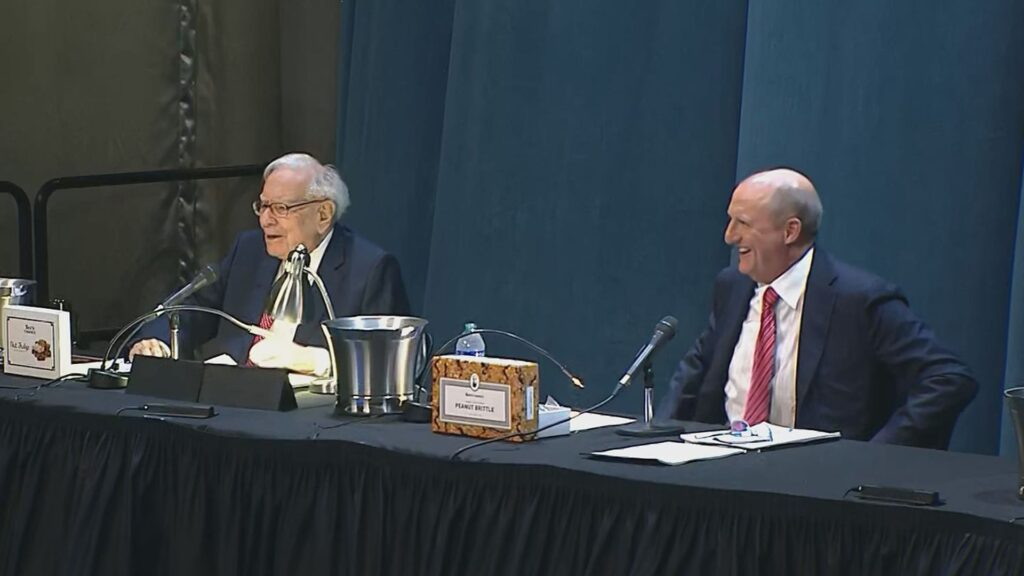

Warren Buffett and Greg Abel in the course of the Berkshire Hathaway Annual Shareholders Assembly in Omaha, Nebraska on Could 4, 2024.

CNBC

Warren Buffett has been mum about tariffs and the current market turmoil, however will lastly converse his thoughts when the 94-year-old funding legend kicks off Berkshire Hathaway’s annual shareholder assembly on Saturday.

Tens of 1000’s of rapt shareholders will descend on Omaha, Nebraska this weekend for the annual gathering dubbed “Woodstock for Capitalists.” This 12 months’s assembly marks the sixtieth anniversary of Buffett main the corporate, and is the second with out Buffett’s long-time companion Charlie Munger, who died in late 2023.

The most important occasion within the Cornhusker State subsequent to a Nebraska-Oklahoma soccer recreation, this 12 months’s assembly comes as markets have turned unsure after President Donald Trump’s aggressive rollout of the best tariffs on imports in generations. (Many had been suspended for 90 days afterward.) Wall Avenue economists left and proper are sounding the alarms {that a} recession could also be within the offing, as current knowledge pointed to indicators of financial weakening.

“As a result of Berkshire owns so many companies, they’re mainly on the entrance traces of all the pieces when it comes to the financial system falling off. Is it even worse than what the numbers are already exhibiting?” mentioned Steve Test, founding father of Test Capital Administration, which counts Berkshire as its largest holding. “I hope, greater than something, that he speaks out towards the best way tariffs have been executed. Everyone seems to be on the lookout for what Warren Buffett has to say.”

Traders’ north star

The “Oracle of Omaha” could have already let his actions do the speaking. Berkshire has bought extra inventory than it is purchased for 9 straight quarters, dumping greater than $134 billion price in 2024. That was primarily on account of reductions in Berkshire’s two largest fairness holdings — Apple and Financial institution of America. Because of the promoting spree, by December Berkshire’s monumental pile of money had grown to yet one more report, at $334.2 billion.

The world is raring to listen to if Buffett, essentially the most well-known advocate of worth investing, used the April market meltdown to hunt for bargains and lay the groundwork for offers. Though Buffett does not make predictions of short-term market route, buyers will hear carefully for any alerts of his continued confidence within the U.S. financial system — regardless of the tariff shock.

“I feel the large query on everybody’s thoughts is what is going to Warren do with the pile of money that they’re sitting on and, extra particularly, when can it’s deployed, as he may also help buyers gauge when the all clear signal is lit,” mentioned David Wagner, a portfolio supervisor at Aptus Capital Advisors and a Berkshire shareholder. Many buyers, he famous, “are inclined to view Warren because the north star.”

Buffett will make just a few introductory remarks at 9am ET Saturday, adopted by an hours-long question-and- reply panel. Buffett’s designated successor, Greg Abel, and Berkshire’s insurance coverage chief, Ajit Jain, will be a part of Buffett on stage within the morning, with Buffett and Abel alone within the afternoon. The Q&A session will be broadcast on CNBC and webcast in English and Mandarin.

Huge Apple query

Shareholders are additionally curious for Buffett to elucidate his motivation in slashing his longtime Apple stake. After a head-turning promoting spree for 4 quarters in a row, Berkshire’s Apple holding has stayed at a fair 300 million shares because the finish of September, main many to take a position that Buffett is finished promoting the inventory in the intervening time.

Eventually 12 months’s annual assembly, Buffett steered that the sale was for tax causes following sizable features. He additionally implied that promoting down Apple might be tied to his desirous to keep away from a better tax invoice sooner or later if charges went greater to fund the yawning U.S. fiscal deficit. With a change in authorities in Washington, shareholders need to hear Buffett’s reasoning immediately.

“You may’t use that clarification anymore as a result of it clearly doesn’t apply,” mentioned David Kass, a finance professor on the College of Maryland. “If he bought extra, it could point out that he most likely felt it was absolutely valued, or Warren Buffett being the genius that he’s, he was capable of see forward at a number of the dangers that might face Apple, in case there is a commerce battle and tariffs.”

Berkshire’s first-quarter earnings report, due Saturday morning, will present the conglomerate’s high fairness holdings, which may give buyers a touch as as to whether the Apple stake was adjusted once more.