April 20 (Reuters) – A clutch of U.S. regional lenders on Thursday joined friends in reporting deposit outflows for the primary quarter as clients spooked by a banking disaster moved funds to greater establishments or sought increased yields in cash market funds.

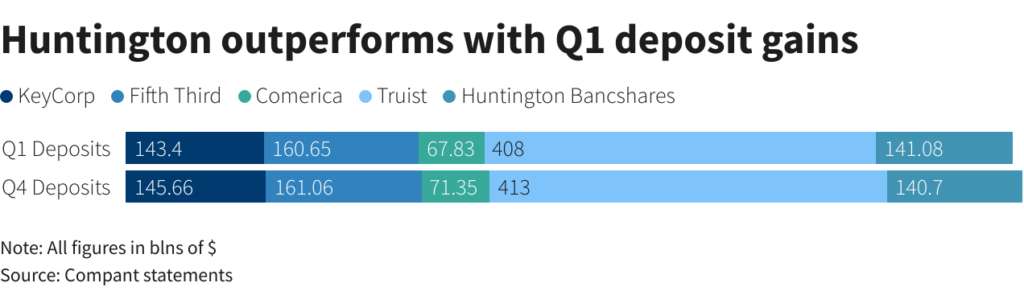

Shares in Fifth Third Bancorp (FITB.O), Comerica (CMA.N), Truist Monetary Corp (TFC.N) and KeyCorp (KEY.N) fell because the deposit flight dampened a bounce within the lenders’ curiosity revenue from the U.S. Federal Reserve’s aggressive financial coverage tightening by means of the previous 12 months.

Solely Huntington Bancshares Inc (HBAN.O) managed to develop common whole deposits by $472 million from the prior quarter.

Its shares outperformed the broader sector with a virtually 1% achieve in morning buying and selling, whereas the others fell between 1% and 6%.

Executives at Comerica anticipate a steep decline this 12 months in deposits because the fallout from the turmoil lingers.

“Our estimated common year-over-year deposit decline of 12% to 14% assumes continued stabilization and displays the affect from Fed financial actions that started final 12 months along with the primary quarter trade occasions,” Comerica finance head James Herzog stated in a publish earnings name.

In the meantime, Fifth Third executives anticipated deposits to be steady or develop from the first-quarter common degree all through 2023.

KeyCorp, in distinction, sees deposits for the complete 12 months to be flat to down 2% and web curiosity revenue to say no between 1% and three%.

Deposit outflows have been on the heart of investor considerations after financial institution runs final month at two mid-sized lenders sparked worries of sector-wide instability.

Within the aftermath, the KBW Regional Banking Index (.KRX) has tumbled 19.4% this 12 months, by means of final shut.

Wall Road lending titans Financial institution of America (BAC.N), Citigroup (C.N) and Wells Fargo and Co (WFC.N) additionally reported deposit declines between 1% and three% within the quarter as banks stay sluggish in elevating charges it pays depositors.

Shoppers are anticipated to increase the shift towards different belongings in search of increased returns until banks enhance deposit charges, analysts have stated.

Huntington lower its forecast for web curiosity revenue this 12 months as a recession turns into extra doubtless, its chief government informed Reuters on Thursday.

On Wednesday, Residents Monetary (CFG.N) slashed its forecast for web curiosity revenue, anticipating a rise within the price it pays out for deposits.

Reporting by Manya Saini in Bengaluru; Enhancing by Shounak Dasgupta

: .