NEW YORK, March 24 (Reuters) – Traders are counting on an previous technique to navigate the present tumult in asset costs: shopping for shares of the large U.S. firms that led markets greater for years.

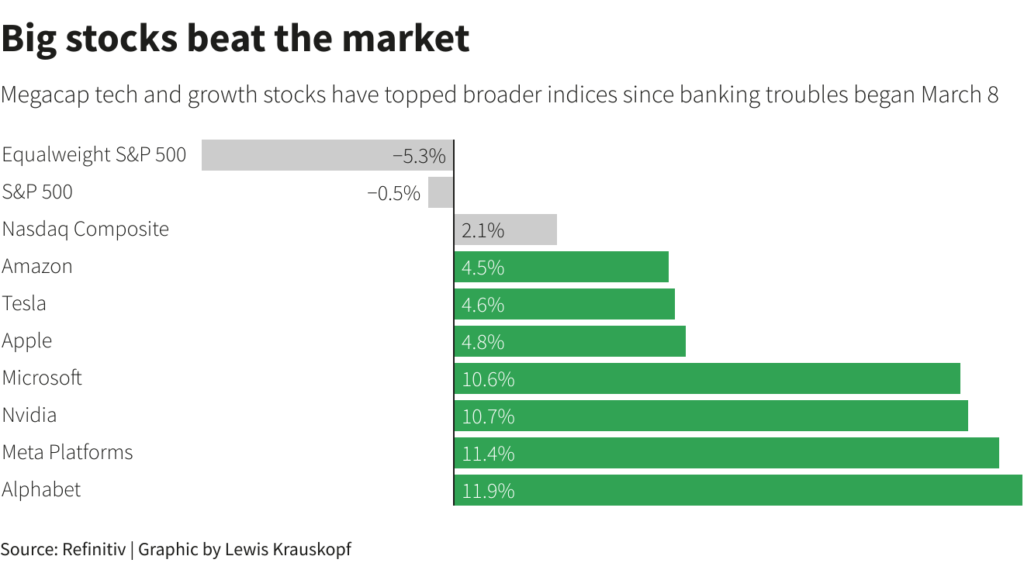

Shares of the highest 5 firms by market worth — Apple (AAPL.O), Microsoft (MSFT.O), Alphabet (GOOGL.O), Amazon (AMZN.O) and Nvidia (NVDA.O) — have gained between 4.5% and 12% since March 8, when troubles at Silicon Valley Financial institution set off banking system worries. In that interval, the S&P 500 has fallen 0.5%.

Megagaps are attracting bets due to sturdy stability sheets, strong revenue margins and enterprise fashions anticipated to carry up higher if recession hits, traders mentioned. A current pullback in U.S. bond yields, whose ascent punished development shares final 12 months, can also be buoying their costs in 2023.

However their power may have drawbacks. Megacaps’ rising market capitalization means indexes such because the S&P 500 are more and more pushed by a smaller cluster of shares. That would spur volatility in broader markets if circumstances change and traders make a fast exit from huge tech and development names.

“The view from traders is that know-how firms are in a greater place to get by an unsure time frame,” mentioned Keith Lerner, co-chief funding officer at Truist Advisory Providers, which is chubby the tech sector. Nevertheless, “when you’ve crowding you possibly can see a pointy reversal out of nowhere as a result of everyone seems to be in the identical space.”

Power in megacaps additionally cloaks weak spot elsewhere. Measures of market breadth have turned extra unfavorable, whereas the equal-weighted S&P 500 (.SPXEW), a proxy for the common inventory within the benchmark index, is down over 5% since March.

Traders are bracing for extra banking sector volatility subsequent week, after sharp declines in shares of European giants Deutsche Financial institution and UBS on Friday adopted the collapse of Silicon Valley Financial institution and Signature Financial institution earlier this month. Upcoming U.S. knowledge on client confidence and inflation may additionally sway markets.

Megacaps led the U.S. market within the decade following the monetary disaster and spearheaded Wall Road’s blistering rebound after the selloff in early 2020 fueled by the coronavirus pandemic. However they tumbled final 12 months, because the Federal Reserve raised rates of interest to combat 40-year excessive inflation.

Their rebound this 12 months accelerated as issues over the banking system spiked, and the mixed weight of Apple and Microsoft within the S&P 500 just lately topped 13%. That was the very best in over 30 years for any high two shares within the index, based on Todd Sohn, technical strategist at Strategas.

The burden of the highest 5 S&P 500 firms has rebounded to 21.7% from 18.8% for the highest 5 shares on the finish of 2022.

As megacaps have rallied, some indicators of breadth, which technical analysts view as gauges of broad market well being, have darkened just lately.

The variety of new 52-week lows on the New York Inventory Trade and Nasdaq was on tempo to eclipse new highs for 3 straight weeks, a reversal after new highs had topped new lows nearly each week to begin 2023, based on Willie Delwiche, funding strategist at Hello Mount Analysis.

Additional, the proportion of business teams tracked by Delwiche above their 10-week transferring averages has plummeted from 87% in early February to 7% within the newest week.

“After some hopeful indicators earlier this 12 months, it’s proof that the sample of weak spot beneath the floor that we noticed final 12 months is re-emerging,” Delwiche mentioned. “We have to see higher participation if the indexes are going to have the ability to maintain the subsequent leg greater.”

The efficiency of megacaps may endure if banking worries ease and traders scoop up economically delicate shares which have struggled. The S&P 500 power sector (.SPNY) is down 7.5% since March 8, whereas the industrials sector (.SPLRCI) is off 5%.

A rebound in U.S. bond yields may strain tech and development shares. Earnings development within the tech sector, in the meantime, is anticipated to path the general S&P 500 in 2023.

However, some traders are bullish on megacap shares.

Regardless of final 12 months’s market swoon, “our bias has been that we predict we’re nonetheless in … an up development,” mentioned Thomas Martin, senior portfolio supervisor at GLOBALT Investments, who’s chubby many megacaps.

In flip, he mentioned, that probably means “the big-cap development shares would be the ones who lead from right here.”

Reporting by Lewis Krauskopf; Enhancing by Ira Iosebashvili and David Gregorio

: .