derived product candidates for treating most cancers. On September 25, Sonnet introduced a one-for-eight reverse inventory cut up of its frequent shares to be efficient September 30. The reverse cut up is aimed to extend the per share buying and selling worth of SONN shares to fulfill the minimal bid worth requirement for Nasdaq itemizing.

Si6 Metals (BWNAF) – Australia-based Si6 Metals is a mineral exploration firm with a concentrate on battery and treasured metals. On September 25, Si6 introduced a 1:1 rights subject to lift funds for exploration at its Lithium Valley, Pimento, and Monument tasks. Furthermore, the corporate seeks shareholder approval for a one-for-20 reverse inventory cut up set for a future date.

Tremendous Micro Laptop (SMCI) – Tremendous Micro Laptop manufactures servers and different {hardware} merchandise and is likely one of the main beneficiaries of the AI revolution. On August 6, SMCI introduced a ten-for-one inventory cut up of its frequent inventory, to be efficient October 1.

Q Valuable & Battery Metals Corp. (BTKRF) – Q Valuable & Battery Metals, beforehand generally known as Black Tusk Assets is a Canadian-based minerals exploration firm. On September 25, the corporate introduced a ten-for-one reverse inventory cut up of its frequent inventory to enhance its per share buying and selling worth and buying and selling liquidity. The shares will begin buying and selling on a cut up adjusted foundation on October 1.

LakeShore Biopharma (LSB) – LakeShore Biopharmaceuticals is a biopharmaceutical firm with a concentrate on analysis and growing vaccines and different immune merchandise within the area of infectious illnesses. On September 27, the corporate’s shareholders accredited a ten-for-one reverse inventory cut up of its frequent inventory. The shares will begin buying and selling on a cut up adjusted foundation on October 4.

Secom Co. Ltd. (SOMLY) – Japan-based Secom is safety providers supplier. Secom introduced a two-for-one inventory cut up of its frequent shares to be efficient October 2.

Nitto Denko (NDEKY) – Japan-based Nitto Denko produces adhesives, industrial tapes, contact panels, insulation, vinyl, and different hygiene merchandise. On September 25, NDEKY introduced a five-for-one inventory cut up of its frequent inventory to be efficient October 2.

AGBA Group Holding (AGBA) – Hong-Kong primarily based AGBA is a monetary providers firm that provides business-to-business (B2B) platform, healthcare and wellness providers, fintech companies, in addition to monetary advisory providers. AGBA’s shareholders accredited a ahead inventory cut up within the ratio of 1.9356, to be efficient October 2.

Cauldron Power Ltd. (CAULF) – Australia-based Cauldron Power Ltd. is a uranium exploration firm. The corporate introduced new securities issuance of over 112 million new totally paid strange shares with a file date of October 3.

ADiTx Therapeutics (ADTX) – ADiTx Therapeutics is a pre-clinical stage life science firm with a concentrate on restoring immune tolerance and delivering long-lasting therapy outcomes for continual illnesses. On September 27, ADiTx introduced a one-for-40 reverse inventory cut up of its frequent inventory. The shares will begin buying and selling on a inventory adjusted foundation on October 2.

GoldHaven Assets (GHVNF) – Canada-based GoldHaven Assets is a junior exploration firm, targeted exploration of gold tasks. On September 26, GoldHaven introduced a one-for-four reverse inventory cut up to be efficient on October 2.

Bonjour Holdings Ltd. (BJURF) – Hong-Kong-based Bonjour Holdings is a sequence of retail shops promoting magnificence and way of life merchandise in Hong Kong and Macau. On September 3, the corporate introduced a one-for-twenty reverse inventory cut up of its frequent shares, to be efficient October 3.

Lam Analysis (LRCX) – Lam Analysis is an American wafer fabrication tools producer and provider to the semiconductor business. The corporate is predicted to endure a inventory cut up within the ratio of ten-for-one, efficient October 3.

36Kr Holdings (KRKR) – 36Kr Holdings operates a web-based media publishing portal that gives enterprise providers, together with internet advertising providers, enterprise value-added providers, and subscription providers. On September 19, KRKR introduced a one-for-20 reverse inventory cut up of its ADS (American Depositary Shares) to extend the per share buying and selling worth of its ADS. The reverse inventory cut up will change the ratio of strange shares to ADS to one-to-500 from one-to-25. Efficient October 3, the ADS will begin buying and selling on a split-adjusted foundation.

Biodexa Prescription drugs (BDRX) – Biodexa is a clinical-stage biotechnology firm targeted on growing therapy for oncology and different therapeutic areas. On September 19, BDRX introduced a one-for-25 reverse inventory cut up of its ADR (American Depositary Receipt). The reverse inventory cut up will change the ratio of strange shares to ADR from one-to-400 to one-to-10,000. Efficient October 4, the ADR will begin buying and selling on a split-adjusted foundation.

Sify Applied sciences Ltd. (SIFY) – India-based Sify Applied sciences is an info expertise and communications providers supplier. On September 19, Sify introduced a reverse inventory cut up of its frequent shares within the ratio of one-for-six, efficient October 4.

Streamline Well being Options (STRM) – Streamline Well being Options gives built-in options, technology-enabled providers, and analytics that drive compliant income resulting in improved monetary efficiency throughout the enterprise. On September 26, the corporate introduced a one-for-15 reverse inventory cut up of its frequent inventory to adjust to Nasdaq’s minimal bid worth requirement. The shares will begin buying and selling on a cut up adjusted foundation on October 4.

To seek out extra details about historic and upcoming inventory splits, go to the TipRanks Inventory Splits Calendar.

Disclosure