OMAHA, Neb. — Warren Buffett struck a pessimistic tone about Berkshire Hathaway‘s myriad of companies on Saturday, saying he expects an earnings decline in mild of an financial slowdown.

“Within the common financial system, the suggestions we get is that, I’d say, maybe the vast majority of our companies will really report decrease earnings this 12 months than final 12 months,” the “Oracle of Omaha” advised tens of 1000’s of shareholders at Berkshire’s 2023 annual assembly.

associated investing information

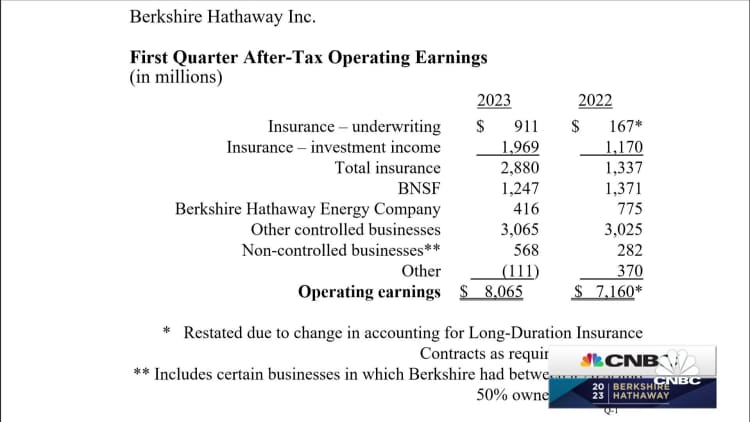

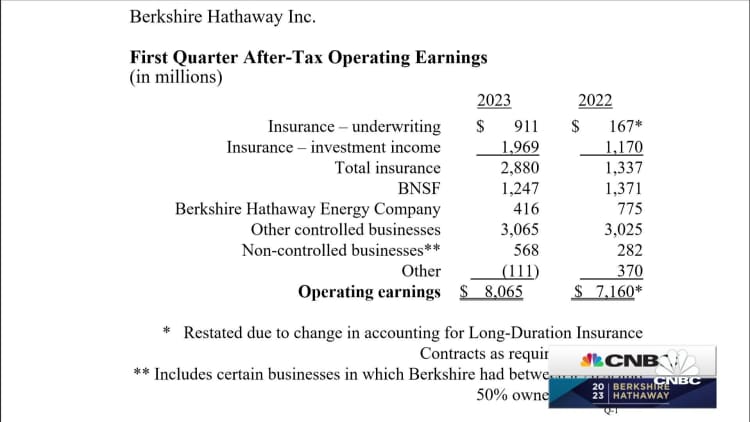

Berkshire has fared properly to date regardless of a difficult macro surroundings with working earnings leaping 12.6% within the first quarter. The sturdy efficiency was pushed by a rebound within the conglomerate’s insurance coverage enterprise. Total earnings additionally rose sharply thanks partially to beneficial properties its fairness portfolio, led by Apple. Berkshire’s railroad enterprise, BNSF, together with its power firm did see year-over-year earnings declines final quarter.

The 92-year-old investing icon believes that a few of his managers at Berkshire subsidiaries had been caught off guard by the swift change in shopper conduct, as they put the Covid-19 pandemic behind them. This led them to overestimating demand for sure merchandise, and now they are going to want gross sales to eliminate the surplus stock.

“It’s a totally different local weather than it was six months in the past. And quite a few our managers had been stunned,” Buffett stated. “A few of them had an excessive amount of stock on order, after which abruptly it received delivered, and other people weren’t in the identical state of mind as earlier.”

The U.S. financial system is grappling with a collection of aggressive charge hikes, which partly triggered three financial institution failures within the span of just some weeks as a consequence of mismatched property and liabilities. The Federal Reserve simply accepted its tenth charge hikes since 2022, taking the fed funds charge to a goal vary of 5%-5.25%, the very best since August 2007.

“It was extra excessive in World Conflict II, however this was excessive this time,” Buffett stated.