(Bloomberg) — US equity-index futures fluctuated between features and losses as traders debated whether or not inflation had eased sufficient to encourage the Federal Reserve to sluggish financial tightening.

Most Learn from Bloomberg

Contracts on the S&P 500 and Nasdaq 100 index rose about 0.1% every after Tuesday’s rally in US shares on the again of a fifth month of decline in consumer-price development. Treasuries rallied for a second day, whereas the greenback slipped. The Stoxx Europe 600 Index dropped for the second time in three days. Constitution Communications Inc. declined 5.8% in premarket New York buying and selling amid concern its capital-spending plan could crimp money movement.

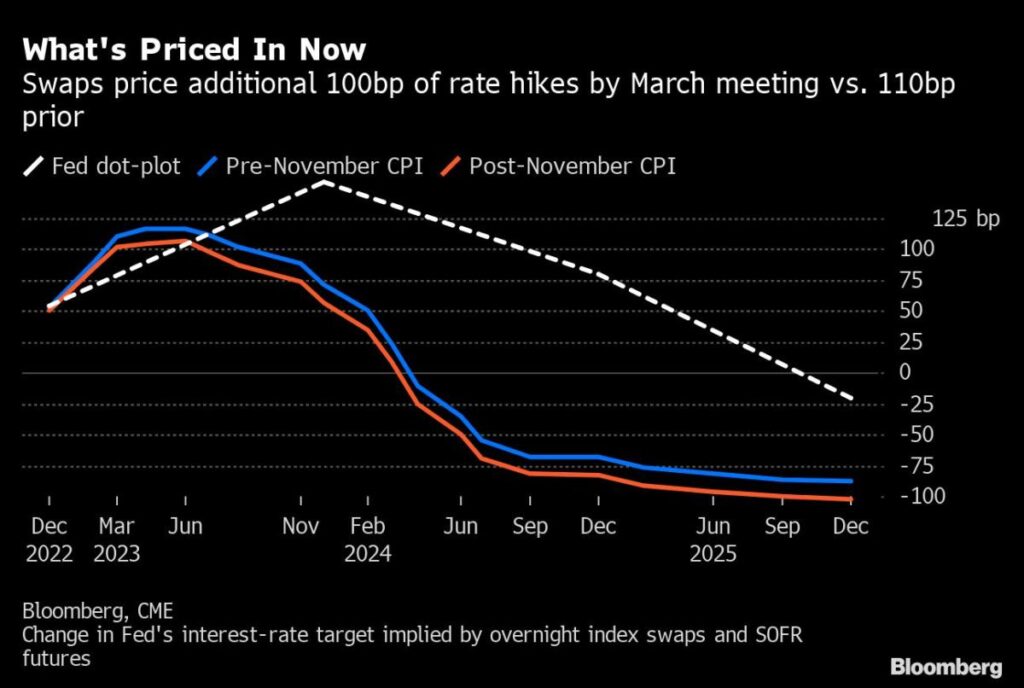

Whereas a softer-than-expected determine for US client value index stoked a rally throughout shares and bonds, the features had been tempered by warning that the Fed should stay resolute on persevering with price hikes. After a 50 basis-point enhance in Fed’s coverage price later Wednesday was firmly priced in, merchants remained on the sting over what indicators policymakers could provide on when the hikes will cease and whether or not a price lower is feasible subsequent yr.

“The query is, with inflation nonetheless at generational highs, will the Fed stroll by way of that door?” Stephen Innes, managing companion at SPI Asset Administration, wrote in a be aware. “After an initially high-spirited response, the comparatively muted response for shares is probably going attributable to pre-risk occasion positioning, prevailing bearish development sentiment, technical components and the satan within the particulars.”

Europe’s fairness benchmark fell after posting the largest single-day advance since Nov. 10 as warning prevailed over Fed’s messaging later within the day in addition to expectations for price hikes by the European Central Financial institution and Financial institution of England on Thursday.

Treasuries with shorter-term maturities posted the largest features Wednesday. The 2-year and five-year rated shed 4 foundation factors every. Merchants are betting that the Fed, after immediately’s transfer, will go for 50 foundation factors extra of hikes, after which an equivalent-sized lower by the top of subsequent yr.

Constitution Communications Inc., the second-largest US cable TV supplier, fell in early buying and selling after saying it’ll spend $5.5 billion to carry higher-speed broadband connections to clients. Greater capital expenditure and decrease money movement create near-term uncertainty, but increasing the footprint might gasoline subscriber development, Bloomberg Intelligence analysts mentioned.

Within the UK, the pound traded close to the strongest stage since June. Inflation within the nation fell from a 41-year excessive in November, elevating the chance that the worst of the cost-of-living squeeze is over. A gauge of the greenback’s power traded 0.3% decrease.

Shares in Hong Kong, Japan and Australia held advances, nudging the MSCI Asia Pacific index towards a three-month excessive and a detailed of 19% above its October low.

Jitters over Fed coverage echoed within the oil market, the place West Texas Intermediate futures halted a two-day advance. Merchants additionally weighed the demand outlook amid a speedy rest of Covid restrictions in China towards the impact of latest circumstances on financial exercise within the nation.

Key occasions this week:

-

FOMC price determination and Fed Chair information convention, Wednesday

-

China medium-term lending, property funding, retail gross sales, industrial manufacturing, surveyed jobless, Thursday

-

ECB price determination and ECB President Lagarde briefing, Thursday

-

Charge choices for UK BOE, Mexico, Norway, Philippines, Switzerland, Taiwan, Thursday

-

US cross-border funding, enterprise inventories, empire manufacturing, retail gross sales, preliminary jobless claims, industrial manufacturing, Thursday

-

Eurozone S&P World PMI, CPI, Friday

A few of the primary strikes in markets:

Shares

-

Futures on the S&P 500 had been little modified as of 5:39 a.m. New York time

-

Futures on the Nasdaq 100 had been little modified

-

Futures on the Dow Jones Industrial Common had been little modified

-

The Stoxx Europe 600 fell 0.6%

-

The MSCI World index rose 0.1%

Currencies

-

The Bloomberg Greenback Spot Index fell 0.3%

-

The euro rose 0.3% to $1.0661

-

The British pound rose 0.2% to $1.2395

-

The Japanese yen rose 0.6% to 134.73 per greenback

Cryptocurrencies

-

Bitcoin rose 0.4% to $17,824.45

-

Ether rose 0.2% to $1,322.72

Bonds

-

The yield on 10-year Treasuries declined one foundation level to three.49%

-

Germany’s 10-year yield superior 4 foundation factors to 1.97%

-

Britain’s 10-year yield superior one foundation level to three.31%

Commodities

-

West Texas Intermediate crude rose 1% to $76.14 a barrel

-

Gold futures fell 0.3% to $1,820 an oz.

This story was produced with the help of Bloomberg Automation.

–With help from Richard Henderson, James Hirai and Georgina Mckay.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.