(Bloomberg) — The bond market lastly bought the Federal Reserve’s message on charges, whereas inventory buyers proceed to disregard it, for probably the most half.

Most Learn from Bloomberg

Whereas the temper music soured within the latter half of the week, equities are nonetheless largely defying the one factor that has repeatedly proved kryptonite in previous rallies: Surging rates of interest.

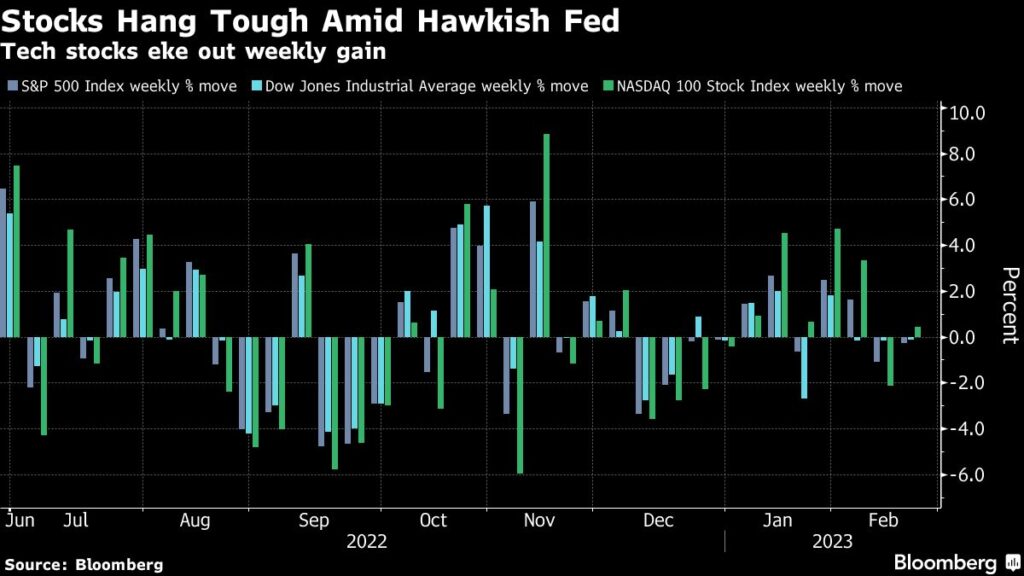

With a slew of Fed officers threatening to ramp up charge hikes after still-hot financial information, Treasury yields broke out anew and merchants raised their expectations for the way excessive the benchmark charge will go. But the S&P 500 completed the week decrease by simply 0.3%, and the Nasdaq 100 eked out a 0.4% acquire as still-loose monetary circumstances bely the most-aggressive coverage tightening marketing campaign in a technology.

The brutal repricing within the two-year Treasury observe would suggest a 5% to 10% hunch within the Nasdaq 100 and extra for unstable tech equities, if previous market strikes are something to go by, in line with JPMorgan Chase & Co.’s Marko Kolanovic.

Nevertheless, still-resilient equities have diverged from contemporary bond losses, a doubtlessly unsustainable improvement.

That would imply dangerous information for hedge-fund managers who’ve snapped up tech shares over the previous two weeks, and bodes sick for balanced-portfolio methods which might be nonetheless reeling from final yr’s bond-stock crash.

“The important thing threat is that we’re coping with a little bit of a replay from final yr,” stated Christian Mueller-Glissmann, the pinnacle of asset allocation for portfolio technique at Goldman Sachs Group Inc. “When you have excessive inflation threat and excessive macro volatility, then each equities and bonds can go down collectively. And that’s the key concern for us after this bullish sentiment shift — that we may get one other 60/40 drawdown.”

To date, that’s been something however an issue.

Each property rallied to begin the yr earlier than surprisingly sturdy hiring information, housing numbers and retail gross sales, together with extra hawkish Fed commentary despatched Treasuries right into a tailspin this month. Shares, in the meantime, are primarily flat in February, holding onto positive aspects from the second-best January in twenty years.

“We’re not bullish on the stickiness of this as we don’t see any sort of Fed pivot” from charge hikes within the close to time period, Nicole Webb, senior vp and monetary advisor at Wealth Enhancement Group, stated on Bloomberg’s “What Goes Up” podcast.

That’s to not say cracks aren’t exhibiting within the fairness rally. The tech-heavy gauge ended the week with a two-day hunch of two.6%. And the riskiest a part of the credit score market confirmed minor indicators of misery. Each the iShares iBoxx Excessive Yield Company Bond ETF (ticker HYG) and the SPDR Bloomberg Excessive Yield Bond ETF (JNK) declined this week, and are every buying and selling under their 50-day transferring common traces.

Central bankers are thought to look askance on unbridled fairness positive aspects due to their potential to fan consumption and costs. Proper now, each shares and the economic system are buzzing alongside, usually a welcome pairing. An excessive amount of of a superb factor may show an issue ought to the cycle construct on itself, nevertheless. Notably if financial-market resilience involves be seen as one of many issues protecting customers from reining themselves in.

Inventory buyers have been betting on a Goldilocks-like state of affairs, with development remaining resilient and inflation cooling quick by the second half of the yr. Goldman’s Mueller-Glissmann says that’s probably incorrect. The financial institution’s economists say that the Fed can engineer a mushy touchdown, however additionally they assume that to get a deal with on inflation, development has to sluggish.

“If the Fed has to go additional to realize that, then it is going to occur. The market is pricing a no-landing — we undoubtedly take the opposite aspect on that as a result of it’s a bit too optimistic,” he stated.

Goldman recommends a defensive positioning for dangerous property, together with shopping for put choices and going obese money, whereas additionally adopting underweight positions in bonds as a consequence of expectations of upper charges.

“The market is mispricing each inflation and charges. The problem from right here is that we’re susceptible to disappointment each on development and inflation,” he stated.

–With help from Katie Greifeld.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.