March 31 (Reuters) – March recorded the worst U.S. financial institution failures because the 2008 disaster, however that didn’t cease some buyers from snapping up battered monetary shares to bolster their bets on the sector’s long-term well being, fund-flow information confirmed.

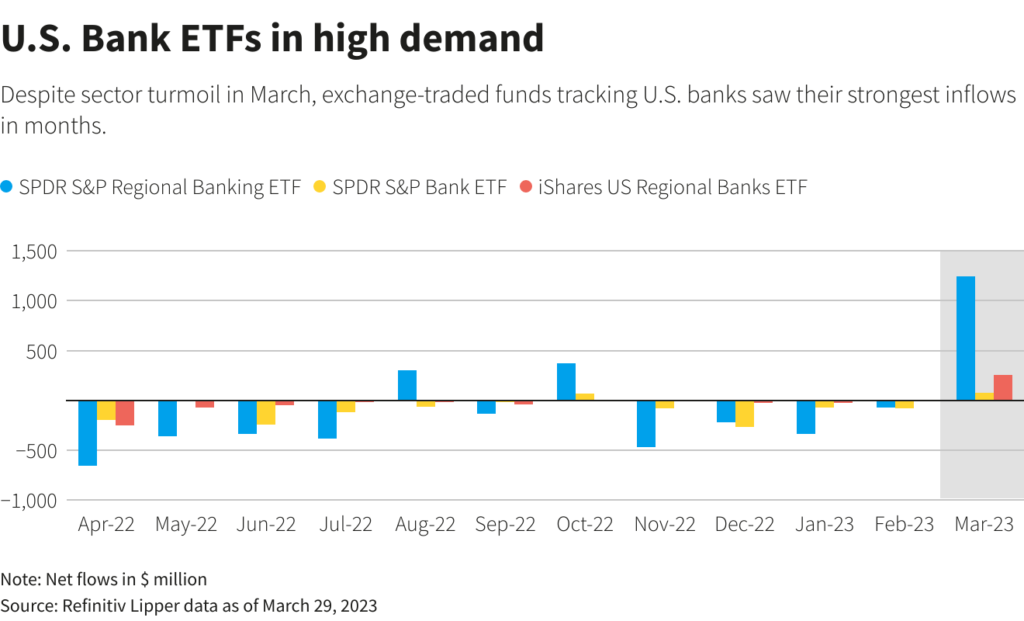

Trade-traded funds monitoring U.S. regional banks noticed their strongest web inflows in months, with the SPDR S&P Regional Banking ETF receiving $1.25 billion within the month to March 29, whereas the iShares U.S. Regional Banks ETF (IAT.P) took in $258 million, based on Refinitiv Lipper information.

March was the primary month of web shopping for for the IAT fund in a yr, and top-of-the-line months on file when it comes to flows for KRE.

That is regardless of each funds plunging about 29% in March because the collapse of Silicon Valley Financial institution and Signature Financial institution triggered fears of a contagion and doubts concerning the sector’s stability, making U.S. regional banks among the many worst-performing sectors this yr.

“A whole lot of buyers are assuming that the worst of the volatility has cooled at this level and benefiting from these decrease costs,” mentioned Roxanna Islam, head of sector and business analysis at VettaFi.

A swift response from regulators and central banks inspired buyers trying to “purchase on the backside,” Islam mentioned.

Traders additionally eyed funds monitoring bigger banks assumed to be extra steady, with the SPDR S&P Financial institution ETF taking in practically $79 million in March, its first month of web shopping for since October.

“Financial institution equities are already pricing in numerous unhealthy information,” mentioned John Tierney, strategist at MacroHive, recommending elevated allocations to huge banks together with JPMorgan Chase & Co (JPM.N) and Citigroup (C.N).

“As markets proceed to quiet down … banks typically and main banks particularly will outperform the S&P 500.”

General costs for these funds recovered barely over the previous week as banking sector worries eased, however the KBE fund is ready to drop 23% for the month, its worst since COVID-19 lockdowns roiled markets two years in the past. The S&P 500 (.SPX) rose 2.5%.

Reporting by Lisa Pauline Mattackal in Bengaluru; Enhancing by Devika Syamnath

: .