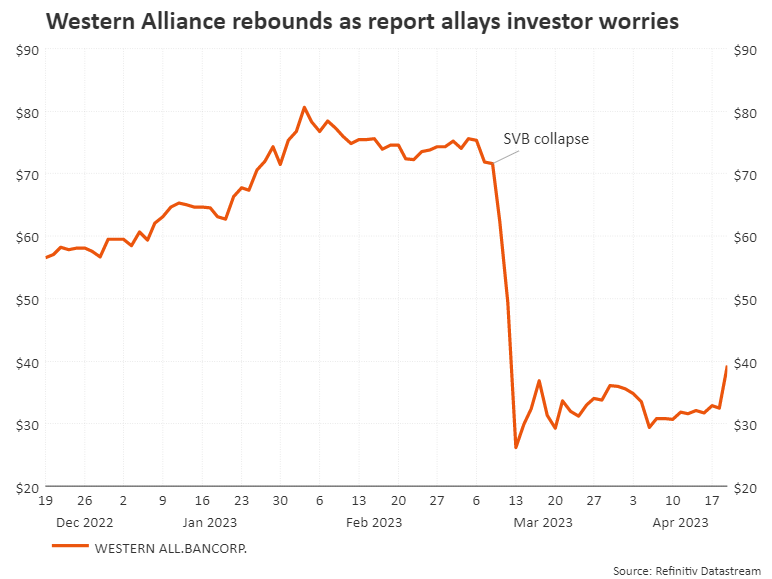

April 19 (Reuters) – Shares of Western Alliance Bancorp (WAL.N) surged 24% on Wednesday after the U.S. regional financial institution posted stronger-than-expected earnings and mentioned its deposits had stabilized, serving to allay fears that final month’s banking disaster might envelop extra lenders.

The Phoenix, Arizona-based financial institution’s quarterly outcomes additionally lifted the shares of different regional lenders punished by inventory traders final month as customers shifted their deposits into larger establishments following the collapse of Silicon Valley Financial institution.

Western Alliance mentioned late on Tuesday that complete deposits fell 11% to $47.6 billion within the first quarter from the earlier three months, however that deposits steadied late within the quarter and grew by $2 billion from March 31 to April 14.

Steadiness sheet repositioning, which included promoting some belongings and reclassifying loans, resulted in non-operating prices of $110 million, the financial institution added.

“We’re seeing constructive information from a regional financial institution that was within the crosshairs of the entire disaster,” Ryan Detrick, chief market strategist at Carson Group in Omaha, mentioned in an e mail following Western Alliance’s report.

“We aren’t absolutely out of the woods but, however issues are a complete lot brighter for the monetary sector and sure will solely get higher as confidence returns,” he added.

Wedbush Securities raised its score on Western Alliance to “outperform” from “impartial” and added the financial institution to its “Finest concepts checklist”, amongst shares together with Apple (AAPL.O) and Microsoft (MSFT.O).

Western Alliance’s outcomes soothed considerations concerning the stability of regional banks following worst U.S. banking disaster since 2008. PacWest Bancorp (PACW.O) and First Republic Financial institution (FRC.N) every soared greater than 12%, whereas the SPDR S&P Regional Banking ETF (KRE.P) climbed about 4%.

Zions Bancorp (ZION.O) jumped 7.4% throughout Wednesday’s buying and selling session, however then fell 5% in prolonged buying and selling after the Utah-based lender reported quarterly earnings that missed estimates as larger provisions to cowl mortgage losses offset the influence of rising charges on its curiosity revenue.

The rally in Western Alliance following its report stood out amongst a number of regional banks which have posted quarterly outcomes this week.

Residents Monetary Group Inc (CFG.N) edged up 0.2% after reporting a quarterly revenue early on Wednesday that missed Wall Avenue’s estimates.

U.S. Bancorp (USB.N) rose 2.3% after beating estimates for first-quarter revenue, whereas growing its rainy-day funds to $427 million from $112 million final 12 months.

Charles Schwab Corp (SCHW.N) climbed 2.8%, extending this week’s achieve to about 10% after the brokerage’s quarterly revenue surpassed estimates on Monday, whereas its stoop in deposits was not as extreme as anticipated.

Western Alliance’s inventory stays down over 40% from early March, earlier than Silicon Valley Financial institution’s collapse.

Reporting by Noel Randewich

: .