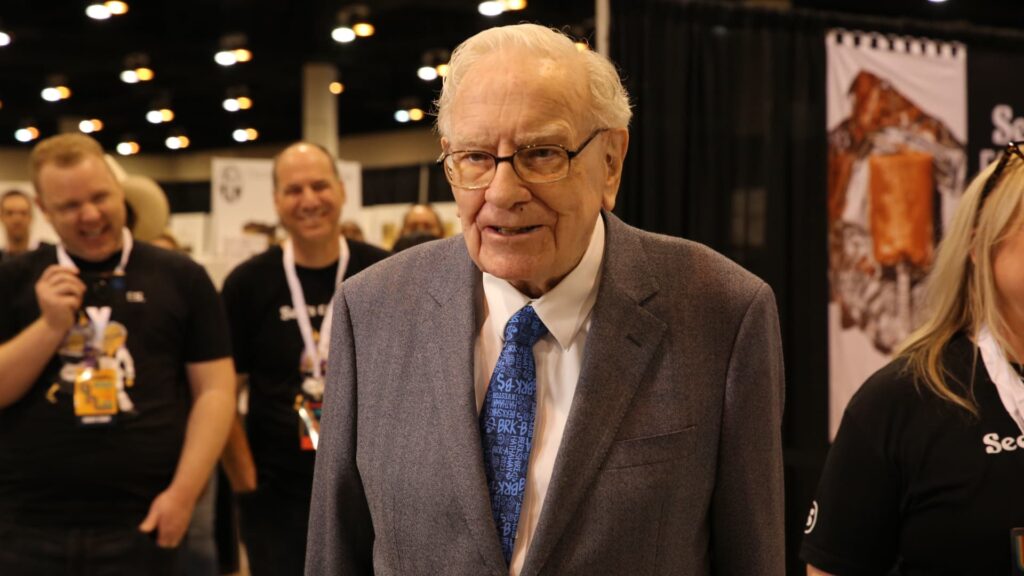

Warren Buffett excursions the grounds on the Berkshire Hathaway Annual Shareholders Assembly in Omaha Nebraska.

David A. Grogan | CNBC

Warren Buffett shared a heartfelt tribute to the late Charlie Munger, calling his enterprise companion of 60 years the architect of immediately’s Berkshire Hathaway.

In his must-read annual letter Saturday, the 93-year-old “Oracle of Omaha” detailed Munger’s instrumental position in serving to him broaden his conglomerate and mirrored on his fruitful and loving relationship together with his right-hand man.

“In actuality, Charlie was the ‘architect’ of the current Berkshire, and I acted because the ‘basic contractor’ to hold out the day-by-day development of his imaginative and prescient,” Buffett wrote. “Charlie by no means sought to take credit score for his position as creator however as an alternative let me take the bows and obtain the accolades. In a manner his relationship with me was half older brother, half loving father.”

Munger died in November, a few month shy of his a centesimal birthday. Munger’s funding philosophy rubbed off on a younger Buffett, giving rise to the sprawling conglomerate value $900 billion immediately. Buffett reminisced the start of buying Berkshire, then a textile mill, and the way Munger instilled a blueprint in him to rework the corporate.

“Charlie, in 1965, promptly suggested me: ‘Warren, overlook about ever shopping for one other firm like Berkshire. However now that you simply management Berkshire, add to it great companies bought at honest costs and quit shopping for honest companies at great costs. In different phrases, abandon every little thing you realized out of your hero, Ben Graham. It really works however solely when practiced at small scale.’ With a lot back-sliding I subsequently adopted his directions,” Buffett wrote within the letter.

Buffett studied underneath fabled father of worth investing Benjamin Graham at Columbia College after World Battle II and developed a unprecedented knack for choosing low-cost shares. It was Munger who made him understand this cigar-butt investing technique may solely go up to now, and if he needed to broaden Berkshire in a big manner, it would not be sufficient.

“A few years later, Charlie turned my companion in working Berkshire and, repeatedly, jerked me again to sanity when my previous habits surfaced,” Buffett mentioned. “Till his loss of life, he continued on this position and collectively we, together with those that early on invested with us, ended up much better off than Charlie and I had ever dreamed doable.”

The Omaha-based conglomerate — proprietor of every little thing from Geico insurance coverage to BNSF Railway to Dairy Queen ice cream — just lately touched consecutive file highs, buying and selling above $620,000 for Class A shares and boasting a market worth above $900 billion.

“Berkshire has grow to be an amazing firm. Although I’ve lengthy been answerable for the development crew; Charlie ought to perpetually be credited with being the architect,” Buffett mentioned.