Apple (NASDAQ:AAPL), one of many largest producers of high-tech gadgets on this planet, has confronted scrutiny for failing to launch a blockbuster product lately. The Apple Imaginative and prescient Professional, the corporate’s first digital actuality headset, is extensively seen as a possible silver lining that would change into the largest product launch since AirPods.

The Apple Imaginative and prescient Professional might be obtainable for buy within the U.S. beginning on February 2, and the corporate is but to announce a global launch date. Though I’m starting to be optimistic about what’s in retailer for Apple this yr, I’m impartial on AAPL inventory, nonetheless.

Trying Past Encouraging Demand Tendencies

The Apple Imaginative and prescient Professional has been obtainable for pre-order since January 19, beginning at a worth of $3,499 for the 256 GB model. For comparability, Oculus Quest 3, the most recent AR headset developed and bought by Meta Platforms, Inc. (NASDAQ:META), begins at $499 for the 128 GB model. The hefty worth of the Apple Imaginative and prescient Professional raised issues when the product was unveiled final June, however information from the primary weekend of pre-order availability suggests robust preliminary demand.

In line with common Apple analyst Ming-Chi Kuo, Apple bought between 160,000 and 180,000 Imaginative and prescient Professional items throughout the first pre-order weekend, which suggests the gadget was bought out, as anticipated, throughout the first weekend itself. Because the analyst noticed and reported, anticipated delivery instances for all Imaginative and prescient Professional gadgets prolonged to 5 to seven weeks instantly after pre-ordering was enabled – a transparent indication that the Imaginative and prescient Professional was bought out.

There may be, nonetheless, a serious distinction between blockbuster iPhone fashions and the Imaginative and prescient Professional. Sometimes, iPhones see a gradual rise in delivery instances for at the very least 48 hours after the provision of pre-ordering, however Imaginative and prescient Professional delivery instances remained regular within the first 48 hours after the preliminary burst. This, in accordance with analyst Ming-Chi Kuo, serves as a warning signal.

Apple has a cult-like follower base that strains as much as buy new gadgets as and when they’re launched. A blockbuster product is not going to solely entice this robust follower base however may even enchantment to the lots. The waning demand for the Imaginative and prescient Professional after an preliminary burst suggests the VR headsets are but to draw mass tech customers.

The AR/VR Market Has Room for Disruption

Empirical proof means that Apple has been wildly profitable in aggressively gaining market share in varied client tech niches reminiscent of smartphones, private computer systems, and sensible watches regardless of not having fun with first-mover benefits in any of those markets. Apple’s success stems from the corporate’s confirmed means to develop interesting tech merchandise based mostly on a deep understanding of client preferences.

Right now, the AR/VR headset market is at an toddler stage, with IDC projecting simply 8.1 million AR/VR gadget shipments in 2023. In line with Counterpoint Analysis, Meta dominated this market within the third quarter of 2023, accounting for 49% of all gadget shipments. Counterpoint information reveals that headset shipments plummeted by 29% year-over-year in Q3 as a result of an absence of compelling headset launches.

The comparatively small measurement of the AR/VR headset market leaves ample room for disruption, and Apple has a status for efficiently exploiting related alternatives in different market segments.

Apple’s Scale Downside

Apple has grown in leaps and bounds because the first-ever iPhone was launched in 2007. The huge measurement and scale of the corporate, nonetheless, has made it tough for Apple to satisfy Wall Road’s progress expectations lately. For context, in Fiscal 2023, whole income declined shut to three% year-over-year to $383 billion, whereas web earnings additionally declined by 2.8%.

The issue with Apple’s large scale is that it takes a wildly profitable product to maneuver the needle for the corporate from a monetary efficiency perspective. In 2024, Apple expects to promote 500,000 Imaginative and prescient Professional items, bringing in income of at the very least $1.75 billion. This will likely appear to be an encouraging determine in isolation, however compared to the just about $400 billion in income Apple is projected to usher in this yr, Imaginative and prescient Professional gross sales appear trivial.

Even when Apple sells double the projected Imaginative and prescient Professional items for 2024, this phase will nonetheless account for lower than 1% of whole firm gross sales this yr. Going by this understanding, it appears truthful to conclude that Imaginative and prescient Professional will fail to meaningfully impression Apple’s fundamentals within the foreseeable future.

The extremely anticipated VR headset, nonetheless, has the potential to enhance the market sentiment towards Apple and confirm the corporate’s place as a dominant tech innovator if unit gross sales exceed Wall Road expectations this yr.

Is Apple Inventory a Purchase, In line with Wall Road Analysts?

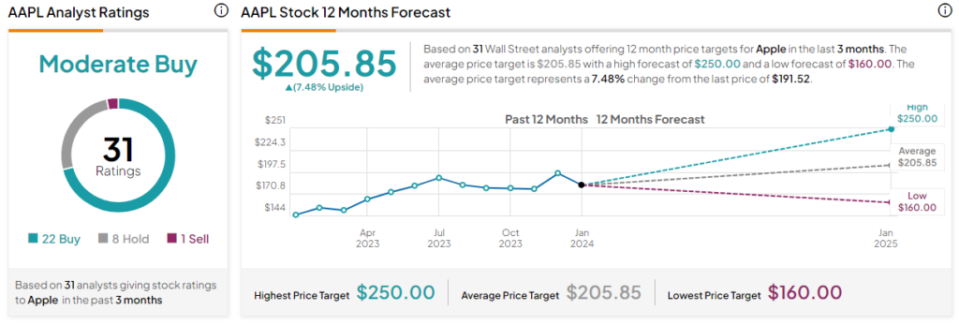

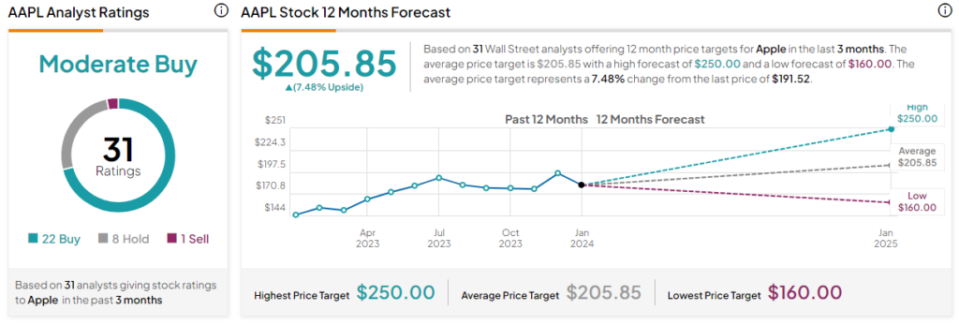

Apple is likely one of the most adopted corporations available in the market. Not surprisingly, Wall Road analysts are sometimes divided about Apple’s prospects, however they’re at present bullish total. The inventory earns a Average Purchase consensus score based mostly on 22 Buys, eight Holds, and one Promote assigned previously three months. Right here’s what some analysts have mentioned about Apple.

On January 18, Financial institution of America Securities upgraded Apple and raised the inventory’s worth goal from $208 to $225, citing the corporate’s promising AI product roadmap, amongst different bullish developments such because the improved outlook for the providers phase. BofA additionally claimed that Imaginative and prescient Professional gross sales may finally surpass iPad income in the long term, with VR going mainstream.

On January 23, Financial institution of America (NYSE:BAC) added Apple to its US 1 record, which is a set of the financial institution’s greatest funding concepts.

Morgan Stanley (NYSE:MS), in its Weekly Heat-Up Report, revealed on January 22, recognized Apple as one of many high high-quality progress shares within the U.S. amongst 56 different corporations which might be seemingly well-positioned to ship alpha returns this yr.

Final week, Piper Sandler highlighted Apple as the threerd most tasty pick of Magnificent 7 shares, behind Alphabet Inc. (NASDAQ:GOOG)(NASDAQ:GOOGL) and Meta Platforms.

General, based mostly on the rankings of 31 Wall Road analysts, the typical Apple inventory worth goal is $205.85, which suggests upside of seven.5% from the present market worth.

The Takeaway: Imaginative and prescient Professional is Thrilling, Apple’s Valuation Is Not

Apple is heading into thrilling days, with the primary batch of Imaginative and prescient Professional items anticipated to be shipped out within the coming weeks. Though the Imaginative and prescient Professional might not have a robust impression on Apple’s earnings this yr, the market might reward Apple handsomely if the gadget attracts tech bulls and constructive critiques from tech lovers. Apple, nonetheless, appears to be like expensively valued at a ahead P/E of 29 in comparison with its five-year common of 25.

Disclosure