When Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett speaks, the entire of Wall Avenue pays shut consideration. Delivering an combination return of greater than 5,180,000% in Berkshire’s Class A shares (BRK.A) since turning into CEO in 1965, and successfully doubling up the annualized whole return of the broad-based S&P 500 spanning nearly six many years, has garnered Buffett fairly the next.

Specifically, traders usually wait on the sting of their seat for clues as to what the affably named “Oracle of Omaha” has been shopping for or promoting. These “clues” might be divulged when:

-

Berkshire Hathaway information its quarterly Type 13F with the Securities and Change Fee — a 13F is a snapshot of what Wall Avenue’s high cash managers have been shopping for and promoting.

-

The corporate lifts the proverbial hood on its quarterly working outcomes.

-

Buffett releases his annual letter to shareholders.

-

Buffett speaks candidly with traders throughout Berkshire’s annual shareholder assembly.

The discharge of Berkshire’s second-quarter working outcomes on August 3 supplied a massive clue as to what the Oracle of Omaha and his trusted funding advisors, Todd Combs and Ted Weschler, have been as much as. Extra particularly, it revealed an unprecedented degree of promoting exercise within the firm’s 44-stock funding portfolio.

Buffett and his group have been net-sellers of equities since October 2022

Let me preface this dialogue by making one factor clear: Warren Buffett is a long-term optimist on the U.S. economic system and inventory market. On quite a few events all through his tenure as CEO, he is spoken concerning the power of the U.S. economic system and the worth of endurance.

However simply because he is a long-term optimist, it doesn’t suggest he’ll overpay for time-tested companies.

Through the June quarter, Berkshire Hathaway’s consolidated money move statements present solely $1.615 billion in fairness safety purchases — a few of which is tied to the corporate’s continued buy of Occidental Petroleum inventory.

Comparatively, Buffett and his high aides oversaw the sale of $77.151 billion of fairness securities. The lion’s share of this promoting exercise is tied to Berkshire’s largest place, Apple (NASDAQ: AAPL). The $84.2 billion truthful worth estimate for Berkshire’s stake in Apple, as of June 30, implies that just about half of the corporate’s holdings within the tech stalwart had been disposed of through the second quarter. This follows the sale of greater than 116 million shares of Apple within the first three months of 2024.

Altogether, $75.536 billion in web equities had been offered within the second quarter, which is probably the most Berkshire Hathaway has ever offered in a single quarter.

Moreover, it marks the seventh consecutive quarter that Buffett and Co. have offered extra securities than they’ve bought:

In combination, $131.63 billion in net-equity gross sales have been undertaken since Oct. 1, 2022.

Warren Buffett’s $132 billion warning has change into deafening

To be truthful, Warren Buffett has a logical scapegoat to justify Berkshire’s record-breaking promoting exercise. Throughout his firm’s annual shareholder assembly in Could, the Oracle of Omaha opined that company tax charges had been seemingly headed greater sooner or later. Thus, locking in some earnings at a traditionally decrease company tax price would, in hindsight, be seen favorably by his firm’s shareholders.

Whereas it is attainable the extraordinary promoting exercise we have witnessed in Apple, and extra just lately Financial institution of America, is tax-based, the extra seemingly clarification is that Buffett’s roughly $132 billion in net-equity gross sales is a silent, but deafening, warning for Wall Avenue.

Though Buffett would by no means wager in opposition to America — i.e., you may by no means seen him shopping for put choices or short-selling shares — he isn’t been shy about holstering his money when worth is few and much between on Wall Avenue. In different phrases, the long-term mantra the Oracle of Omaha preaches does not all the time align along with his actions over shorter timelines.

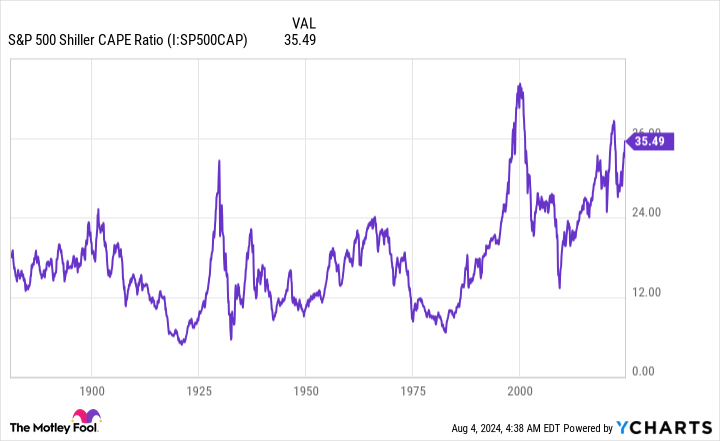

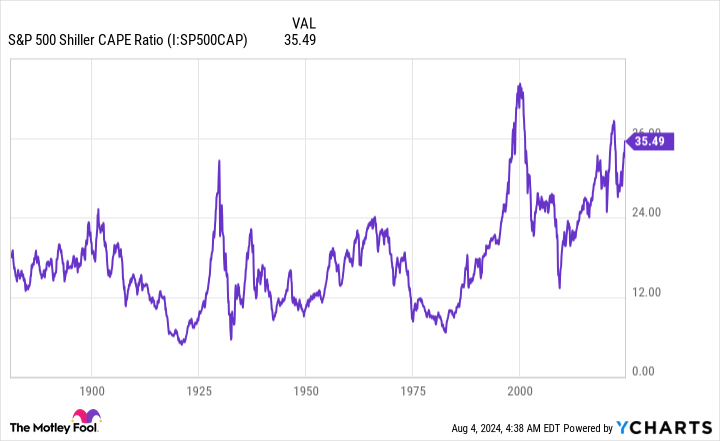

If there is a valuation mannequin that demonstrates simply how dear shares are proper now, it is the S&P 500’s Shiller price-to-earnings (P/E) ratio, which can be generally known as the cyclically adjusted price-to-earnings ratio, or Cape ratio.

Not like the normal P/E ratio, which divides an organization’s share value into its trailing-12-month earnings per share and is well the most-popular valuation metric, the Shiller P/E is predicated on common inflation-adjusted earnings from the prior 10 years. Inspecting a decade’s price of earnings historical past helps to easy out one-off occasions that may adversely impression conventional valuation fashions.

As of the closing bell on August 2, the S&P 500’s Shiller P/E stood at 34.48. That is down modestly from a peak of 37 in latest weeks, however nonetheless represents one of many highest readings we have noticed throughout a bull market rally, when back-tested to 1871!

Together with the current, there have solely been a half-dozen events in additional than 150 years the place the Shiller P/E ratio has topped 30 throughout a bull market. The earlier 5 cases had been all adopted by plunges of 20% to 89% for Wall Avenue’s main inventory indexes.

Although the Shiller P/E is not a timing software and will not assist traders decipher when inventory market corrections will start, it does have a flawless observe document of ultimately forecasting main draw back within the inventory market.

Buffett desires no a part of the “on line casino,” however will pounce when the time is correct

The unprecedented promoting exercise we have witnessed from Buffett and his group by the first-half of the yr was, arguably, telegraphed in February by the Oracle of Omaha himself. In his annual letter to shareholders, he spoke candidly concerning the risks of “casino-like conduct” on Wall Avenue:

Although the inventory market is massively bigger than it was in our early years, in the present day’s lively individuals are neither extra emotionally secure nor higher taught than I used to be at school. For no matter causes, markets now exhibit much more casino-like conduct than they did once I was younger. The on line casino now resides in lots of properties and each day tempts the occupants.

That is one other occasion of Buffett warning traders of the hazards of irrational exuberance on Wall Avenue with out (key phrase!) telling traders to promote their inventory or keep away from the market altogether.

However what Buffett does have working in his and his firm’s favor is the power to answer large-scale market alternatives when the pendulum swings within the different route. Nabbing a large stake in Financial institution of America (by way of most well-liked inventory, initially) in 2011 following the monetary disaster is only one instance of how Berkshire’s funding group has used its treasure chest to benefit from short-lived intervals of concern on Wall Avenue.

Following 1 / 4 that featured historic ranges of fairness gross sales, Berkshire’s money pile, which incorporates money equivalents and U.S. Treasuries, hit an all-time excessive of $277 billion. The choices out there to Buffett and his high aides are seemingly limitless.

If historical past has taught us something, it is that Warren Buffett will deploy Berkshire Hathaway’s money hoard when great companies are buying and selling at truthful costs. Though it may very well be a while earlier than we see this capital put to work, Buffett’s long-term religion within the American economic system and inventory market stays unwavering.

Do you have to make investments $1,000 in Berkshire Hathaway proper now?

Before you purchase inventory in Berkshire Hathaway, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Berkshire Hathaway wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $657,306!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 29, 2024

Financial institution of America is an promoting associate of The Ascent, a Motley Idiot firm. Sean Williams has positions in Financial institution of America. The Motley Idiot has positions in and recommends Apple, Financial institution of America, and Berkshire Hathaway. The Motley Idiot recommends Occidental Petroleum. The Motley Idiot has a disclosure coverage.

Warren Buffett’s Unprecedented $132 Billion Warning to Wall Avenue Cannot Be Ignored Any Longer was initially printed by The Motley Idiot