Markets are down at present, and a collection of associated elements is exerting strain. First, buyers are involved a couple of attainable resurgence within the charge of inflation, which is immediately linked to the second worry. This worry arises from rising oil costs, pushed by the Russian-Saudi settlement to increase their oil manufacturing cuts till December of this 12 months. Lastly, with oil costs approaching $90 per barrel, the price of gasoline is rising within the US markets, regardless that the summer season driving season has come to an finish.

Greater gasoline costs immediately contribute to inflation. In line with the most recent information from AAA, the nationwide common value for a gallon of normal unleaded reached $3.80 on September 6, surpassing final 12 months’s excessive value and incomes the title of the second-highest nationwide common gasoline value. As gasoline costs preserve climbing, it’s seemingly that the Federal Reserve will face heightened strain to think about additional charge hikes, thereby growing the danger of a recession.

Each shift in market circumstances presents alternatives for buyers, whether or not the markets rise or fall. With crude oil costs on the rise and gasoline costs growing, oil shares are positioned for potential beneficial properties.

Wall Road analysts have taken discover and are tagging a few of the market’s largest oil corporations as ‘Buys.’ Let’s dive in and discover these corporations, together with insights from the analysts.

ConocoPhillips (COP)

We’ll begin with ConocoPhillips, one of many business’s giants. The corporate boasts a market cap of over $147 billion and persistently ranks among the many largest unbiased exploration and manufacturing corporations within the oil sector, primarily based on a mixture of confirmed reserves and recognized manufacturing. ConocoPhillips operates in 13 international locations and employs a workforce of over 9,700.

This strong basis positions ConocoPhillips as an oil big able to weathering a risky financial panorama. In its final quarter, ConocoPhillips generated over 1,800 thousand barrels of oil equal per day (Mboe/d), in comparison with just below 1,700 barrels per day within the 2Q22 interval. Yr thus far, as of the top of 1H23, ConocoPhillips’ manufacturing stands at 1,798 Mboe/d, up from the 2022 full-year common of 1,738.

Among the many firm’s distinguished operations are its liquefied pure gasoline (LNG) tasks. LNG is gaining significance as a cleaner-burning fossil gasoline in comparison with coal or oil. ConocoPhillips operates LNG tasks worldwide, with notable places within the Gulf of Mexico, the Caribbean Sea, West Africa’s coast, and Australia.

ConocoPhillips completed the second quarter with $7.1 billion in money and short-term investments – after distributing $2.7 billion to shareholders by means of a mixture of $1.4 billion in dividends and $1.3 billion in share repurchases.

ConocoPhillips provides each a set dividend and a variable dividend that modifications relying on the corporate’s efficiency. The most recent payout included an everyday dividend of $0.51 per share (providing a 1.66% yield) and a variable dividend of $0.60 per share (1.95% yield).

This inventory has caught the eye of Neal Dingmann, 5-star analyst from Truist, who sees the agency’s robust presence in LNG as one among its main upsides. Dingmann writes of this firm and its inventory, “We imagine ConocoPhillips has premiere US upstream stock coupled with a cloth quantity of engaging LNG property. Whereas the corporate’s upstream and LNG property are greater than ample to proceed the enterprise for effectively over a decade, we might not be shocked to see COP add extra positions in both space. Whereas we imagine US ops and LNG will dominate future upside, the corporate additionally has quite a few different engaging property resembling Surmont and Willow that we imagine will produce robust money movement together with a stellar stability sheet.”

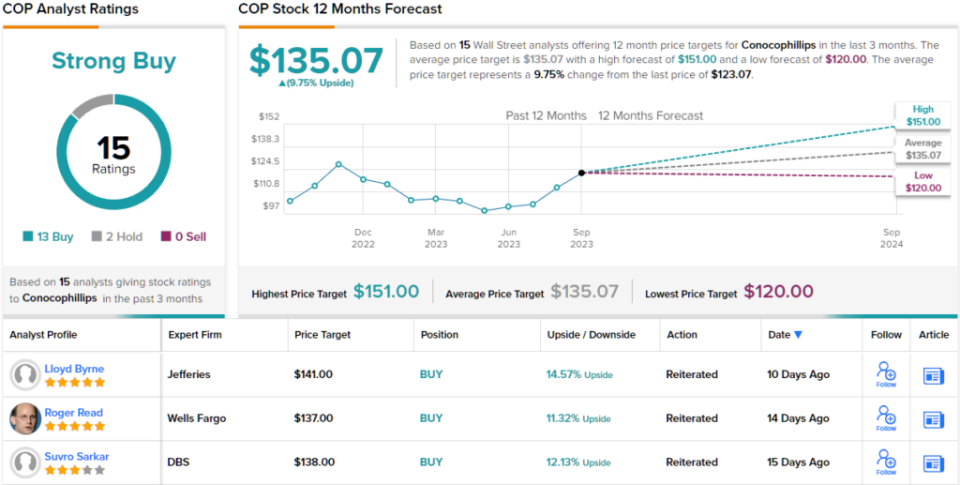

Dingmann’s bullish stance totally complement’s the Purchase score he locations on COP shares, whereas his $151 value goal exhibits his confidence in a 23% upside potential for the approaching 12 months. (To look at Dingmann’s observe file, click on right here)

All in all, no fewer than 15 analysts have weighed in on COP shares lately, with 13 Buys and a couple of Holds giving them a Robust Purchase consensus score. (See ConocoPhillips inventory forecast)

Chevron Company (CVX)

The second main oil firm on our record, Chevron, is among the world’s largest hydrocarbon producers and a large by any measure. The corporate generated practically $240 billion in income final 12 months and boasts a market cap of ~$318 billion.

Chevron is thought for its actions in oil and pure gasoline exploration and manufacturing, its hydrocarbon transportation property (together with a delivery firm for maritime transport), its in depth refinery community that produces a variety of fuels, lubricants, petrochemicals, and components, and its retail section, which features a chain of gasoline stations that market the refined merchandise. Moreover, Chevron is a 50/50 companion with its peer firm Phillips 66 within the manufacturing of commercial fuels and chemical compounds.

A have a look at the final reported quarter, 2Q23, will present us the place the corporate stands. Particularly, revenues have been down virtually 29% from 2Q22, however the $48.9 billion outcome was over $900 million higher than had been anticipated. Chevron’s backside line, reported in non-GAAP measures as an EPS of $3.08, was 10 cents forward of the forecast.

Together with better-than-expected revenues and earnings, Chevron additionally impressed on money flows. The corporate’s money movement from operations was reported as $6.3 billion, a determine that included the $2.5 billion in free money movement. The corporate was ready to make use of its robust money place to ship $7.2 billion in capital returns to shareholders, by means of a mixture of dividends and buybacks.

Chevron final declared its dividend on July 28, for $1.51 per share. This annualizes to $6.04 per frequent share, and yields 3.62%. Chevron has a dividend historical past going again to 1990, and has been regularly elevating the cost since 2005.

So it’s clear that Chevron has sound footing, primarily based on robust fundamentals – and that was the start line for Raymond James analyst Justin Jenkins, who wrote of the corporate: “With a powerful monetary base, excessive relative shareholder payout, and a beautiful relative asset portfolio, we predict Chevron nonetheless provides probably the most straightforwardly optimistic danger/reward in a market that’s develop into more durable to distinguish among the many oil & gasoline majors. 2Q earnings have been once more strong with CVX’s Upstream portfolio with Sunday’s pre-release with robust Permian manufacturing information being the massive upside – underscoring CVX’s Permian development trajectory.”

The 5-star analyst didn’t cease there, however summed up his feedback with an upbeat take: “General, primarily based on a safe stability sheet, top-tier leverage to the oil macro, and capital allocation that continues to maneuver in a most popular course, we preserve our Outperform score…”

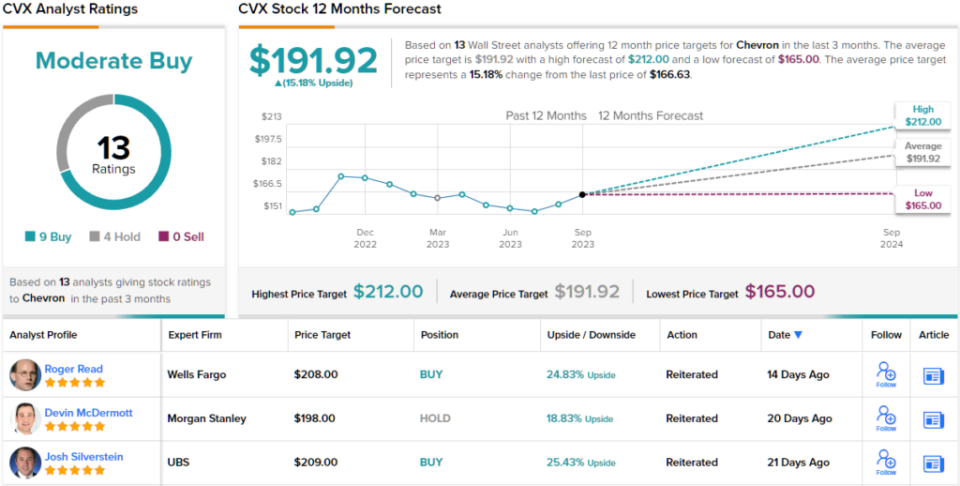

Jenkins’ Outperform (i.e. Purchase) score was paired with a $200 value goal that means a 20% upside on the one-year time horizon. (To look at Jenkins’ observe file, click on right here)

Turning now to the remainder of the Road, 9 Buys and 4 Holds have been revealed within the final three months. Subsequently, CVX has a Reasonable Purchase consensus score. (See Chevron inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally essential to do your personal evaluation earlier than making any funding.