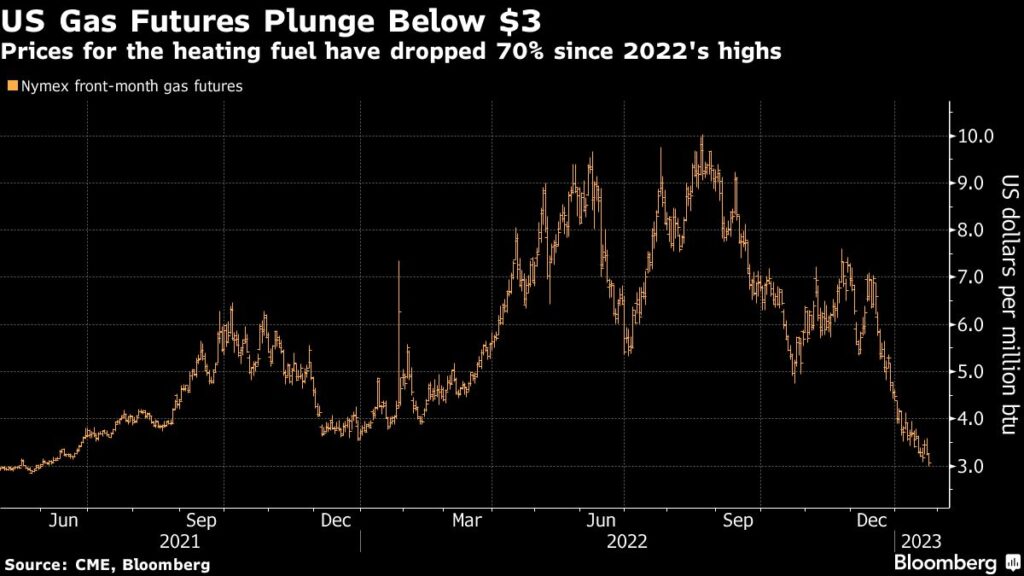

(Bloomberg) — US pure fuel futures prolonged declines beneath $3 amid gentle winter climate that’s helped spark the worst selloff among the many nation’s commodities.

Most Learn from Bloomberg

Fuel for February supply traded as little as $2.857 per million British thermal items on Thursday on the New York Mercantile Alternate. Costs are on the lowest ranges since Might 2021 after dipping beneath $3 on Wednesday.

Doomsday fears that suppliers wouldn’t have the ability to meet wintertime demand have been erased by a confluence of things, main fuel costs to plunge after hitting a 14-year excessive of $10.03 in August.

Key causes for the autumn:

-

The US and Europe managed to refill their buffer inventories forward of winter, and comparatively balmy seasonal temperatures within the Northern Hemisphere have to this point damped demand for heating

-

And a longer-than-expected shutdown at a giant Texas liquefaction terminal has constrained US fuel exports and thus boosted home provides

-

US pure fuel manufacturing rebounded during the last two years to document excessive ranges, flooding the market with gasoline

Pure fuel had been one of the vital bullish commodity tales in recent times. Costs hit the August excessive amid a worldwide provide crunch that was aggravated final 12 months by Russia’s invasion of Ukraine.

However hedge funds have turned essentially the most bearish on US fuel costs in nearly three years, in line with information launched by the US Commodity Futures Buying and selling Fee on Friday.

–With help from Ann Koh and Stephen Stapczynski.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.