(Bloomberg) — The newest studying of the US labor market on Friday is predicted to indicate job development on extra of the downward glide path sought by Federal Reserve coverage makers of their combat to beat again inflation.

Most Learn from Bloomberg

Payrolls are projected to have risen about 200,000 in November, a second month of decelerating good points. Such development, whereas moderating, is nonetheless in step with stable hiring that may prolong the Fed’s rate-hiking marketing campaign into 2023. The report would be the final of its form earlier than the central financial institution’s closing coverage assembly of the 12 months.

Job openings knowledge on Wednesday are seen illustrating a still-healthy urge for food for labor.

Later that day, at a Brookings Establishment occasion, Fed Chair Jerome Powell will supply his evaluation of the financial system as buyers search clues concerning the peak within the benchmark rate of interest.

Learn extra: Most Fed Officers Search to Sluggish Tempo of Price Hikes Quickly

The roles report can be forecast to indicate moderating common hourly earnings development. The Bloomberg survey median requires a 4.6% annual enhance, which might be the smallest since August 2021 and a step in the proper route for Fed policymakers. The unemployment charge most likely held at 3.7%, simply above a five-decade low.

Amongst different key US knowledge, the revenue and spending report on Thursday is forecast to point a softening in core inflation for October. Whereas simmering down, the annual tempo remains to be greater than twice the central financial institution’s aim.

Different experiences embody a survey of producing buying managers, weekly jobless claims, shopper confidence, and the Fed’s Beige E-book of regional financial circumstances throughout the nation.

What Bloomberg Economics Says:

“Despite the fact that mid- to lower-income households have depleted extra financial savings constructed up throughout the pandemic, family steadiness sheets are nonetheless traditionally sturdy in combination. Many lower-income households are getting a lift from state and native authorities stimulus checks. Older People are about to get an 8.7% cost-of-living adjustment to their social-security funds. Residual financial savings from pandemic-era federal stimulus proceed to maintain family spending resilient.”

–Anna Wong, Andrew Husby and Eliza Winger, economists. For full evaluation, click on right here

Elsewhere, the euro-zone could reveal one other double-digit inflation studying — the final such report earlier than the European Central Financial institution’s December charge determination. Australian shopper costs are more likely to enhance once more, and charge hikes are anticipated from Thailand to southern Africa.

Click on right here for what occurred final week and under is our wrap of what’s developing within the international financial system.

Asia

Manufacturing unit output figures from Japan and South Korea will give a sign of how slower international development is weighing on manufacturing there, whereas export figures from Korea on the finish of the week will supply the newest well being examine on the state of worldwide demand.

Japan’s labor market is more likely to present continued tightness, although not sufficient to ensure the wage good points Financial institution of Japan Governor Haruhiko Kuroda seeks for sustainable inflation.

Capital spending knowledge could present Japanese companies are nonetheless betting on a post-pandemic restoration slightly than a looming recession. The numbers will feed into revised GDP figures the next week.

Australia’s month-to-month inflation charge is predicted to hurry up, although quarterly figures will proceed to carry extra sway on coverage making.

The Reserve Financial institution of Australia’s Jonathan Kearns is about to talk on Wednesday, with Governor Philip Lowe giving remarks on Friday.

China’s PMI experiences on Wednesday can be carefully watched because the resurgence in Covid instances, and lockdowns to comprise the unfold, hamper exercise but once more.

Nearly all economists reckon the Financial institution of Thailand will elevate its key charge by 1 / 4 level, returning the benchmark to the extent it had earlier than the pandemic.

Europe, Center East, Africa

A pivotal week for euro-zone financial coverage will function each key knowledge and high-profile remarks from ECB officers.

Most necessary is the inflation studying for November, due on Wednesday. A number of officers have pointed to this as a big enter for his or her closing determination of the 12 months, on Dec. 15, each as an indicator of value pressures and as a knowledge level to feed into their financial projections.

Whereas projected to sluggish for the primary time this 12 months, inflation most likely held above 10% for a second month in November, economists say. Their median prediction is for an consequence of 10.4%, down from 10.6% in October.

Inflation knowledge from the area’s 4 largest economies may also be launched, with all however Spain predicted to indicate a minimum of a slight a slowdown.

ECB President Christine Lagarde testifies within the European Parliament on Monday, and can make an look in Thailand later within the week. Chief Economist Philip Lane delivers a speech in Florence on Thursday. A so-called non-monetary coverage assembly of the Governing Council takes place Wednesday, the day of the inflation knowledge.

Inflation figures may also be launched in Switzerland. Whereas operating lower than a 3rd of that within the neighboring euro area, the consumer-price report will tackle added significance as a result of it too is the ultimate take earlier than the Swiss Nationwide Financial institution’s charge determination on Dec. 15, the identical day because the ECB.

Swiss inflation most likely held at 3% in November, the median of 14 forecasts reveals. That might mark the sixth consecutive month the place it has been a minimum of a share level above the central financial institution’s 2% ceiling.

Wanting south, Ghana’s charge determination on Monday could also be a detailed name. Inflation at 40% has but to peak, producer costs are surging, and the cedi has depreciated by nearly 28% in opposition to the greenback since final month’s 250 basis-point hike. On the similar time, enterprise sentiment has slumped.

Price setters in Lesotho and Namibia are anticipated to comply with South Africa’s Reserve Financial institution and lift charges on Tuesday and Wednesday, respectively, to guard their foreign money pegs. Additionally on Wednesday, Mozambique’s central financial institution is about to maintain borrowing prices unchanged.

Policymakers in Botswana will most likely do likewise on Thursday for a second straight assembly after a big minimize in gasoline costs that will ease strain on inflation.

Latin America

October commerce outcomes kick off a busy week in Mexico, adopted by unemployment, remittances, the year-to-date price range steadiness, manufacturing, and Banco de Mexico’s quarterly inflation report.

The resilience of Latin America’s second-biggest financial system within the second half of 2022 may even see Banxico mark up its full-year output forecast, whereas the specter of recession within the US pushes the financial institution to chop its 2023 GDP forecast of 1.6%.

After posting 11.7% development in 2021 it’s all gone downhill for Chile: the financial system shrank in July-September, will doubtless achieve this once more within the fourth quarter, and the central financial institution is forecasting a unfavourable print for 2023. Of the seven October financial indicators posted this week, anticipate some double-digit tumbles.

Client costs in Peru’s capital of Lima seem to have peaked, however still-surging core inflation could cinch the case for a seventeenth straight charge hike on the central financial institution’s Dec. 7 assembly.

Brazil’s broadest measure of inflation — the IGP-M index — is predicted to have fallen for a fourth month in November.

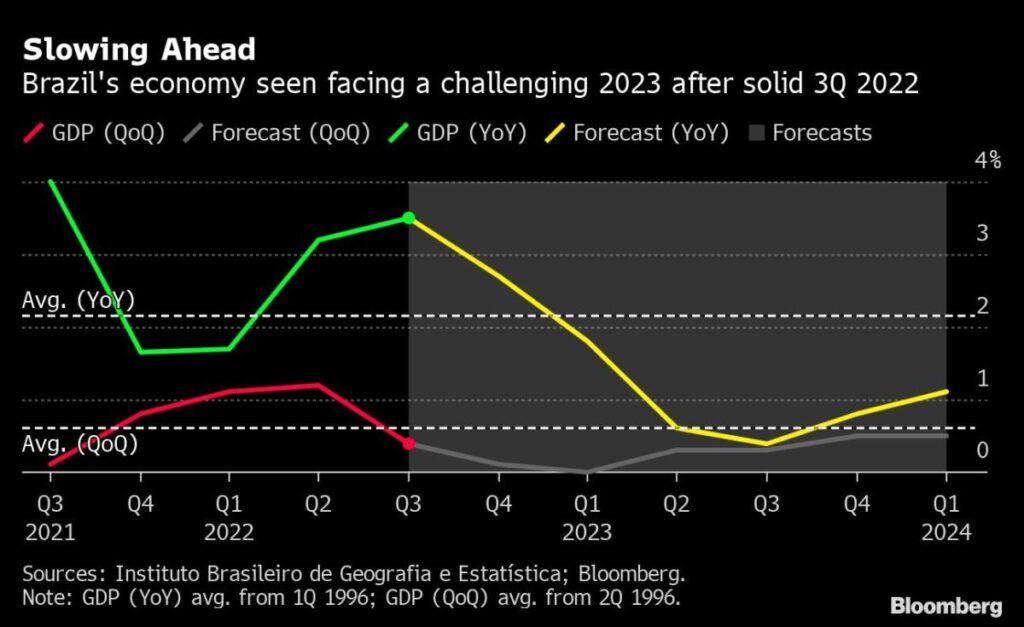

Third-quarter output figures from Brazil launched on Thursday could characterize a near-term high-water mark for Latin America’s largest financial system, with analysts forecasting a protracted bout of below-trend development into 2024.

–With help from Malcolm Scott, Robert Jameson, Sylvia Westall and Monique Vanek.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.