This story was initially revealed on TKer.co

Shares kicked off the brand new yr on a constructive be aware, with the S&P 500 climbing 1.4% final week. The index is now up 8.9% from its October 12 closing low of three,577.03 and down 18.8% from its January 3, 2022 closing excessive of 4,796.56.

In the meantime, the market’s many bears received extra firm.

Michael Kantrowitz, the chief funding strategist at Piper Sandler, expects the S&P 500 to tumble to three,225 by yr finish, Bloomberg reported on Wednesday. This name makes him essentially the most bearish of Wall Road’s prime inventory market forecasters.

Byron Wien, the legendary former chief funding strategist at Morgan Stanley and present vice chairman at Blackstone, warned on Wednesday that monetary markets might slide through the first half of the yr earlier than rallying once more.

“Regardless of Fed tightening, the market reaches a backside by mid-year and begins a restoration corresponding to 2009,“ Wien wrote.

Will the bears be confirmed proper this yr? Perhaps.

However the truth that a lot of Wall Road is bearish may very well produce the other outcome.

“Wall Road is bearish,” Savita Subramanian, head of U.S. fairness technique at BofA, wrote on Wednesday. “That is bullish.“

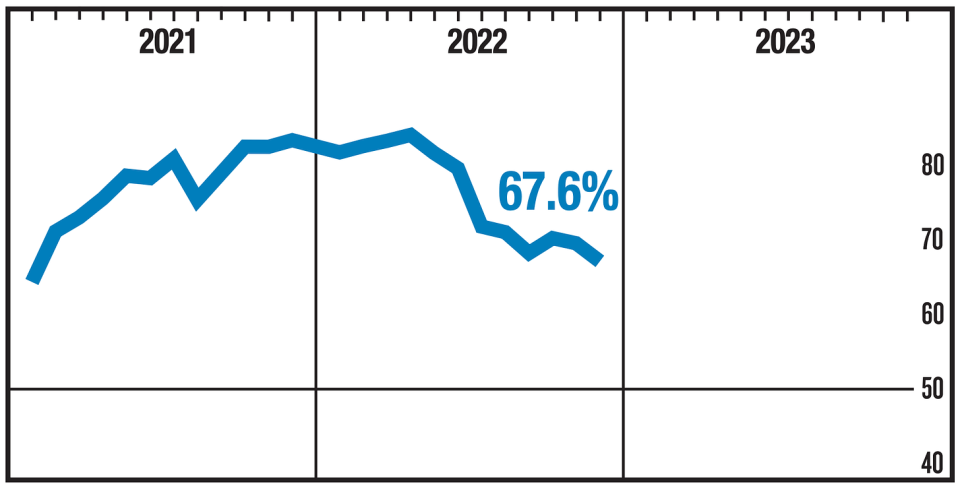

Subramanian was referring to the contrarian sign from BofA’s proprietary “Promote Facet Indicator,” which tracks common really helpful allocation to shares by U.S. sell-side strategists. Whereas it doesn’t at present mirror “excessive bearishness,” it’s at a stage that “suggests an anticipated worth return of +16% over the following 12 months (~4400 for the S&P 500).”

Subramanian’s official goal for the S&P 500 is 4,000, which is on the bearish finish of Wall Road. Although she has warned towards being out of the market at a time when the consensus expects decrease costs.

Going into 2022, Wall Road was caught wrong-footed by being too bullish forward of what grew to become a historic bear market.

Will the consensus be proper this time with their bearishness?

We’ll solely know in hindsight.

We do nevertheless know that the inventory market goes up in most years.

And long term traders ought to bear in mind the chances of producing a constructive return improves for individuals who can put within the time.

Reviewing the macro crosscurrents 🔀

There have been a number of notable information factors from final week to contemplate:

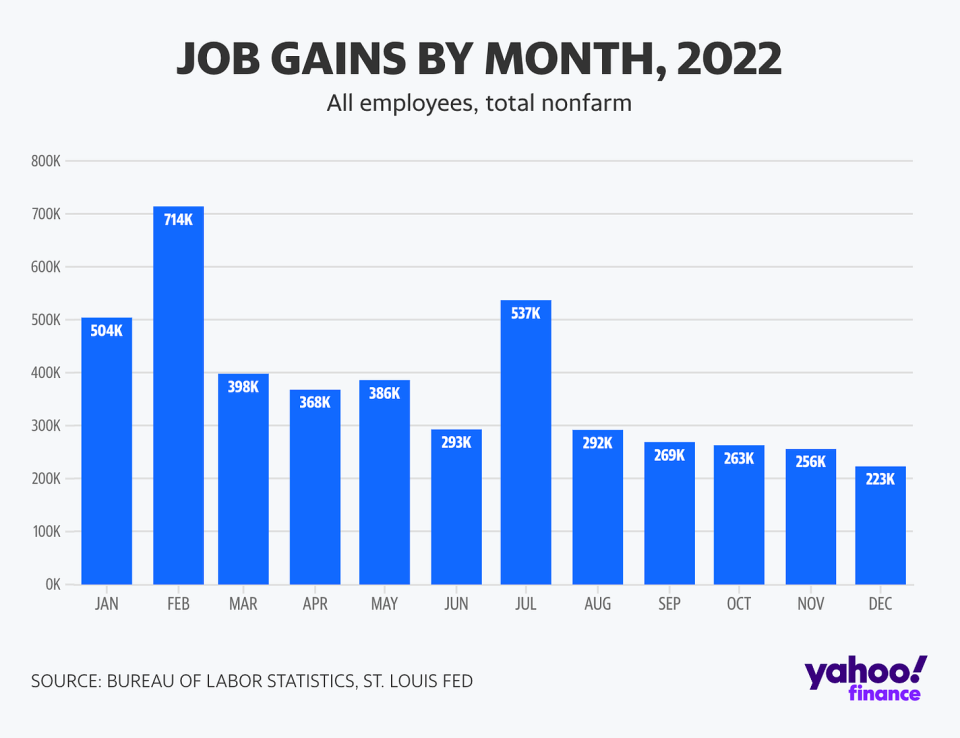

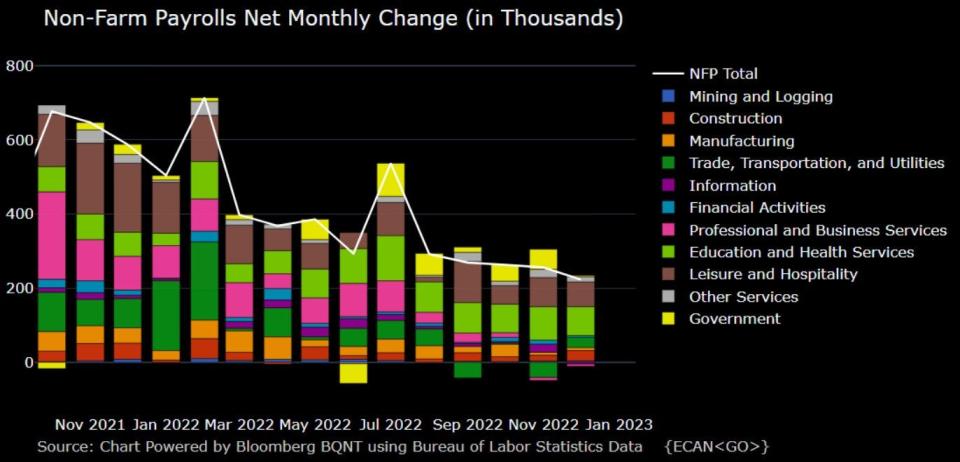

🚨 Job progress. In response to BLS information launched Friday, U.S. employers added 223,000 jobs in December, stronger than the 203,000 acquire economists anticipated. Over the course of 2022, employers added a whopping 4.5 million jobs.

Nearly all main business classes reported features. The knowledge sector, which incorporates the tech business, noticed job losses. For extra context on these losses, learn: “Do not be misled by no-context experiences of huge tech layoffs 🤨“

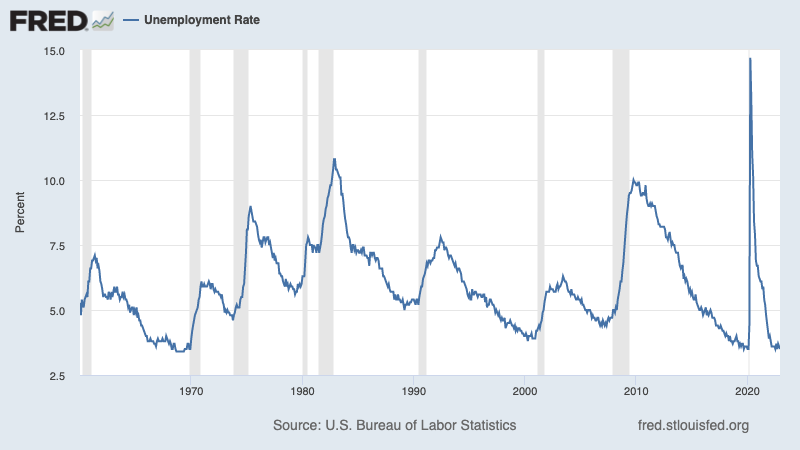

📉Unemployment price tumbles. The unemployment price fell to three.5% (or 3.468% unrounded) from 3.6% within the prior month. That is the bottom price since 1969.

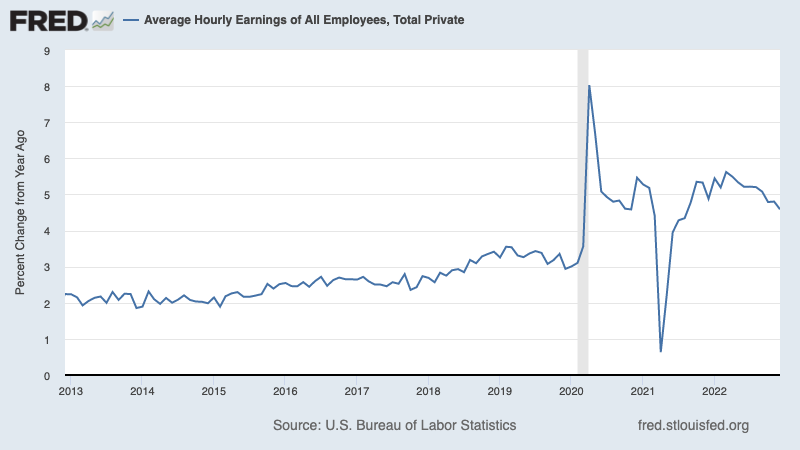

💰 Wage progress cools. Common hourly earnings in December elevated by 0.3% month-over-month, cooler than the 0.4% price anticipated. On a year-over-year foundation, common hourly earnings have been up 4.6%, which was decrease than the 5.0% anticipated. For extra on why this issues, learn: “A key chart to observe because the Fed tightens financial coverage 📊“

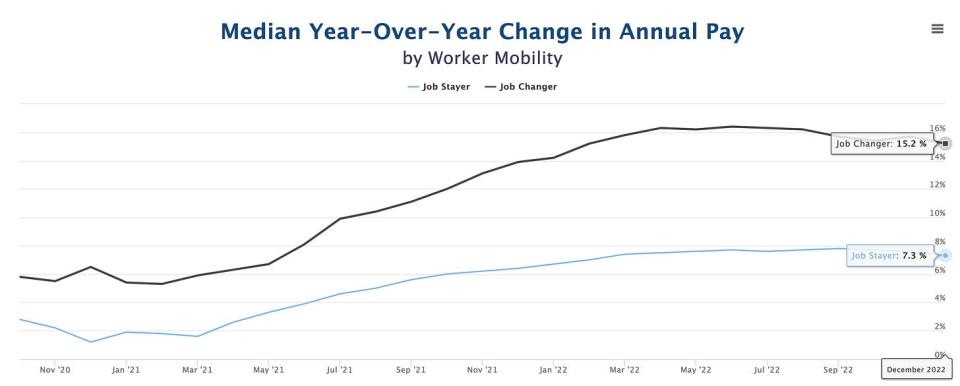

📈 Job switchers get higher pay. In response to ADP, which tracks personal payrolls and employs a unique methodology than the BLS, annual pay progress in December for individuals who modified jobs was up 15.2% from a yr in the past. For many who stayed at their job, pay progress was 7.3%.

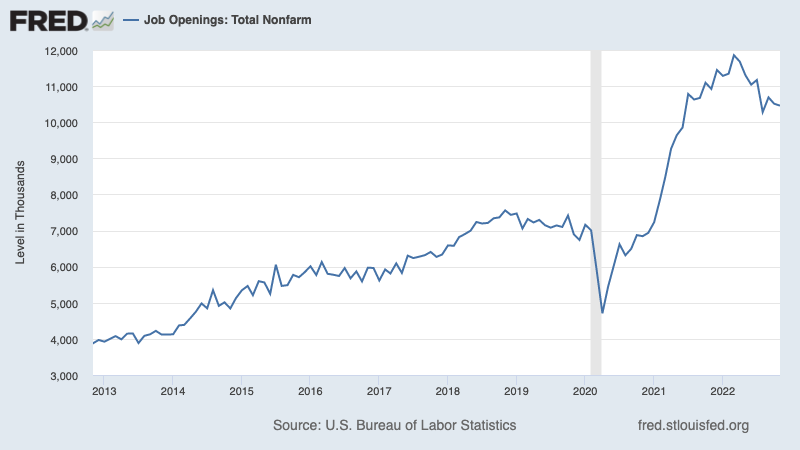

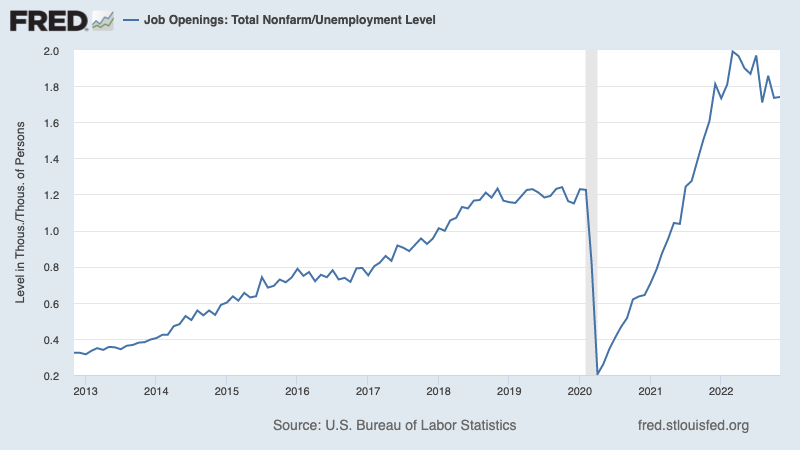

👍 There are many job openings. In response to BLS information launched Wednesday, U.S. employers had 10.46 million job openings listed in November, down modestly from 10.51 million openings in October. Whereas openings are beneath the report excessive of 11.85 million in March, they continue to be nicely above pre-pandemic ranges.

Throughout the interval, there have been 6.01 million folks unemployed. Which means there have been 1.74 job openings per unemployed individual in November. That is down from 1.99 in March, nevertheless it nonetheless suggests there are many alternatives on the market for job seekers.

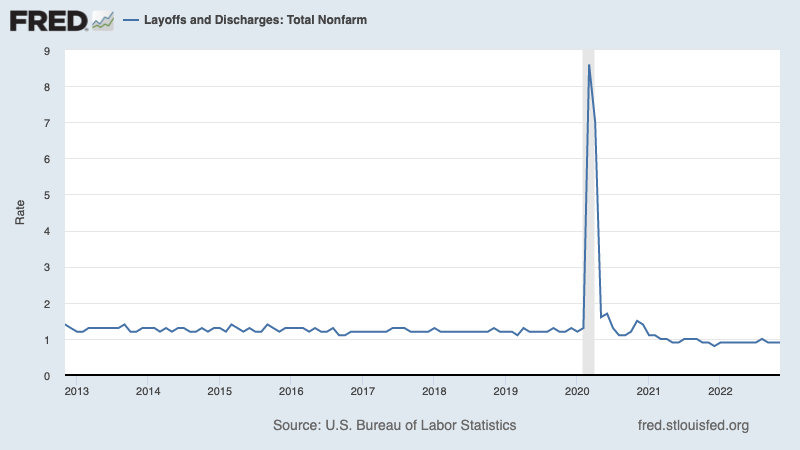

👍 Layoff exercise is low. The layoff price (i.e., layoffs as a proportion of complete employment) stood at 0.9% in November, unchanged from its October stage. It was the twenty first straight month the speed was beneath its pre-pandemic lows.

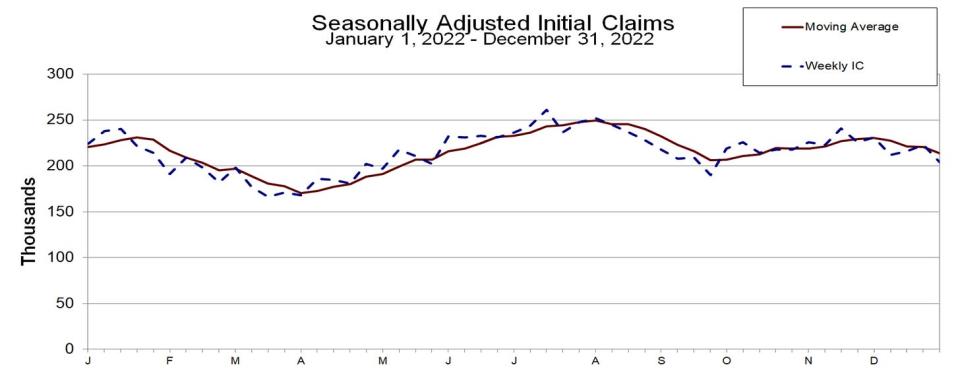

💼 Unemployment claims stay low. Preliminary claims for unemployment advantages fell to a three-month low of 204,000 through the week ending Dec. 31, down from 223,000 the week prior. Whereas the quantity is up from its six-decade low of 166,000 in March, it stays close to ranges seen in periods of financial enlargement.

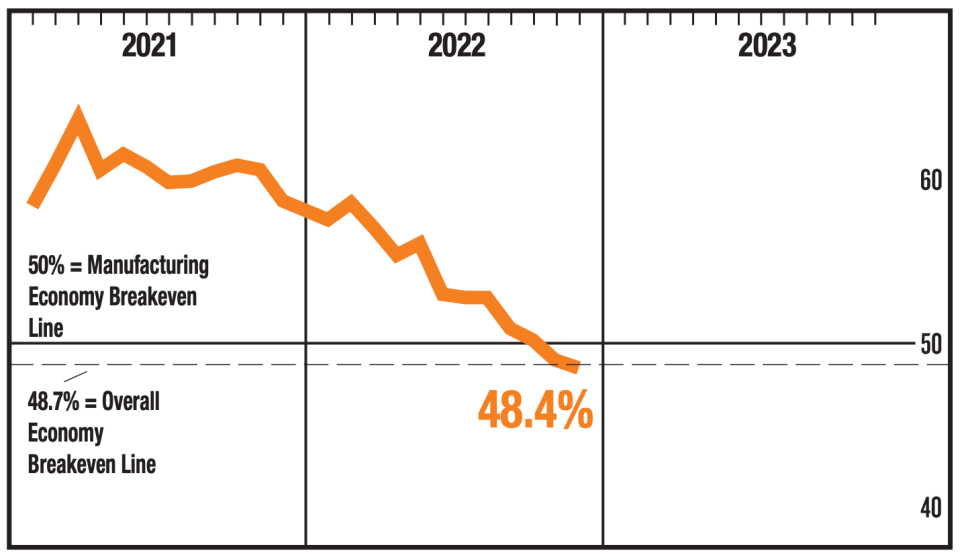

🛠 Manufacturing cools. The ISM’s Manufacturing PMI fell to 48.4 in December from 49.0 in November. A studying beneath 50 alerts contraction within the sector.

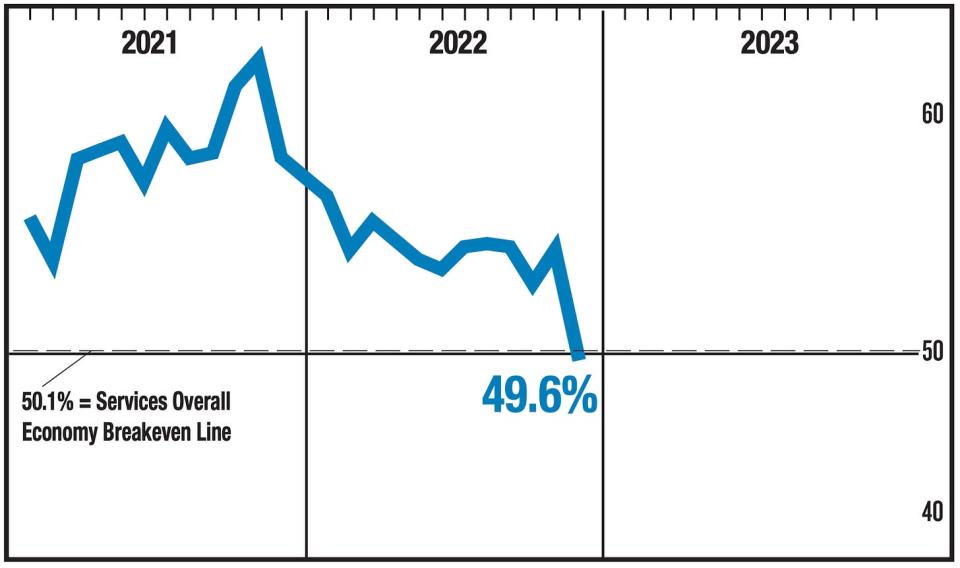

📉 Providers cool. The ISM’s Providers PMI fell to 49.6 in December from 56.5 in November. A studying beneath 50 alerts contraction within the sector.

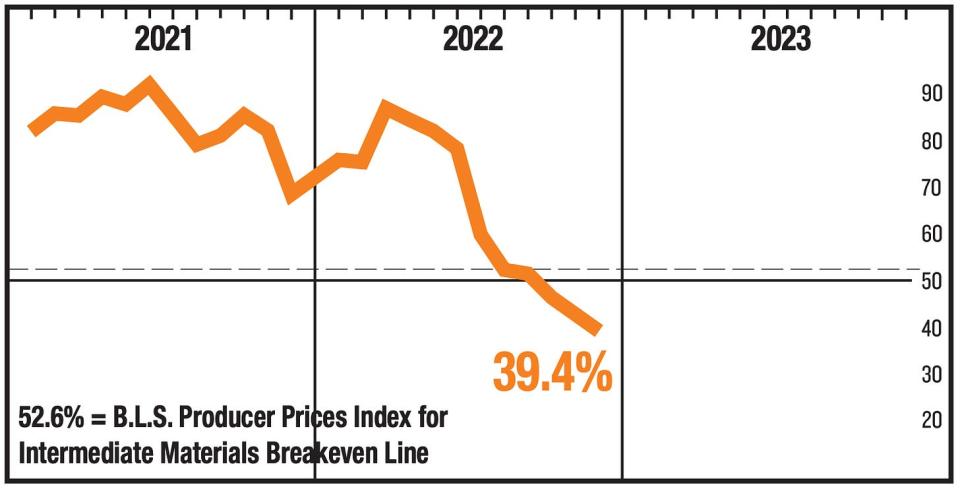

📉 Surveys say costs are cooling. ISM Manufacturing PMI Costs Index fell deeper into contraction.

The ISM Providers PMI Costs Index suggests costs are nonetheless rising, however at a decelerating price.

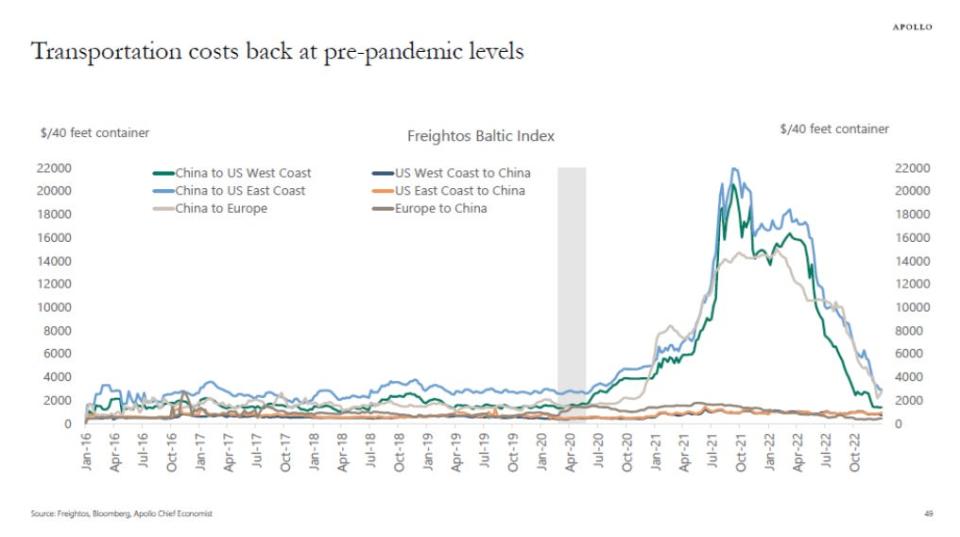

⛓️ “Provide chains are again to regular.” From Apollo World’s chief economist Torsten Slok: “Provide chains are again to regular, and the value of transporting a 40-feet container from China to the US West Coast has declined from $20,000 in September 2021 to $1,382 right now, see chart beneath. This normalization in transportation prices is a big drag on items inflation over the approaching months.“

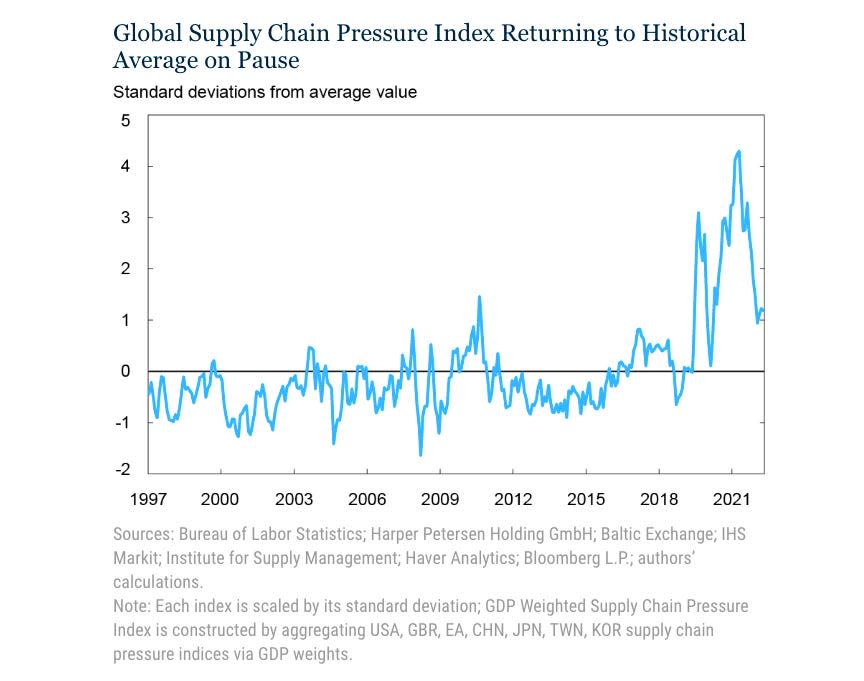

The New York Fed’s World Provide Chain Strain Index — a composite of assorted provide chain indicators — declined barely in December and is hovering at ranges seen in late 2020. From the NY Fed: “World provide chain pressures decreased reasonably in December, disrupting the upward development seen over the earlier two months. The most important contributing components to provide chain pressures have been rises in Korean supply instances and Taiwanese inventories, however these have been greater than offset by smaller adverse contributions over a bigger set of things.“

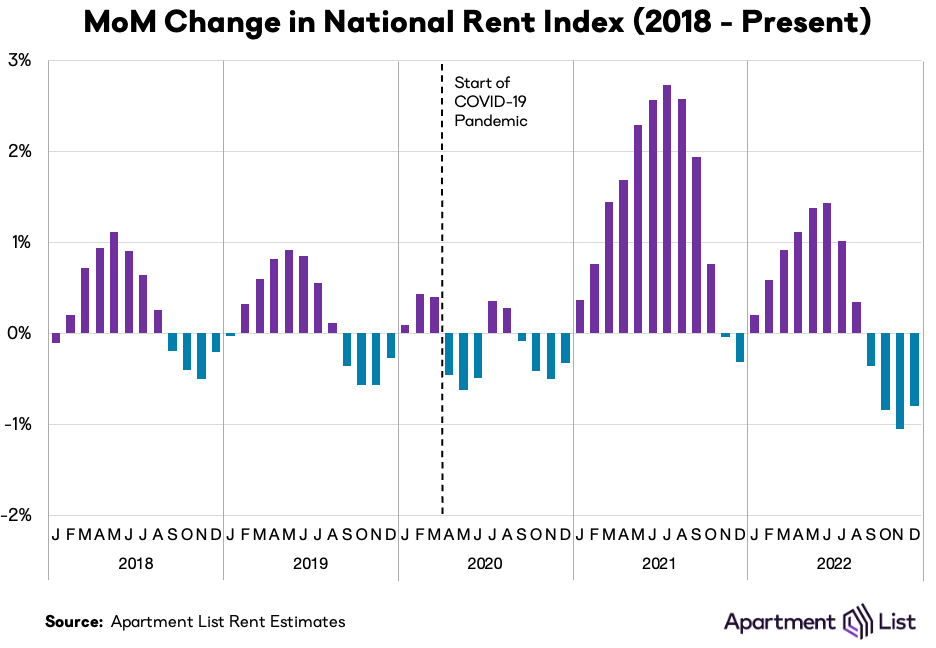

📉 Rents are down. From Residence Checklist: “We estimate that the nationwide median hire fell by 0.8 % month-over-month in December. That is the fourth consecutive month-to-month decline, and the third largest month-to-month decline within the historical past of our estimates, which begin in January 2017. The previous two months (October and November 2022) are the one two months with sharper declines.“

➕ No extra adverse yielding debt. From Bloomberg: “The world’s pile of negative-yielding debt has vanished, as Japanese bonds lastly joined world friends in providing zero or constructive earnings. The worldwide inventory of bonds the place traders acquired sub-zero yields peaked at $18.4 trillion in late 2020, in accordance with Bloomberg’s World Combination Index of the debt, when central banks worldwide have been maintaining charges at or beneath zero and shopping for bonds to make sure yields have been repressed.“

Placing all of it collectively 🤔

Inflation is cooling from peak ranges. However, inflation stays excessive and should cool by much more earlier than anybody is comfy with worth ranges. So we must always anticipate the Federal Reserve to proceed to tighten financial coverage, which implies tighter monetary situations (e.g. greater rates of interest, tighter lending requirements, and decrease inventory valuations). All of this implies the market beatings will proceed and the danger the economic system sinks right into a recession will intensify.

However it’s vital to do not forget that whereas recession dangers are elevated, shoppers are coming from a really robust monetary place. Unemployed persons are getting jobs. These with jobs are getting raises. And lots of nonetheless have extra financial savings to faucet into. Certainly, robust spending information confirms this monetary resilience. So it’s too early to sound the alarm from a consumption perspective.

At this level, any downturn is unlikely to show into financial calamity provided that the monetary well being of shoppers and companies stays very robust.

As at all times, long-term traders ought to do not forget that recessions and bear markets are simply a part of the deal whenever you enter the inventory market with the purpose of producing long-term returns. Whereas markets have had a horrible yr, the long-run outlook for shares stays constructive.

For extra on how the macro story is evolving, try the earlier TKer macro crosscurrents »

For extra on why that is an unusually unfavorable setting for the inventory market, learn “The market beatings will proceed till inflation improves 🥊“ »

For a more in-depth have a look at the place we’re and the way we received right here, learn “The sophisticated mess of the markets and economic system, defined 🧩”

This story was initially revealed on TKer.co

Sam Ro is the founding father of TKer.co. Comply with him on Twitter at @SamRo

Click on right here for the most recent inventory market information and in-depth evaluation, together with occasions that transfer shares

Learn the most recent monetary and enterprise information from Yahoo Finance

Obtain the Yahoo Finance app for Apple or Android

Comply with Yahoo Finance on Twitter, Fb, Instagram, Flipboard, LinkedIn, and YouTube