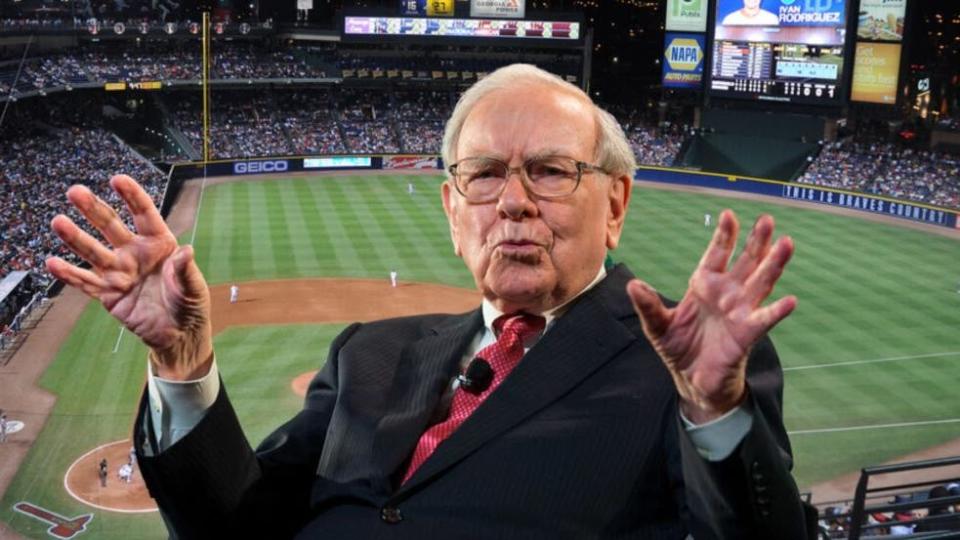

Investing is linked to threat, a actuality acknowledged by buyers globally. The potential for everlasting capital loss is a elementary concern in finance, defining the essence of threat. But, perceptions of threat range amongst buyers. Warren Buffett, one of many richest individuals on the planet, gives a novel perspective on this subject.

In 1993, Buffett spoke to Columbia College’s Enterprise College graduates. Requested about his technique for evaluating threat, he stated, “Threat comes from not understanding what you’re doing.” This quote displays Buffett’s funding philosophy, highlighting the essential function of information and understanding in lowering threat.

Buffett’s technique focuses on long-term enterprise fundamentals over short-term market modifications. He doesn’t unexpectedly react to share value drops in his holdings, basing his selections on an in-depth understanding of the companies.

Don’t Miss:

A mistake early in Buffett’s profession exemplifies this precept, albeit not in a constructive means. At age 21, he invested 20% of his internet wealth in a Sinclair service station, in the end shedding all the $2,000 funding, in accordance with the ebook “The Offers of Warren Buffett, Quantity 1: The First $100M.”

Buffett’s loss taught him the worth of aggressive benefit in enterprise. His Sinclair station struggled in opposition to a dominant Texaco station, highlighting the significance of a novel market place. This lesson later guided his profitable investments in American Categorical Co. and Coca-Cola Co., which benefitted from sturdy buyer loyalty and aggressive benefits.

Enterprise threat, a main focus for Buffett, issues the longer term earnings of firms. He seeks to spend money on companies poised for earnings development. Understanding an organization’s potential and components influencing its earnings helps Buffett keep away from uninformed decision-making.

Buffett, regardless of being hailed as one of many biggest buyers, has confronted notable failures all through his profession, along with his early missteps at Sinclair service station. Two vital examples are his investments in Dexter Shoe Co. and Power Future Holdings Corp.

Trending: Copy and paste Mark Cuban’s startup funding technique in accordance with his colourful portfolio.

The Dexter Shoe Co. deal in 1993, the place Buffett used Berkshire Hathaway inventory value $433 million, ended up being a serious loss. The worth of these shares in the present day is estimated to be round $8.7 billion, marking the deal as a monetary catastrophe. Power Future Holdings resulted in a lack of $873 million for Berkshire Hathaway, in accordance with CBS Information. Buffett bought bonds of Power Future Holdings, value $2.1 billion in 2007, is betting on rising pure gasoline costs. Nevertheless, the corporate declared chapter in 2014, and Berkshire bought the bonds at a big loss.

These experiences illustrate that funding threat isn’t nearly market unpredictability or financial instability; it’s profoundly about an investor’s information and comprehension of their investments. Buffett’s strategy emphasizes the significance of knowledgeable decision-making in profitable investing, offering important insights for buyers in any respect ranges.

Investing in startups presents comparable dangers however with the potential for top rewards. Like Buffett, buyers can reduce threat by totally understanding the enterprise, its market potential and the crew behind it. This information-based strategy aligns with Buffett’s philosophy: Knowledgeable selections can considerably cut back the dangers related to investing in early-stage firms.

Learn Subsequent:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Sport with the #1 “information & every little thing else” buying and selling instrument: Benzinga Professional – Click on right here to start out Your 14-Day Trial Now!

Get the newest inventory evaluation from Benzinga?

This text Warren Buffett’s First Failed Enterprise Enterprise Value Him 20% Of His Internet Value — Now He Says, ‘Threat Comes From Not Understanding What You are Doing’ initially appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.