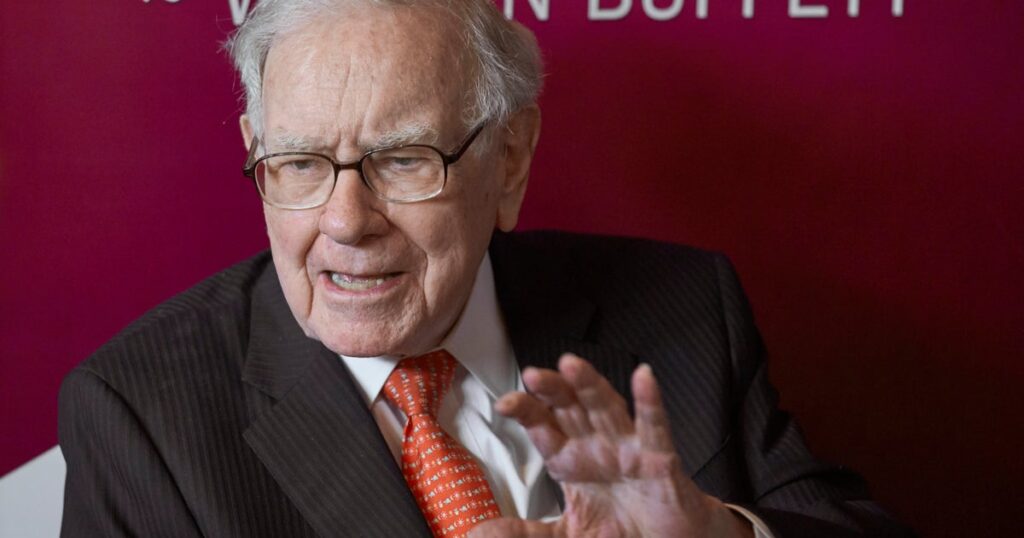

OMAHA, Neb. (AP) — Revered investor Warren Buffett shocked an area stuffed with his shareholders Saturday by saying that he needs to retire on the finish of the 12 months.

Buffett stated he’ll suggest to Berkshire Hathaway’s board Sunday that Greg Abel ought to turn out to be CEO on the finish of the 12 months.

“I believe the time has arrived the place Greg ought to turn out to be the chief govt officer of the corporate at 12 months finish,” Buffett stated.

Abel has been Buffett’s designated successor for years, and he already manages all of Berkshire’s noninsurance companies. However it was at all times assumed he wouldn’t take over till after Buffett’s dying. Beforehand, the 94-year-old Buffett has at all times stated he has no plans to retire.

Buffett introduced the information on the finish of a five-hour query and reply interval and didn’t take any questions on it. He stated the one board members who knew this was coming had been his two youngsters, Howard and Susie Buffett. Abel, who was sitting subsequent to Buffett on stage, had no warning.

Abel returned to the stage an hour later with out Buffett to conduct the corporate’s formal enterprise assembly, and he responded to the information.

“I simply wish to say I couldn’t be extra humbled and honored to be a part of Berkshire as we go ahead,” Abel stated.

Many buyers have stated they imagine Abel will do job working Berkshire, however it stays to be seen how good he can be at investing Berkshire’s money. Buffett additionally endorsed him Saturday by pledging to maintain his fortune invested within the firm.

“I’ve no intention — zero — of promoting one share of Berkshire Hathaway. I’ll give it away ultimately,” Buffett stated. “The choice to maintain each share is an financial determination as a result of I believe the prospects of Berkshire can be higher underneath Greg’s administration than mine.”

1000’s of buyers within the Omaha area gave Buffett a chronic standing ovation after his announcement in recognition of his 60 years main the corporate.

CFRA analysis analyst Cathy Seifert stated it needed to be exhausting for Buffett to achieve this determination to step down.

“This was in all probability a really powerful determination for him, however higher to go away by yourself phrases,” Seifert stated. “I believe there can be an effort at sustaining a ‘enterprise as normal’ surroundings at Berkshire. That’s nonetheless to be decided.”

Abel anticipated to do properly

In lots of respects, Abel has already been working a lot of the corporate for years. However he hasn’t been managing Berkshire’s insurance coverage operations or deciding the place to speculate all of its money. He’ll now take these duties on, however Vice Chairman Ajit Jain will stay to assist oversee the insurance coverage corporations.

Funding supervisor Omar Malik of Hosking Companions in London stated earlier than Buffett’s announcement that he wasn’t apprehensive about Berkshire’s future underneath Abel.

“Not likely (apprehensive). He’s had such a very long time alongside Warren and an opportunity to know the companies,” Malik stated about Abel.

The query is will he allocate capital as dynamically as Warren? And the reply is not any.

“However I believe he’ll do a advantageous job with the help of the others,” Malik stated.

Cole Smead of Smead Capital Administration stated he wasn’t shocked Buffett is stepping down after watching him Saturday as a result of the 94-year-old wasn’t as sharp as in previous years. At one level, he made a primary math mistake in certainly one of his solutions. At different factors, he obtained off observe whereas telling tales about Berkshire and his investing with out answering the query he was requested.

Abel is properly regarded by Berkshire’s managers and Buffett has praised his enterprise acumen for years. However he may have a tough time matching Buffett’s legendary efficiency, and since he doesn’t management 30% of Berkshire’s inventory like Buffett does, he received’t have as a lot leeway.

“I believe the problem he’s going to have is that if anybody goes to provide him Buffett or (former Vice Chairman Charlie) Munger’s go card? Not an opportunity in God’s title,” Smead stated. Buffett at all times loved a loyal following amongst shareholders.

Buffett has stated that Abel may even be a extra hands-on supervisor than he’s and get extra out of Berkshire’s corporations.

“I believe we’ll get a extra hands-on supervisor and that may very well be {that a} good factor,” Steven Test, who runs Test Capital Administration, stated beforehand. However he stated Abel additionally is aware of that these managers benefit from the freedom to run their companies and Abel isn’t going to do something to show them off.

Buffett earlier warned that Trump’s tariffs had been dangerous

Earlier, Buffett warned Saturday concerning the dire international penalties of President Donald Trump’s tariffs whereas telling the hundreds of buyers gathered at his annual assembly that “commerce shouldn’t be a weapon” however “there’s no query that commerce might be an act of battle.”

Buffett stated Trump’s commerce insurance policies have raised the danger of worldwide instability by angering the remainder of the world.

“It’s a giant mistake in my opinion when you’ve 7.5 billion individuals who don’t such as you very properly, and you’ve got 300 million who’re crowing about how they’ve achieved,” Buffett stated as he addressed the subject on everybody’s thoughts initially of the Berkshire Hathaway shareholders assembly.

Whereas Buffett stated it’s best for commerce to be balanced between international locations, he doesn’t assume Trump goes about it the best approach together with his widespread tariffs. He stated the world can be safer if extra international locations are affluent.

“We ought to be trying to commerce with the remainder of the world. We must always do what we do greatest and they need to do what they do greatest,” he stated.

Market turmoil doesn’t create huge alternatives

Buffett stated he simply doesn’t see many attractively priced investments that he understands lately, so Berkshire is sitting on $347.7 billion in money, however he predicted that at some point Berkshire can be “bombarded with alternatives that we are going to be glad we have now the money for.”

Buffett stated the current turmoil within the markets that generated headlines after Trump’s tariff announcement final month “is actually nothing.” He dismissed the current drop available in the market as a result of he’s seen three intervals within the final 60 years of managing Berkshire when his firm’s inventory was halved. He cited when the Dow Jones industrial common went from 240 on the day he was born in 1930 right down to 41 through the Nice Melancholy as a very vital drop within the markets. At the moment the Dow Jones Industrial Common sits at $41,317.43.

“This has not been a dramatic bear market or something of the type,” he stated.

Buffett stated he hasn’t purchased again any of Berkshire’s shares this 12 months both as a result of they don’t appear to be a discount both.

Investor Chris Bloomstran, who’s president of Semper Augustus Investments Group, advised the Gabelli funding convention Friday {that a} monetary disaster may be the perfect factor for Berkshire as a result of it will create alternatives to speculate at engaging costs.

“I’m certain he’s praying that the commerce battle will get worse. He received’t say that publicly, however Berkshire wants a disaster. I imply Berkshire thrives in disaster,” Bloomstran stated.

Berkshire assembly attracts hundreds

The assembly attracts some 40,000 folks yearly who wish to hear from Buffett, together with some celebrities and well-known buyers. This 12 months, Hillary Rodham Clinton additionally attended. Clinton was the final candidate Buffett backed publicly as a result of he has shied away from politics and any controversial matter in recent times for worry of wounding Berkshire’s companies.

Haibo Liu even camped out in a single day exterior the sector to be first in line Saturday morning. Liu stated he worries that this 12 months may very well be Buffett’s final assembly since he’s 94, so he made it a precedence to attend his second assembly.

“He has helped me rather a lot,” stated Liu who traveled from China to attend. “I actually wish to categorical my due to him.”