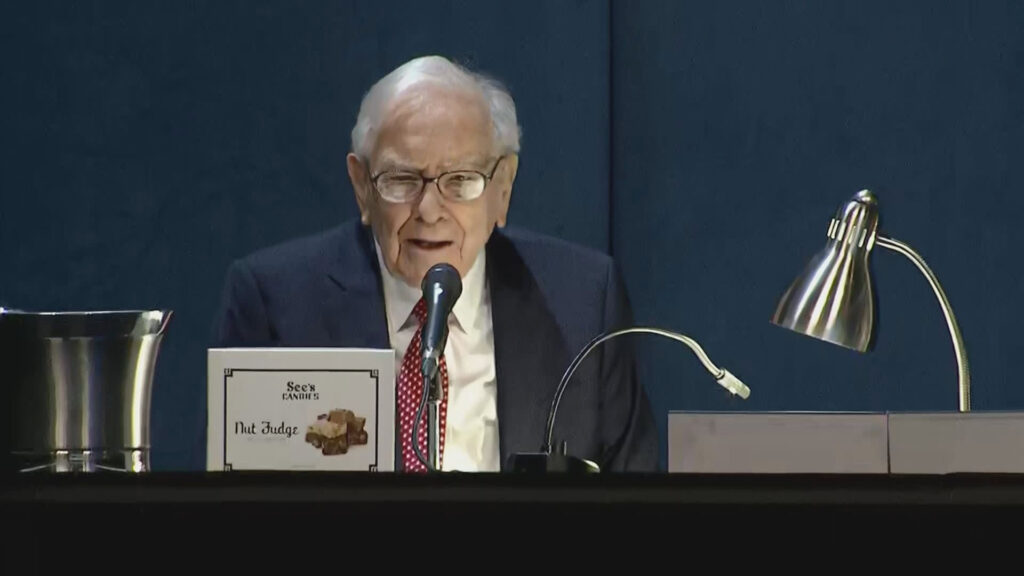

Warren Buffett speaks through the Berkshire Hathaway Annual Shareholders Assembly in Omaha, Nebraska, on Might 4, 2024.

CNBC

Warren Buffett’s Berkshire Hathaway bought extra shares of Occidental Petroleum after the oil and fuel producer tumbled greater than 30% from its file excessive.

The Omaha, Nebraska-based conglomerate scooped up 763,017 shares of the Houston-based power firm on Friday for $35.7 million, based on a regulatory submitting. Berkshire is Occidental’s largest investor, holding a 28.2% stake.

Shares of Occidental have fallen almost 32% from an all-time excessive reached final April. The inventory dropped greater than 17% in 2024 as oil costs weakened.

Occidental shares over the previous yr

In late December, Berkshire bought 8.9 million Occidental shares throughout a broad market pullback. Occidental stays Berkshire’s sixth-largest fairness holding.

Buffett has made clear he will not take full management of the oil firm, based by legendary oilman Armand Hammer. There had been hypothesis of a takeover after Berkshire acquired regulatory approval to purchase as a lot as a 50% stake.

The “Oracle of Omaha” beforehand mentioned he began shopping for Occidental after studying a transcript of the oil firm’s earnings convention name. Occidental additionally pays a 1.8% dividend yield and has been investing in a carbon seize enterprise.

Berkshire additionally owns $10 billion of Occidental most popular inventory and has warrants to purchase one other 83.9 million widespread shares for $5 billion, or $59.62 every. The warrants had been obtained as a part of Berkshire’s 2019 deal that helped finance Occidental’s buy of Anadarko Petroleum.