Could 5 (Reuters) – Shares in PacWest Bancorp (PACW.O) jumped almost 82% amid a broader rebound in U.S. regional banks on Friday after analysts upgraded numerous lenders they mentioned had been oversold, although some traders fretted the surge could also be short-lived.

Investor worries in regards to the well being of mid-sized lenders deepened in latest days following the collapse of First Republic Financial institution and PacWest’s announcement that it was exploring strategic choices to bolster its funds, which triggered a brutal sell-off.

The whiplash in regional banks’ shares underscores ongoing investor uncertainty over the well being of the sector as market sentiment has began to over-run stability sheet fundamentals.

Friday’s soar, buoyed by a stronger-than-expected jobs report that lifted Wall Road’s primary indexes, might be painful for some traders which have guess closely in opposition to regional banks.

“The regional financial institution group has fully disconnected from the basics throughout this week’s sell-off,” Artwork Hogan, B. Riley Wealth chief market strategist, wrote in a be aware to traders.

JPMorgan analysts, led by Steven Alexopoulos, upgraded their rankings of a number of regional banks on Friday, together with Western Alliance, Comerica and Zion Bancorp, saying that the shares seem “considerably mispriced” after seeing “intense shorting/promoting strain.”

“With sentiment very unfavorable and a possible sector re-rating on the horizon, we now transfer to the center of the boat and undertake a impartial sector stance,” the analysts wrote in a be aware to traders.

Western Alliance (WAL.N) and Zion Bancorp (ZION.O) gained 49% and 19%, respectively. Comerica Inc (CMA.N) rose 17%, Keycorp (KEY.N) was up almost 10%, First Horizon Corp (FHN.N) added 9%, and Truist Monetary Corp (TFC.N) jumped about 10%.

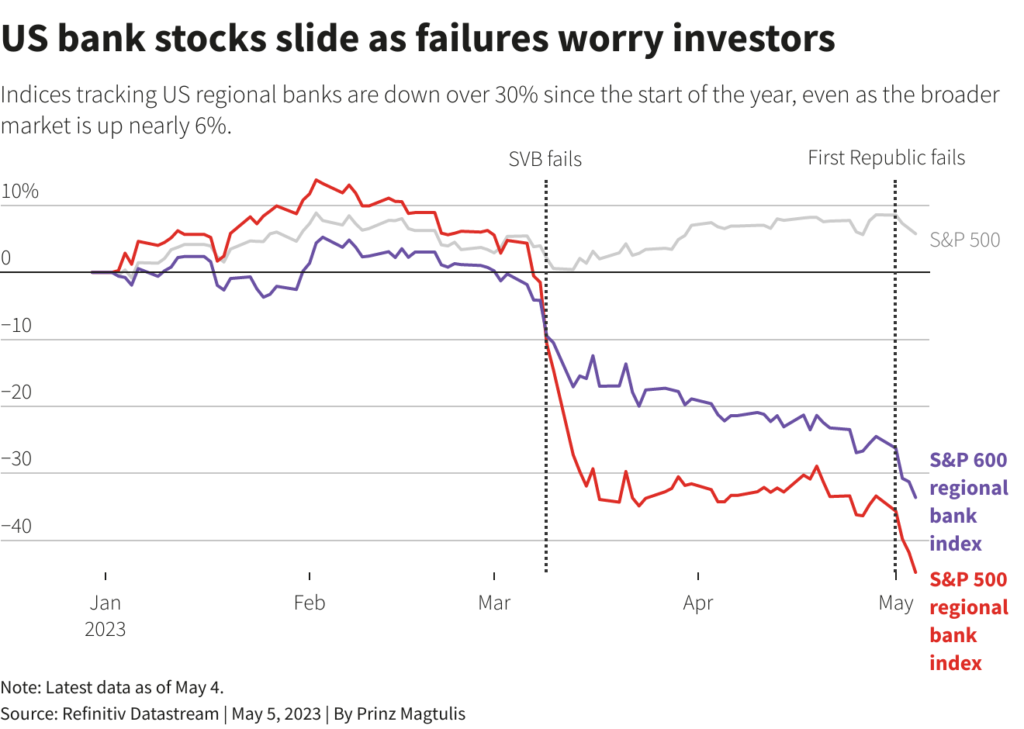

The KBW Regional Banking Index (.KRX), which has plunged about 30% this yr, closed almost 5% greater.

RELIEF RALLY

However some traders mentioned the rebound could not sign a long-term shift in sentiment.

“It is extra of reduction rally simply after the dramatic sell-off,” mentioned Sandy Villere, portfolio supervisor at Villere & Co in New Orleans, including the market may be anticipating some sort of authorities help for the sector in coming days.

Wall Road executives have urged regulators to offer larger safety for financial institution deposits, arguing solely a powerful intervention may cease the contagion, though some analysts have mentioned such a transfer isn’t instantly doubtless.

“The latest actions in financial institution fairness costs are extra about basic confidence than deposits. That might be a tougher subject for regulators to deal with,” mentioned Citigroup analysts.

On Friday, St. Louis Fed President James Bullard reiterated the place of regulators that the banking sector is essentially in fine condition, telling the Financial Membership of Minnesota that regional banks had a “couple of points” however represented a small share of U.S. monetary intermediation.

Deposits at small U.S. financial institution fell barely to $5.32 trillion within the week ending on April twenty sixth in contrast with $5.34 trillion within the prior week, Fed knowledge confirmed on Friday, indicating that prospects retained confidence in mid-sized lenders.

U.S. Treasury Secretary Janet Yellen will even inform her Group of Seven counterparts subsequent week that the banking system stays sound, Reuters reported on Friday.

As many as 16 midsized banks have shed greater than $57 billion in market capitalization since final Friday, Reuters calculations confirmed.

Quick-sellers reaped a mixed $430.47 million in paper income betting in opposition to PacWest, Western Alliance, Zion and First Horizon on Thursday, in response to knowledge from analytics agency Ortex.

“A shift in momentum may trigger a large quick squeeze,” mentioned Hogan.

Regional banks have hit again at quick sellers, writing in a letter to Securities and Change Fee chair Gary Gensler on Thursday that many such bets did “not seem to mirror the issuers’ monetary standing.” Gensler mentioned on Thursday the company would probe any manipulative habits.

Reporting by Manya Saini in Bengaluru; further reporting by Amruta Khandekar

Enhancing by Vinay Dwivedi

: .