(Bloomberg) — The Federal Reserve will get contemporary perception into its inflation problem this week amid expectations US costs continued to rise at a stubbornly quick tempo prior to now month.

Most Learn from Bloomberg

The buyer worth index report for October is scheduled for Thursday, and is about to have climbed 7.9% from a 12 months in the past, solely a slight slowing from 8.2% recorded in September, in line with the median forecast of economists surveyed by Bloomberg Information.

Strip out meals and power and the index doubtless edged right down to a 6.5% outcome from September’s 6.6% advance. That’s nonetheless far above the two% inflation the Fed targets primarily based on a separate gauge.

On a month-over-month foundation, the core measure is projected to rise 0.5%, matching the common tempo since October of final 12 months and indicating the Fed has made little progress arresting rampant inflation with its sequence of jumbo price hikes.

Fed officers, led by Chair Jerome Powell, raised their key rate of interest on Nov. 2 by 75 foundation factors for the fourth assembly in a row.

Whereas they hinted at a possible willingness to gradual the tempo of will increase after they subsequent collect in December, that may finally rely upon whether or not the outlook for inflation cools. Coverage makers are already signaling that charges might peak at the next stage than beforehand assumed.

What Bloomberg Economics Says:

“On the floor, the core studying, which excludes meals and power, ought to include some good inflation information for Fed doves. Worth pressures in each core items and providers will doubtless average.”

–For extra, learn the complete Week Forward for the US

The inflation surge actually has implications for lawmakers as US voters go to the polls on Tuesday. Opinion polls recommend Democrats will lose management of the Home of Representatives and presumably the Senate as effectively.

Click on right here for what occurred final week and under is our wrap of what’s developing within the international financial system.

Asia

Japan is anticipated to present particulars early within the week of a $200 billion additional price range to fund its newest financial stimulus package deal. How a lot will probably be funded by new issuance of bonds will probably be below shut scrutiny because the nation provides to the developed world’s worst public debt load.

Japanese wage and spending figures out Tuesday are more likely to present a continued fall in households’ buying energy and expenditure as inflation strengthens. Every day intervention information for September are anticipated to indicate only one entry into markets to prop up the yen earlier than Japan ramped up its technique in October.

Reserve Financial institution of Australia’s Deputy Governor Michele Bullock sheds mild on the most recent pondering on coverage because the central financial institution seems to decide on an prolonged common sized rate-hike technique.

China is about to report commerce information on Monday and inflation numbers on Wednesday, with weakening manufacturing unit costs and tame shopper costs one other signal of weak point in momentum.

Indonesia posts GDP information on Monday and the Philippines does so on Thursday.

Europe, Center East, Africa

The week kicks off with a gathering of euro-area finance chiefs in Brussels. They’re more likely to lament the financial woes of a area that appears headed for recession whereas shopper costs are at a file excessive.

A flurry of European Central Financial institution officers are scheduled to talk, amongst them President Christine Lagarde, Vice President Luis de Guindos, and Chief Economist Philip Lane.

Within the UK, third-quarter output on Friday is anticipated to indicate a contraction of 0.5%, proof that the financial system is already in a recession that the Financial institution of England predicts might rival that of the Nineties. 4 BOE price setters — together with Chief Economist Huw Capsule — will probably be watched for any indication on what the UK central financial institution might do at its subsequent assembly after its newest 75 basis-point hike.

In japanese Europe, the central banks of Poland and Romania are predicted to carry charges to 7% and 6.75%, respectively. Serbia can even need to resolve whether or not to shift, days after placing a cope with the Worldwide Financial Fund.

Knowledge from Ghana on Wednesday might present annual inflation in October was virtually quadruple the ten% ceiling of the central financial institution’s goal. Egyptian inflation for October could also be little modified from the earlier month’s 15% on Thursday, in information that embody a interval earlier than the most recent devaluation of the pound.

Latin America

Chile posts a raft of financial information on Monday, together with commerce and copper exports, adopted by October inflation figures Tuesday which are anticipated to indicate a second straight year-on-year decline from August’s 14.1% cycle excessive.

In Brazil, authorities election-related stimulus spending and tax cuts ought to bolster September’s retail gross sales figures. Search for a dramatic slowdown in shopper costs to increase into October, with early estimates of 6.4% almost 600 foundation factors under April’s studying.

Analysts proceed to mark up their third-quarter development forecasts for Colombia’s financial system, suggesting robust September outcomes for manufacturing, industrial output and retail gross sales.

Peruvian central financial institution chief Julio Velarde final week sounded very very similar to a coverage maker able to snap a file tightening cycle that’s raised the important thing price to a two-decade excessive 7%. Each inflation and the financial system are slowing.

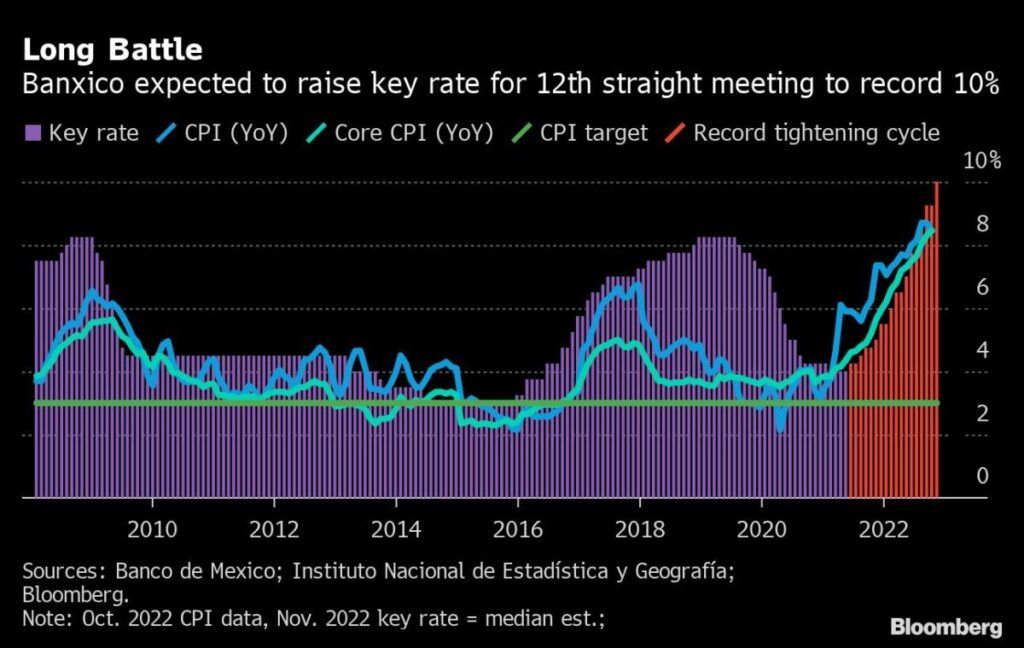

The main target of a busy week in Mexico will probably be squarely on a full set of shopper worth information and the central financial institution’s Thursday price determination.

Whereas headline inflation is forecast to gradual from a third-quarter peak, it’s the core readings that fear coverage makers led by central financial institution chief Victoria Rodriguez. That, together with a surprisingly robust third-quarter GDP report and an unrelenting Fed, ought to transfer Banxico to hike the important thing price to a file 10%.

–With help from Zoe Schneeweiss, Malcolm Scott and Robert Jameson.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.