If any Wall Avenue-listed firm represents the ups and downs of China’s economic system, it might be Alibaba (NYSE:BABA). You might be able to load up on Alibaba shares proper now, particularly for those who’re optimistic that China will flip a nook this yr. For the very long run, I’m bullish on BABA inventory, however as we speak, I’m offering a cautionary notice because of an imminent make-or-break occasion.

Alibaba is mainly the Chinese language counterpart to America’s Amazon (NASDAQ:AMZN). Like Amazon within the U.S., Alibaba is an e-commerce big in China that can also be profitable in market niches outdoors of e-commerce.

Possibly China is on the cusp of an financial comeback of epic proportions; it’s laborious to know for certain. However, if Alibaba posts constructive numbers and offers encouraging steering in an upcoming earnings report, the bull case for BABA inventory may very well be virtually unassailable.

Is Alibaba Inventory Too Low cost to Ignore?

Initially, I ought to tackle an eyebrow-raising remark made by a extremely revered analyst agency. Particularly, Barclays (NYSE:BCS) analysts reportedly went as far as to declare that Alibaba inventory is “too low cost to disregard.”

Definitely, it’s laborious to argue with the “low cost” designation. Whereas American expertise shares soared final yr, BABA inventory foundered like a sinking ship. Therefore, for those who actually consider in shopping for low and promoting excessive, investing in Alibaba ought to make excellent sense.

Making use of conventional valuation metrics appears to help this level. Alibaba’s GAAP trailing 12-month price-to-earnings (P/E) ratio of 10.6x is undoubtedly extra interesting than the sector median P/E ratio of 17.51x.

Barclays analyst Jiong Shao additionally thought of Alibaba’s valuation. Observing that Alibaba has generated $27 billion in free money movement within the final 12 months, Shao assessed Alibaba’s valuation as “among the many most compelling.” Moreover, Shao believes that BABA inventory “screens as the most cost effective main tech inventory globally” and assigned it an Chubby ranking.

In case that’s not sufficient motivation for you, right here’s one other piece of notable information. Apparently, there’s been some severe insider shopping for happening at Alibaba. Particularly, Alibaba co-founder Jack Ma reportedly bought $50 million value of the corporate’s shares.

Not solely that, however Alibaba Chairman reportedly purchased $151 million value of BABA inventory shares in final yr’s fourth quarter. That’s a certain signal of confidence amongst two Alibaba insiders with deep data concerning the firm.

Merchants are Excited About Alibaba, however be Cautious Now

Pleasure over Chinese language tech-related shares constructing, however does this imply you must put money into Alibaba proper now? Not essentially, as ready may very well be essentially the most prudent coverage.

The thrill isn’t restricted to Alibaba however actually pertains to Chinese language companies typically. That’s as a result of China’s central financial institution plans so as to add $139 billion value of long-term liquidity to the nation’s economic system by lowering the money reserve ratio for banks. Furthermore, Chinese language authorities are reportedly an enormous $278 billion rescue/bailout/stabilization bundle.

Consequently, inventory merchants lately devoured up shares of Alibaba inventory and different China-associated tech shares. Thus, within the quick time period, it is likely to be claimed that the forceful measures of China’s central financial institution have been profitable.

However, it’s too early to easily declare victory and assume that Chinese language shares will proceed increased all year long. Authorities intervention within the economic system and markets isn’t all the time the best resolution to a crashing inventory market. As an example, you could recall the time when Chinese language authorities restricted quick promoting with a purpose to prop up the nation’s inventory market. This tactic didn’t work nicely in the long term.

Whether or not China’s authorities intervention succeeds in supporting the nation’s economic system and markets stays to be seen. One might actually argue that the U.S. inventory market has benefited at any time when the Federal Reserve pumped liquidity into the banking system. So, possibly this technique will work in China, with constructive ramifications for Alibaba.

That mentioned, it’s in all probability not a super time to leap proper into BABA inventory. Alibaba has a crucially vital earnings report arising on January 31. It will be fairly disappointing if the corporate breaks its wonderful monitor document of consecutive EPS forecast beats.

The stakes are excessive, and so are the expectations. Wall Avenue anticipates that Alibaba will report EPS of $2.73 for the third quarter of Fiscal 12 months 2024. That’s increased than any quarterly EPS forecast in current historical past for Alibaba. May a serious letdown be in retailer?

Is BABA Inventory a Purchase, In response to Analysts?

On TipRanks, BABA is available in as a Robust Purchase based mostly on 18 Buys and two Maintain rankings assigned by analysts up to now three months. The typical Alibaba inventory worth goal is $118.60, implying % upside potential.

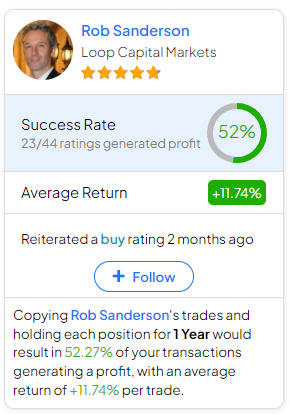

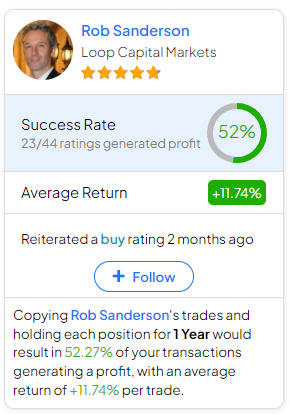

If you happen to’re questioning which analyst it is best to comply with if you wish to purchase and promote BABA inventory, essentially the most worthwhile analyst overlaying the inventory (on a one-year timeframe) is Rob Sanderson of Loop Capital Markets, with a mean return of 11.74% per ranking and a 52% success price. Click on on the picture under to be taught extra.

Conclusion: Ought to You Think about BABA Inventory?

I’m bullish on Alibaba’s development prospects, however just for the very long run. For the quick time period, there’s uncertainty concerning China’s intervention in addition to Alibaba’s imminent earnings outcomes. Subsequently, I really feel that ready for a short time longer is a wise coverage. Even when Alibaba has the potential to stage an epic comeback in 2024, proper now, I’m not prepared to contemplate a share place in BABA inventory.

Disclosure