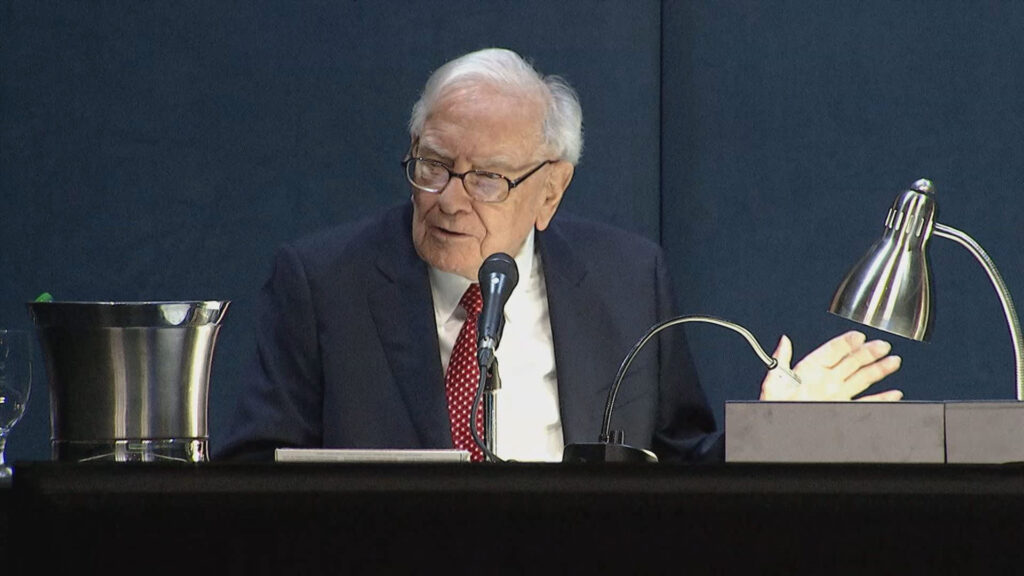

Warren Buffett speaks through the Berkshire Hathaway Annual Shareholders Assembly in Omaha, Nebraska on Might 4, 2024.

CNBC

A coincidence or grasp plan? Warren Buffett now owns the very same variety of shares of Apple as he does Coca-Cola after slashing the tech holding by half.

Many Buffett followers made the curious remark after a regulatory “13-F” submitting Wednesday night time revealed Berkshire Hathaway‘s fairness holdings on the finish of the second quarter. It confirmed an similar 400 million share depend in Apple and Coca-Cola, Buffett’s oldest and longest inventory place.

It is prompted some to consider that the ‘Oracle of Omaha’ is completed promoting down his stake within the iPhone maker.

“If Buffett likes spherical numbers, he will not be planning to promote any further shares of Apple,” mentioned David Kass, a finance professor on the College of Maryland’s Robert H. Smith College of Enterprise. “Simply as Coca-Cola is a ‘everlasting’ holding for Buffett, so could also be Apple.”

The 93-year-old legendary investor first purchased 14,172,500 shares of Coca-Cola in 1988 and elevated his stake over the following few years to 100 million shares by 1994. So the investor has stored his Coca-Cola stake regular at primarily the identical round-number share depend for 30 years.

As a consequence of two rounds of 2-for-1 inventory splits in 2006 and 2012, Berkshire’s Coca-Cola holding grew to become 400 million shares.

Buffett mentioned he found the enduring smooth drink when he was solely 6 years previous. In 1936, Buffett began shopping for Cokes six at a time for 25 cents every from his household grocery retailer to promote across the neighborhood for 5 cents extra. Buffett mentioned it was then he realized the “extraordinary client attractiveness and business prospects of the product.”

Slashing Apple stake

Investing in tech high-flyers corresponding to Apple seems to defy Buffett’s long-held worth investing ideas, however the famed investor has handled it as a client merchandise firm like Coca-Cola fairly than a expertise funding.

Buffett has touted the loyal buyer base of the iPhone, saying individuals would hand over their automobiles earlier than they offer up their smartphones. He even known as Apple the second-most vital enterprise after Berkshire’s cluster of insurers.

So it was surprising to some when it was revealed that Berkshire dumped greater than 49% of its stake within the iPhone maker within the second quarter.

Many suspected that it was a part of portfolio administration or an even bigger general market view, and never a judgement on the long run prospects of Apple. The sale introduced down Apple’s weighting in Berkshire’s portfolio to about 30% from nearly 50% on the finish of final 12 months.

And with it settled at this spherical quantity, it seems to be in a spot that Buffett favors for his most cherished and longest-held equities.

Nonetheless, some mentioned it might simply be a pure coincidence.

“I do not assume Buffett thinks that approach,” mentioned Invoice Stone, chief funding officer at Glenview Belief Firm and a Berkshire shareholder.

However at Berkshire’s annual assembly in Might, Buffett did evaluate the 2 and reference the holding interval for each was limitless.

“We personal Coca-Cola, which is a superb enterprise,” Buffett mentioned. “And we personal Apple, which is a good higher enterprise, and we are going to personal, until one thing actually extraordinary occurs, we are going to personal Apple and American Specific and Coca-Cola.”