WASHINGTON, Could 10 (Reuters) – It wasn’t the March 10 collapse of Silicon Valley Financial institution that prompted Carissa Rodeheaver, head of a group financial institution tucked within the mountains of western Maryland, to rethink technique.

That course of began final 12 months when Federal Reserve rate of interest hikes and a much less sure financial surroundings brought about Rodeheaver, the CEO of the $1.9 billion First United Financial institution & Belief (FUNC.O) in Oakland, Maryland, to shift focus from industrial actual property lending, start “husbanding deposits” with a harder have a look at the collateral backing loans, and find yourself with solely a slight, $9.6 million enhance in lending over the primary three months of 2023.

“While you get into larger rates of interest … you look to your collateral,” Rodeheaver mentioned in an interview. “We’re tightening on value and profitability … That’s going to sluggish lending a bit.”

In assessing the affect of the aggressive price hikes which have lifted the Fed’s benchmark in a single day rate of interest a full 5 proportion factors over 14 months, U.S. central financial institution officers could take some solace from First United’s expertise that the worst type of credit score shock has been averted regardless of the dramatic collapses two months in the past of SVB and Signature Financial institution and the more moderen failure of First Republic Financial institution.

First United did see deposits depart early within the first quarter of this 12 months as some account holders spent down balances and others sought larger rates of interest, however padded its money with brokered deposits and “strategic” borrowing from the Federal Residence Mortgage Financial institution system, based on the corporate’s outcomes for the quarter.

But if lending elevated solely barely, enhance it did. For Fed officers, that would spell the distinction between considerations about an economy-wrecking credit score crash, and the type of restraint policymakers wouldn’t solely anticipate as they elevate charges, however have to take root for inflation to sluggish.

‘PART OF THE TRANSMISSION’

A Fed report on monetary stability and a central financial institution survey of financial institution mortgage officers this week bolstered that the banking system wasn’t getting ready to a broad disaster however was making credit score much less obtainable and costlier, a course of that ought to imply much less shopper and enterprise spending and, ultimately, decrease inflation.

“Information exhibiting that banks have began to lift lending requirements … is typical for the place we’re within the financial cycle,” Fed Governor Philip Jefferson mentioned on Tuesday. “The economic system has began to sluggish in an orderly trend” in response to larger rates of interest, Jefferson mentioned, calling tighter credit score circumstances “a part of the transmission mechanism of financial coverage.”

After the Fed raised its coverage price to the 5.00%-5.25% vary at a gathering final week, debate shifted as to if policymakers would discover that stage sufficient to regulate inflation, permitting them to pause the tightening cycle, or whether or not additional will increase would possibly show mandatory.

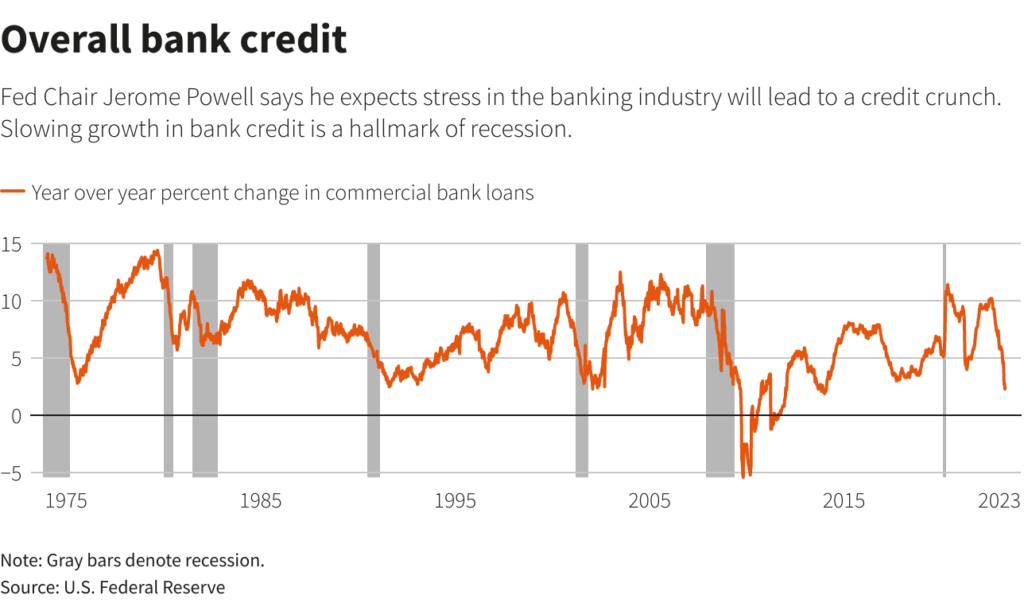

One focus is whether or not the banking sector, rattled by the failures of the three regional lenders and dealing with the quickest price will increase because the Nineteen Eighties, would crack down so onerous on lending that the economic system spun right into a recession.

In keeping with the minutes of the Fed’s March 21-22 assembly, central financial institution employees not less than noticed “the potential financial results of the current banking-sector developments” as ample to shift the outlook from “subdued development” to a “gentle recession” later this 12 months. Fed Chair Jerome Powell mentioned that employees forecast was reiterated ultimately week’s assembly.

Powell, nevertheless, mentioned he felt the affect of the credit score shock “stays unsure,” and his personal baseline outlook doesn’t embody a recession.

Latest knowledge and survey responses even have pointed away from the harshest outcomes. Financial institution lending dipped about 1.7% within the two weeks following SVB’s collapse, however has risen since then and recouped a couple of third of the decline.

The Fed’s Senior Mortgage Officer Opinion Survey, which was performed after the collapse of SVB and launched on Monday, was much less dire than anticipated: Solely a barely bigger share of banks tightened requirements for key enterprise loans in contrast with the survey in January. The Fed’s semi-annual monetary stability report, additionally launched on Monday, noticed scant proof of a broad disaster growing.

‘STILL MAKING DEALS’

Buyers responded by boosting bets that the Fed will find yourself elevating charges at its subsequent assembly in June, although they proceed to provide greater than an 80% chance that it’ll maintain charges on the present stage.

Analysts say the mortgage officers survey could also be much less necessary for what it says concerning the present state of credit score after the SVB collapse than for what it exhibits could unfold in response to a weakening economic system – a dynamic that appears to be affecting mortgage demand in addition to the potential provide.

In response to particular questions tailor-made to the present local weather, mortgage officers noticed continued credit score tightening by means of this 12 months, notably for industrial actual property loans, and declining demand for a broad swath of lending.

The newest sentiment survey from the Nationwide Federation of Unbiased Enterprise buttressed that view, with the share of companies planning capital outlays within the subsequent three to 6 months dipping to what NFIB characterised as a “traditionally weak” 19% in April. The general index fell to greater than a 10-year-low.

The Fed mortgage officers survey confirmed a common wariness concerning the economic system, with respondents saying their plans to tighten credit score revolved round threat model and considerations concerning the worth of collateral greater than from issues with their very own capital or liquidity positions – the type of points which may flag broader monetary stress.

“There’s a risk of recession and clearly we see that, we’re planning for it,” mentioned Greg Hayes, president and chief working officer of Kish Financial institution in central Pennsylvania. “The query is will the Fed again off on the proper time or overshoot?”

Ramon Looby, president and CEO of the Maryland Bankers Affiliation, mentioned Fed price hikes have posed challenges, with a number of the drop in mortgage demand, he suspects, as a result of larger borrowing prices “is likely to be pricing of us out and having them wait on initiatives.”

However banks “are nonetheless making offers,” Looby mentioned. “The Fed and Chair Powell have made it tremendously clear that the objective is to tame inflation, and they’re going to do it by tightening monetary circumstances … How the trade responds – of us are going to be paying way more consideration to liquidity after which being considered.”

Reporting by Howard Schneider;

Enhancing by Dan Burns and Paul Simao

: .