Santa Claus seems on on the 98th Annual Christmas Tree lighting ceremony on the New York Inventory Alternate on Dec. 1, 2021 in New York.

Bryan R. Smith | Afp | Getty Photos

If historical past is a information, inventory traders could also be poised to get a present over the vacations.

U.S. shares typically gallop at year-end, delivering larger returns for traders. The pattern, often called the “Santa Claus rally,” encompasses the final 5 buying and selling days of the calendar 12 months and the primary two of the brand new 12 months.

associated investing information

Up to now twenty years, the S&P 500 Index — a barometer of U.S. inventory efficiency — has elevated by 0.7% a 12 months, on common, over these seven buying and selling days, based on FactSet knowledge. The S&P 500 was constructive throughout these seven days in 15 of the 20 years — or 75% of the time, FactSet discovered.

The pattern holds when wanting additional again, too.

Throughout that exact seven-day buying and selling interval, the S&P 500 was up a median 1.3% a 12 months courting to 1950 and was constructive in 79% of these years, based on an evaluation by Michael Batnick, managing companion at Ritholtz Wealth Administration.

Extra from Private Finance:

401(ok) ‘hardship’ withdrawals hit document excessive, Vanguard says

Lengthy Covid is distorting the labor market — and that is dangerous for the U.S. economic system

scale back the sting of taking RMDs in a down market

By comparability, S&P 500 returns have been a a lot smaller 0.24% throughout all different seven-day buying and selling intervals courting to 1950, Batnick stated. Shares have been constructive 58% of the time over these intervals.

“That’s significant,” Batnick stated of the distinction in returns and positivity fee.

December tends to be among the many strongest months of the 12 months for U.S. inventory efficiency. Since 1926, solely returns in July and April have outpaced December’s common — about 1.9% and 1.7% versus 1.6%, respectively, based on knowledge from Morningstar Direct.

It is a bit hazy why the Santa Claus rally exists

It is not totally clear why shares sometimes rally in December and into January. Potential contributors embody optimism in regards to the coming 12 months, vacation spending, inventory merchants on trip and establishments squaring their books — even the vacation spirit.

“Once you consider a Santa Claus rally, it is all about anticipating or wanting ahead,” stated Terry DuFrene, international funding specialist at J.P. Morgan Non-public Financial institution in New Orleans. “Now you’ve an opportunity to hit the reset button.”

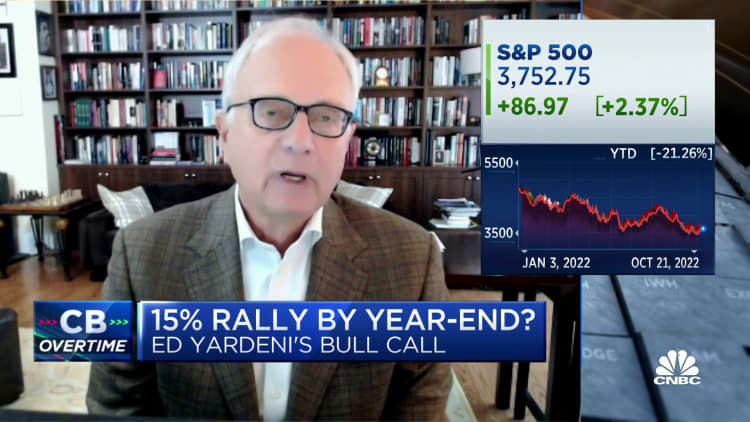

Ed Yardeni, president of Yardeni Analysis, informed CNBC that Santa Claus rallies are “notably predictable and robust” throughout midterm election years, which frequently present a tailwind to the inventory market — and it typically would not matter which occasion takes management of the Home or Senate.

“Midterm elections, it doesn’t matter what, tend to be very bullish, and the Santa Claus rally continues by means of the subsequent three, six, 12 months,” he stated.

The market typically responds positively to divided authorities because of the relative predictability that comes with legislative gridlock. Republicans took the Home and Democrats retained management of the Senate on this 12 months’s midterm elections.

Regardless of the cause for the Santa Claus rally, traders can use a bit of fine information.

The S&P 500 is down about 17% in 2022. Bonds, sometimes a ballast when shares are down, have additionally been within the doldrums; the Bloomberg U.S. Combination bond index, a barometer of U.S. bonds, is down 11% in 2022.

In fact, previous efficiency does not imply it is a given shares will rally.

The Federal Reserve is poised to proceed its cycle of elevating rates of interest throughout a coverage assembly subsequent week. The central financial institution started elevating borrowing prices aggressively in March this 12 months to tame stubbornly excessive inflation.

On Tuesday, People will get a have a look at whether or not inflation eased additional in November, when the U.S. Bureau of Labor Statistics points its newest month-to-month client value index report.

A bigger-than-expected enhance in rates of interest or indicators that inflation was hotter than anticipated might gasoline stock-market jitters towards year-end.