(Bloomberg) — US brief vendor Hindenburg Analysis LLC is concentrating on Asia’s richest man with accusations of market manipulation and fraud after a run of often-successful bets in opposition to corporations starting from electric-vehicle maker Nikola Corp. to Twitter Inc.

Most Learn from Bloomberg

The agency run by Nate Anderson printed an virtually 100-page report on Gautam Adani’s Adani Group, sending shares of the Indian group’s corporations tumbling Wednesday. Hindenburg mentioned it’s brief Adani securities through derivatives and US-traded bonds. Adani Group rejected the accusations as “baseless” and “selective misinformation.”

Hindenburg has focused about 30 corporations since 2020, and their shares on common misplaced about 15% the subsequent day, in response to calculations by Bloomberg Information. The shares on common had been down 26% six months later.

At the same time as Adani disputes the allegations, some fund managers are prone to bail out of Adani shares due to the heightened concentrate on environmental, social and governance standards.

“Given Hindenburg’s popularity, one can assume that these allegations have been completely researched,” mentioned Guillermo Hernandez Sampere, head of buying and selling at asset supervisor MPPM GmbH.

With the marketing campaign, Hindenburg is taking over its greatest goal by far and making a foray into Indian shares that’s uncommon for a US brief vendor. Anderson’s most high-profile brief assault focused electric-vehicle maker Nikola, which he accused of “an ocean of lies.”

Anderson’s agency follows the usual process for a so-called activist brief: After researching a possible goal, Hindenburg locations a guess that the inventory will decline, then trumpets its analysis publicly, utilizing social media to get the message out. Hindenburg’s Twitter account has greater than 259,000 followers, whereas Anderson’s private deal with has one other 26,500.

Activist shorts maintain themselves out as watchdogs who defend traders from accounting and administration misdeeds, whereas the businesses they aim usually accuse them of market manipulation.

Regulators typically have pushed again in opposition to brief sellers, and the US Justice Division in 2021 collected data on dozens of funding companies and researchers as a part of a sweeping hunt for potential buying and selling abuses by shorts, in response to folks with data of the matter. No costs have been introduced from the investigation.

Hindenburg wasn’t instantly obtainable to touch upon its observe file. Adani Group’s chief monetary officer mentioned the analysis was a “malicious mixture of selective misinformation and off, baseless and discredited allegations.”

Right here’s a have a look at a few of Hindenburg’s notable brief targets:

EV Spree

-

Anderson took an curiosity in Nikola after Bloomberg Information printed a narrative on how founder Trevor Milton had exaggerated the aptitude of his debut semi truck. Nikola, which at one level had a $34 billion market worth, is now price $1.3 billion, and a jury in October convicted Milton of defrauding traders. The inventory has tumbled greater than 94% for the reason that brief vendor’s report.

-

Hindenburg additionally focused Lordstown Motors Corp. for deceptive traders on its demand and manufacturing capabilities. The corporate later confirmed it had disclosed inaccurate details about curiosity from potential prospects. The corporate, as soon as valued at greater than $5 billion, is now price lower than $260 million. Its share have fallen greater than 90% for the reason that Hindenburg report.

-

The brief vendor in July 2020 questioned the “astronomical” market worth of one other EV firm, Workhorse Group Inc., and mentioned it had lengthy odds of profitable a mail truck contract from the US Postal Service. It didn’t win the contract. The corporate’s market worth has slumped to $332 million from $1.5 billion since Hindenburg tweeted out its warning.

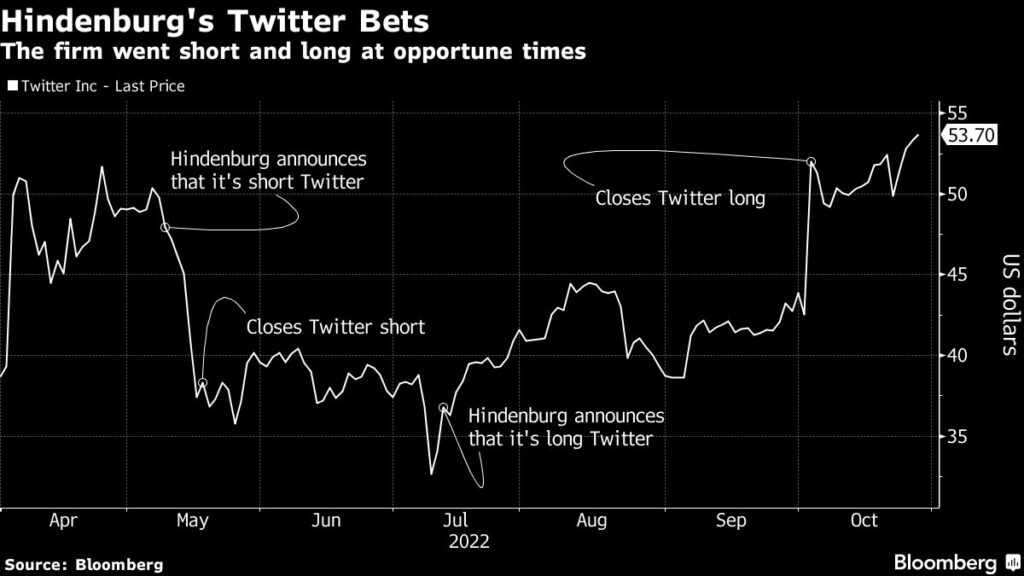

Twitter: First Quick, Then Lengthy

-

Hindenburg additionally made bets on each a decline and enhance in Twitter’s inventory because it went via dizzying swings earlier than Elon Musk closed his acquisition of the corporate. Twitter dropped from $49.80 the session previous to Hindenburg saying its brief to $37.39 on Could 16. The next day, Anderson tweeted that Hindenburg had closed out of its place. In mid-July, when Twitter’s inventory worth was round its low level in the course of the Musk deal saga, Hindenburg introduced that it had taken what it referred to as a major lengthy place.

Focusing on the SPACs

-

DraftKings Inc. and Clover Well being Investments Corp. had been a few of Anderson’s high-profile bets in opposition to companies that went public through special-purpose acquisition corporations. The brief vendor mentioned in June 2021 that insiders at DraftKings made earnings on the deal announcement with a blank-check agency, amongst different allegations. The inventory has fallen greater than 70% since then. The sports-betting firm, which denied wrongdoing, obtained a subpoena from the US Securities and Alternate Fee in July 2021 searching for paperwork regarding these allegations.

-

Clover Well being, backed by enterprise capitalist and SPAC mogul Chamath Palihapitiya, has fallen greater than 90% since Hindenburg printed a report in February 2021 alleging the corporate had misled traders. The SEC started an investigation after the report, which the corporate mentioned was stuffed with inaccuracies.

Listed below are some shares on which Hindenburg issued short-seller analysis studies since 2020:

–With help from P R Sanjai, Jan-Patrick Barnert, Ksenia Galouchko and Abhishek Vishnoi.

(Updates so as to add background on Hindenburg brief positions)

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.